Highlights:

- U.S. spot Bitcoin ETFs brought in $91.6 million, ending their streak of daily outflows.

- BlackRock’s IBIT topped with $42M inflow, followed by Bitwise and Grayscale additions.

- Ethereum ETFs rebounded with $35M inflows after losing $617M in two days.

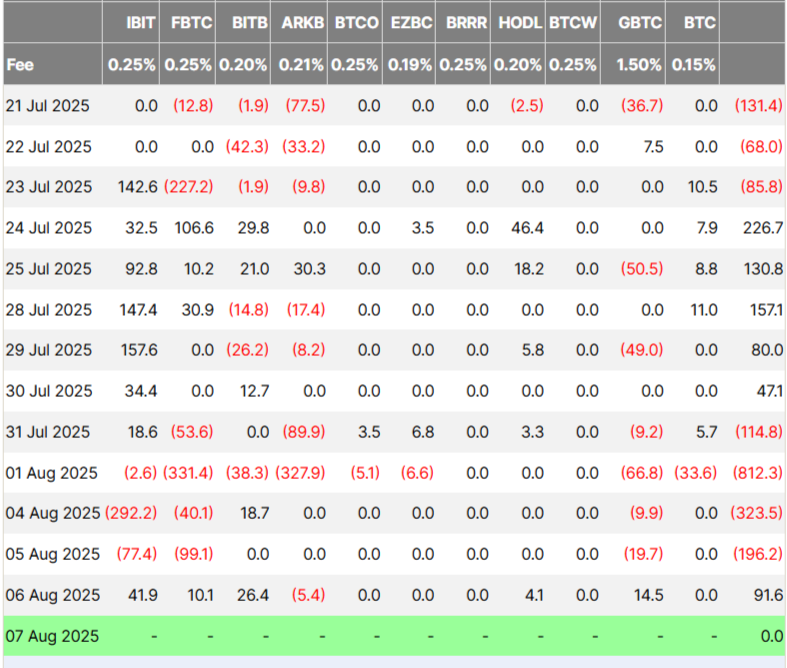

Data from Farside reveals that U.S. spot Bitcoin (BTC) exchange-traded funds (ETFs) registered $91.5 million in net inflows during the day. Leading the momentum was BlackRock’s iShares Bitcoin Trust ETF (IBIT), which attracted $41.9 million in new investments. Next came Bitwise Bitcoin ETF (BITB), which recorded $26.4 million in inflows. Grayscale BTC Trust (GBTC) also saw gains, collecting $14.5 million.

Fidelity Wise Origin Bitcoin Fund (FBTC) and VanEck Bitcoin ETF (HODL) recorded smaller increases, but ARK & 21Shares’ ARKB slipped with a $5.4 million outflow. The return to inflows comes after a large $1.45 billion outflow over the past four days. This drop was mainly due to worries about the economy and falling interest in risky assets. On Wednesday, U.S. spot Bitcoin ETFs saw $196.2 million in outflows.

Bitcoin has been moving in a quiet range between $140,000 and $150,000. This may be due to profit-taking after weak U.S. economic data. At the time of writing, Bitcoin was up 2.2% in the last 24 hours, trading at $116,311, according to CoinMarketCap.

Ethereum ETFs Bounce Back with $35M Inflows

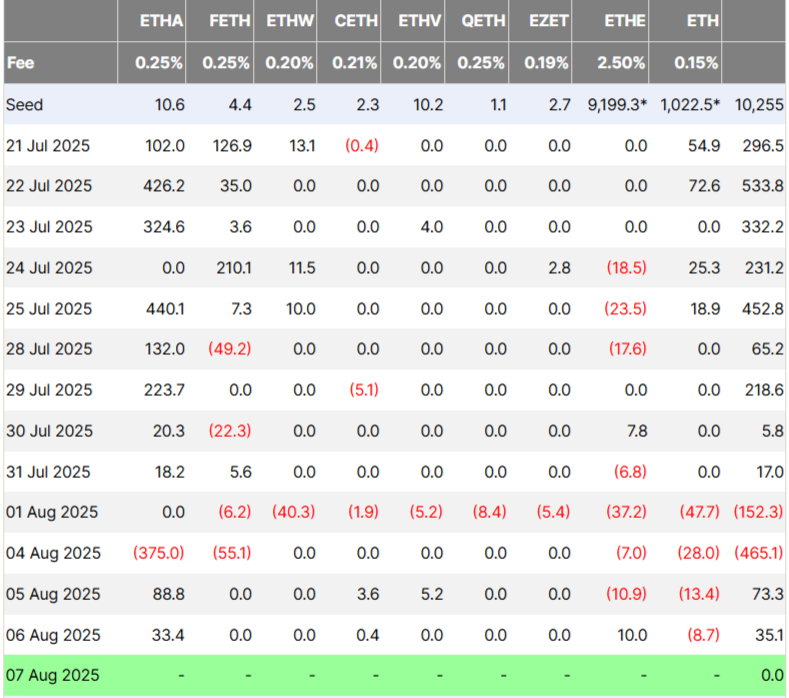

On the other hand, spot Ether ETFs saw net inflows of $35.1 million on Wednesday. BlackRock’s iShares Ethereum Trust ETF (ETHA) recorded the highest inflows, bringing in $33.4 million. Meanwhile, the Grayscale Ethereum Trust ETF (ETHE) followed with an addition of $10 million. However, Grayscale’s Mini Ethereum Trust experienced net outflows, losing $8.7 million during the same period. Spot Ethereum ETFs moved back to net inflows on Tuesday, ending a short two-day outflow streak. During that dip, around $617 million was pulled from the nine Ethereum-focused funds.

Global Institutions Double Down on Crypto ETFs

Firms are showing continued interest in crypto ETFs despite recent market volatility and sharp outflows. SBI Holdings, a major Japanese financial group, has shared plans to launch a Bitcoin/XRP ETF on the Tokyo Stock Exchange. This move depends on getting approval from Japan’s Financial Services Agency (FSA) for crypto-related investment trusts and ETFs.

In its Q2 financial report, SBI also introduced two new fund proposals. One is the SBI Fund of Crypto-Asset ETFs, which plans to invest 51% in gold ETFs and the rest in Bitcoin ETFs. The second proposal focuses on a new Bitcoin/XRP ETF that would include both Bitcoin and XRP, along with other crypto assets.

Read more here –https://t.co/n2qYSrJfjs

— Bitcoin.com News (@BTCTN) August 6, 2025

Adding to the rising institutional demand, the State of Michigan Retirement System boosted its investment in the ARK 21Shares Bitcoin ETF (ARKB) during the second quarter. It tripled its holdings from 100,000 shares to 300,000 shares. Earlier this year, it also became the first state-level U.S. pension fund to gain exposure to Ethereum by acquiring 460,000 shares of the Grayscale Ethereum Trust (ETHE). Despite recent price dips and uncertain macro conditions, institutional confidence in crypto ETFs continues to grow. It’s a long-term interest beyond short-term market noise.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.