Highlights:

- Bitcoin and Ethereum ETFs traded profitably on May 16 despite generalized market declines.

- All active Bitcoin and Ethereum ETFs had only profits, as none witnessed outflows.

- The crypto market has retraced slightly, impacting BTC and ETH price actions.

Bitcoin (BTC) Exchange Traded Funds (ETFs) and Ethereum (ETH) ETFs saw only gains in their most recent outing. The profits ensured the funds had net weekly gains. SosoValue reported that Bitcoin ETFs gained $260.27 million, while Ethereum funds attracted $22.12 million.

Throughout the week, Bitcoin ETFs had net outflows only on May 14, when they lost $96.14 million. Overall, Bitcoin ETFs gained $603.74 million during the week, marking the funds’ fifth straight profitable week.

Within the same period, Ethereum ETFs witnessed net gains on three occasions. They succumbed to net outflows on May 12 and 15, losing $17.59 million and $39.79 million, respectively. Like Bitcoin, ETH ETFs also had net weekly profits of about $41.59 million as they bounced back from last week’s $38.15 million loss.

On May 16, U.S. spot Bitcoin ETFs recorded a total net inflow of $260 million, marking three consecutive days of net inflows. Spot Ethereum ETFs saw a total net inflow of $22.117 million, with none of the nine ETFs experiencing net outflows.https://t.co/Hj2Gs49bWa

— Wu Blockchain (@WuBlockchain) May 17, 2025

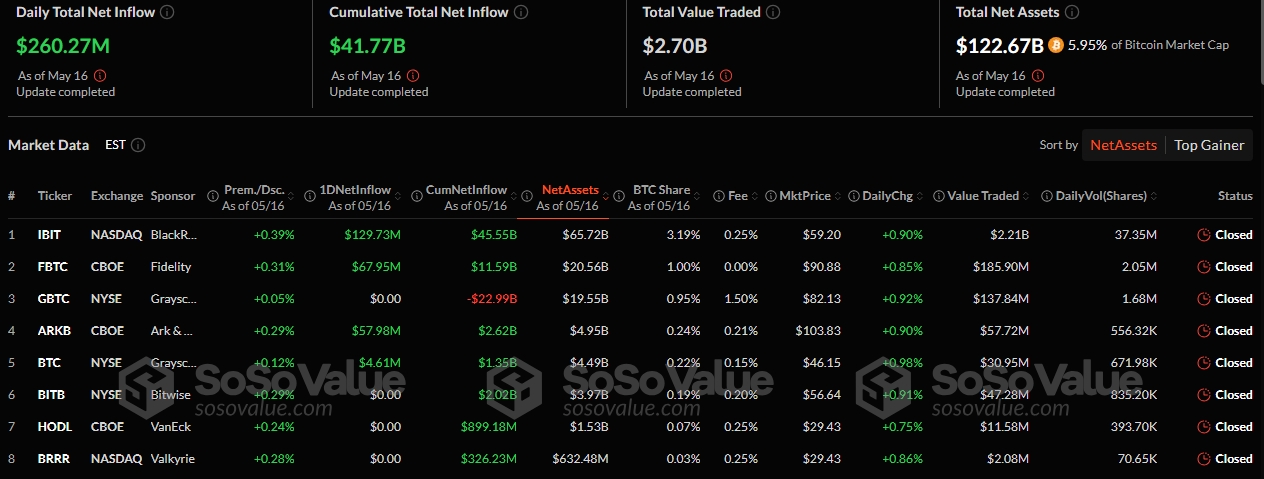

Bitcoin ETFs Contributions to the Latest Net Inflow

Yesterday, only four Bitcoin ETFs were active, as the remaining eight funds neither gained nor lost money. As usual, BlackRock Bitcoin ETF (IBIT) had the highest profits, valued at about $129.73 million. Two other funds’ gains exceeded $50 million. They include Fidelity Bitcoin ETF (FBTC), with a $67.95 million profit, and ARK 21Shares Bitcoin ETF (ARKB) with a $57.98 million gain.

Grayscale Mini Bitcoin ETF (BTC) also attracted cash inflows worth $4.61 million. Consequently, the total value traded rose from $2.58 billion to $2.7 billion. The total net assets valuation also appreciated from $121.47 billion to $122.67 billion, while cumulative net inflows reached $41.77 billion from $41.51 billion.

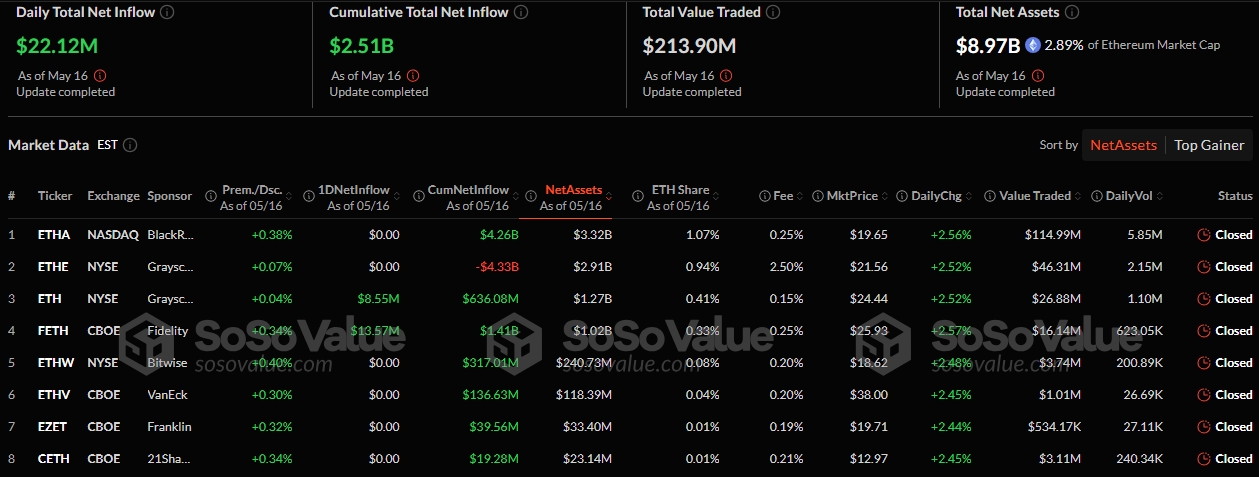

Ethereum ETFs Record Minimal Activities

On May 16, only two Ethereum ETFs were active, as seven other funds had neither inflows nor outflows. These active ETFs were the Fidelity Ethereum ETF (FETH) and the Grayscale Mini Ethereum ETF (ETH). Both gained $13.57 million and $8.55 million, respectively.

As a result of the net inflows, Ethereum ETFs’ cumulative net inflows increased slightly from $2.49 billion to $2.51 billion. The net assets also rose from $8.74 billion to $8.97 billion. This new net assets valuation represents 2.89% of Ethereum’s market cap. In contrast, the ETFs’ total value traded dropped from $494.51 million to $213.90 million.

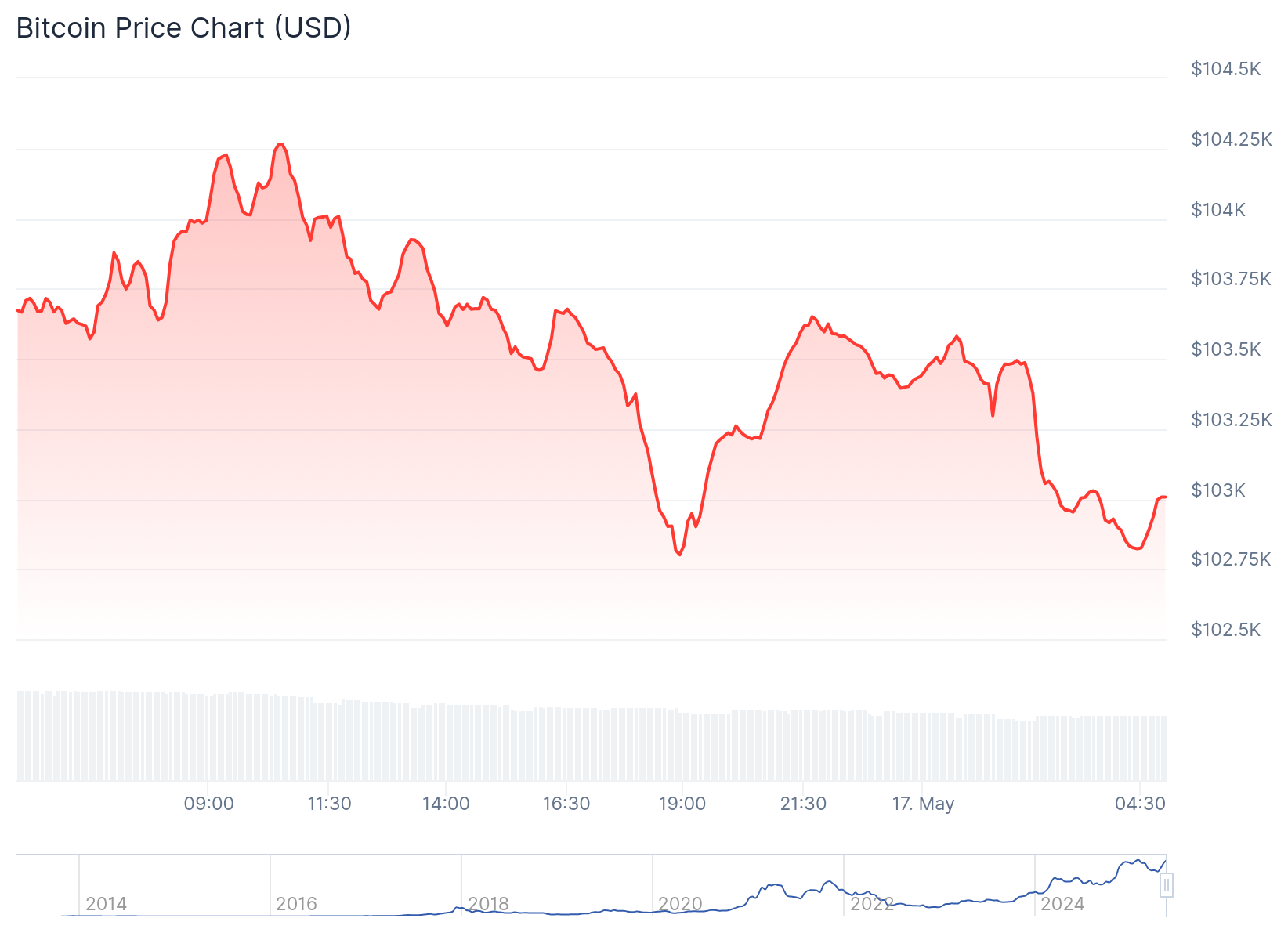

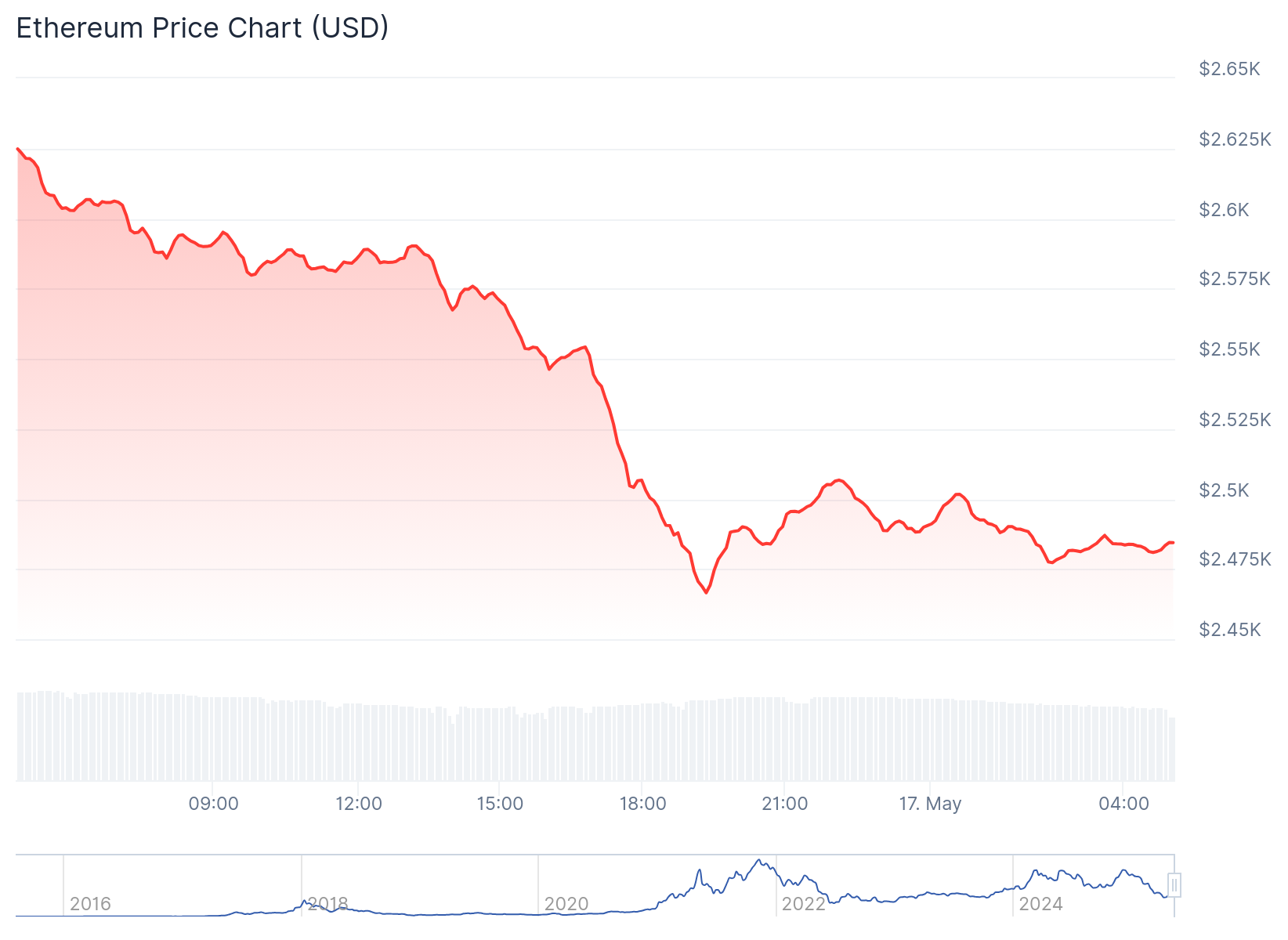

BTC and ETH Suffer Declines Amid a Generalised Market Drop

At the time of writing, the crypto market is down 3.1% in the past 24 hours, boasting a $3.391 trillion valuation. Within the same timeframe, Bitcoin dropped 0.8%, trading at approximately $103,000 and fluctuating between $102,801 and $104,263. This price range highlights tendencies for more pronounced declines.

On its part, Ethereum dropped 5% in the past 24 hours, as its selling price declined to about $2,480. In the past seven days, ETH appreciated by 3.3% and has oscillated between $2,386.88 and $2,693.09. Ethereum’s market capitalization dropped to about $300 billion, while its 24-hour trading volume depreciated by 16.35% to about $21.56 billion.

Despite ETH’s recent struggles, whales’ interest in Ethereum has remained strong. Lookonchain reported that a whale withdrew about 6,053 ETH worth $15.66 million from OKX.

A whale withdrew 6,053 $ETH($15.66M) from #OKX 9 hours ago.https://t.co/OAiPnekPR3 pic.twitter.com/MCBTadumO1

— Lookonchain (@lookonchain) May 17, 2025

In a separate tweet, the on-chain monitor tracked another consistent ETH investment. Lookonchain reported: “Since May 7, Abraxas Capital has withdrawn 278,639 ETH ($655 million) from exchanges at an average price of $2,350, with an unrealised profit of $77 million.” These consistent purchases highlight institutions and individual investors’ faith in ETH as a sustainable store of value.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.