Highlights:

- Bitcoin ETFs saw record $937.7 million outflows, surpassing December’s $680 million mark.

- The massive outflows occurred as BTC dropped below $90k yesterday.

- Analysts warn Bitcoin could drop amid weak sentiment and hedge fund sell-offs.

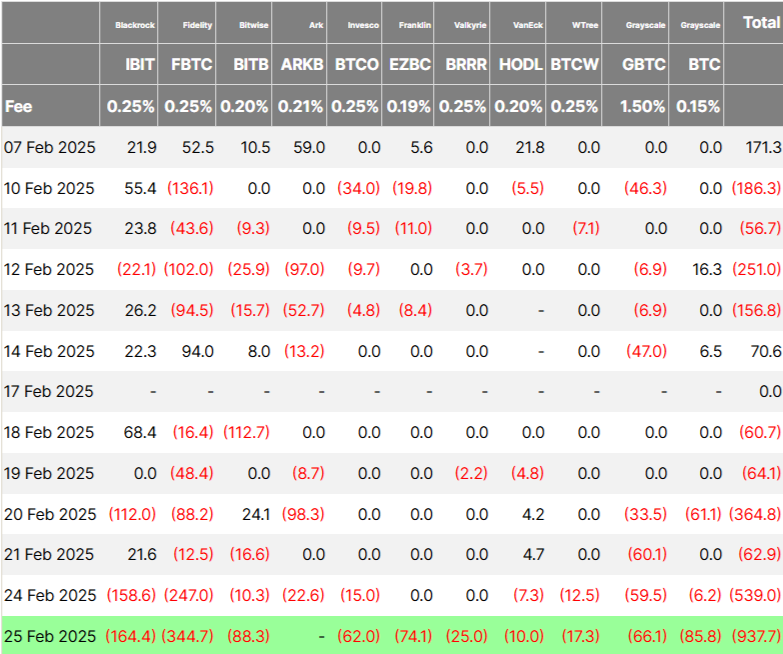

The United States spot Bitcoin (BTC) exchange-traded funds (ETFs) recorded their highest single-day outflow since launch, far exceeding the previous record of $680 million in net outflows on December 19. Farside Investors data reveals that 11 spot Bitcoin funds saw net outflows totaling $937.7 million, excluding ARK 21Shares Bitcoin ETF (ARKB).

It marked the sixth straight day of outflows for the ETF group, following $539 million withdrawn on Monday. The ETF outflows come after a crypto market rout, with Bitcoin dropping 3.4% in the last day. It plunged to a 24-hour low of $86,141 from an intraday high of over $92,000.

Fidelity’s Wise Origin Bitcoin Fund (FBTC) topped the outflows with $344.7 million, marking its largest single-day loss. BlackRock’s iShares Bitcoin Trust (IBIT) followed, seeing $164.4 million withdrawn. Bitwise’s Bitcoin ETF (BITB) faced $88.3 million in outflows. Grayscale’s two funds collectively lost $151.9 million, with $66.1 million from its Bitcoin Trust (GBTC) and $85.8 million from the Bitcoin Mini Trust ETF (BTC).

Even with the sell-off, daily trading volume for spot Bitcoin ETFs jumped by nearly 167%, hitting $7.74 billion. Since their launch, these ETFs have collected a total net inflow of $38.08 billion.

Bitcoin Sell-off Deepens Amid Tariff Concerns and Fed Rate Uncertainty

The sell-off is due to Bitcoin falling below $88,000. Concerns over Trump’s planned tariffs on Canadian and Mexican goods are also rising. A 25% tariff could increase inflation and slow economic growth. This may pressure the Federal Reserve. The Fed plans to cut rates only when inflation nears 2%, but recent data shows it is moving away from that target.

Higher inflation and delayed rate cuts can strengthen the U.S. dollar and put downward pressure on Bitcoin. Meanwhile, the Crypto Fear and Greed Index, which shows market sentiment, fell from 25 to 21, staying in the “extreme fear” zone.

Bitcoin Price Can Drop to $70k: Analysts

Experts like BitMEX co-founder Arthur Hayes and 10x Research’s Markus Thielen say most Bitcoin ETF investors are hedge funds. These funds focus on quick profits from price differences, not holding Bitcoin for the long term.

“Lots of $IBIT holders are hedge funds that went long ETF short CME futures to earn a yield greater than where they fund, short-term US treasuries,” Hayes said. He cautioned that if Bitcoin’s price falls, “these funds will sell $IBIT and buy back CME futures.” This selling might drive Bitcoin down to $70k.

#Bitcoin goblin town incoming:

Lots of $IBIT holders are hedge funds that went long ETF short CME future to earn a yield greater than where they fund, short term US treasuries.If that basis drops as $BTC falls, then these funds will sell $IBIT and buy back CME futures.

These… pic.twitter.com/3PskTxrBPR

— Arthur Hayes (@CryptoHayes) February 24, 2025

Moreover, 10X Research said Bitcoin had formed a diamond top pattern, which often shows a trend reversal. This suggests Bitcoin could fall to around $73,000, near last summer’s lows. Market sentiment remains fragile. Short-term holders are already facing losses, increasing the chance of more sell-offs.

At press time, BTC dropped over 1%, trading at $88,962. Its 24-hour low hit $86,266, while the high reached $89,504.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.