Highlights:

- Bitcoin ETFs maintain stellar performance with another $1 billion inflow contribution.

- ETH ETFs poor outings persist into a sixth consecutive day.

- Bitcoin edges closer to $100k, as Ethereum continues to trade below $3,500 despite a significant jump in the past 24 hours.

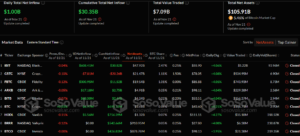

On November 21, Bitcoin (BTC) Exchange Traded Funds (ETFs) recorded another net inflow to extend its profitable outings to four consecutive days. According to SosoValue’s data, Bitcoin ETFs most recent market outing resulted in net profits valued at about $1 billion.

On November 21, the total net inflow of Bitcoin spot ETFs was $1.005 billion. The net inflow of BlackRock ETF IBIT was $608 million, and the net inflow of Fidelity ETF FBTC was $301 million. https://t.co/59u0BnEqLG pic.twitter.com/yntgzssUl7

— Wu Blockchain (@WuBlockchain) November 22, 2024

The latest gainful input closely followed a day after the Bitcoin commodities exceeded $100 billion in assets under management. In yesterday’s BTC ETFs news coverage, Crypto2Community reported that the Bitcoin entities’ total net assets have struck $100.55 billion.

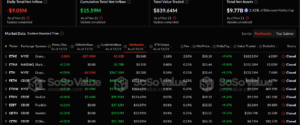

On the other hand, Ethereum (ETH) ETFs poor form persisted, extending into its sixth straight day of amassing losses. The on-chain ETF tracker revealed that the ETH commodities attracted roughly $9.05 million in cash outflows.

On November 21, the total net outflow of Ethereum spot ETF was $9.0492 million. Grayscale ETF ETHE had a net outflow of $27.0753 million on a single day, and Fidelity ETF FETH had a net inflow of $16.79 million on a single day. https://t.co/Tvs2oCSxTg pic.twitter.com/cVDj4SzgSz

— Wu Blockchain (@WuBlockchain) November 22, 2024

Ethereum ETFs’ latest flow data implies that the entities never attracted profits this week. With only one trading day left for the week, ETH commodities have incurred losses estimated at around $162.8 million. Hence, one could confidently assert that Ethereum ETFs are on the verge of recording their first weekly net outflows after recording gains in their previous three weekly metrics.

BTC ETFs Cumulative Net Inflows Hit $30 Billion

With its most recent $1 billion profits, Bitcoin ETF cumulative net inflows have exceeded $30 billion. For context, the total net inflow reflected $30.35 billion, after topping a billion dollars from November 20’s $29.35 billion. Similarly, the total value traded and net assets witnessed significant spikes.

The total value traded increased from $5.09 billion to about $7.1 billion, while total net assets surged from $100.63 billion to $105.91 billion. Meanwhile, BlackRock Bitcoin ETF (IBIT) continues to cement its position as one of the most profitable Bitcoin ETFs with a fresh $608.41 million profitable input.

Like IBIT, Fidelity Bitcoin ETF (FBTC) displayed remarkable market showings. In its most recent outing, the entity witnessed cash inflows of approximately $300.95 million. Aside from IBIT and FBTC, six other entities were active. Five experienced gains, while Grayscale Bitcoin ETF (GBTC) registered the only outflows valued at roughly $7.81 million.

Only two commodities from the remaining five ETFs attracted cash inflows above $10 million. They include Bitwise Bitcoin ETF (BITB) with $68 million and ARK 21Shares Bitcoin ETF (ARKB) with $17.18 million. Other profitable entities are Grayscale Mini Bitcoin ETF (BTC) ($6.97 million), Franklin Bitcoin ETF (EZBC) ($5.7 million), and VanEck Bitcoin ETF (HODL) ($5.56 million).

Grayscale’s ETHE Tops Ethereum ETFs Losses Chart

Like Bitcoin, Grayscale Ethereum ETF (ETHE) topped the loss charts with about $27.08 million in net outflows. Grayscale Mini Ethereum ETF (BTC) followed closely with losses valued at approximately $4.11 million. Aside from the two Grayscale entities, three other ETFs witnessed profitable outings.

They include Fidelity Ethereum ETF (FETH) ($16.79 million), Bitwise Ethereum ETF (ETHW) ($2.89 million), and VanEck Ethereum ETF (ETHV) ($2.46 million). Following the latest contributions, Ethereum ETFS cumulative net inflows have plummeted to about $15.59 million. The total value traded and net assets spiked considerably to about $839.64 million and $9.77 billion, respectively.

Bitcoin Price Edges Closer to $100K as Ethereum Remains Below $3,500

At the time of press, BTC is changing hands at about $99,100, reflecting a 2.3% upswing in the past 24 hours. Notedly, the flagship cryptocurrency established a new all-time high a few hours ago after it struck $99,486.10.

On the other hand, Ethereum displayed a significant 7.6% upswing in its 24-hour-to-date data, with about $3,370 in selling price. Additionally, ETH reflected price extremes, ranging between $3,127.13 and $3,418.54 within a day interval. The minimum and maximum price limits underscore a strong tendency of reclaiming $3,500 soon.