Highlights:

- Bitcoin ETFs saw gains on March 21 to extend their winning streak to the sixth consecutive day.

- The most recent net inflow contributed to Bitcoin ETFs’ first weekly gains after five straight losses.

- Ethereum ETFs recorded net outflows, pushing their loss streak to the thirteenth consecutive day.

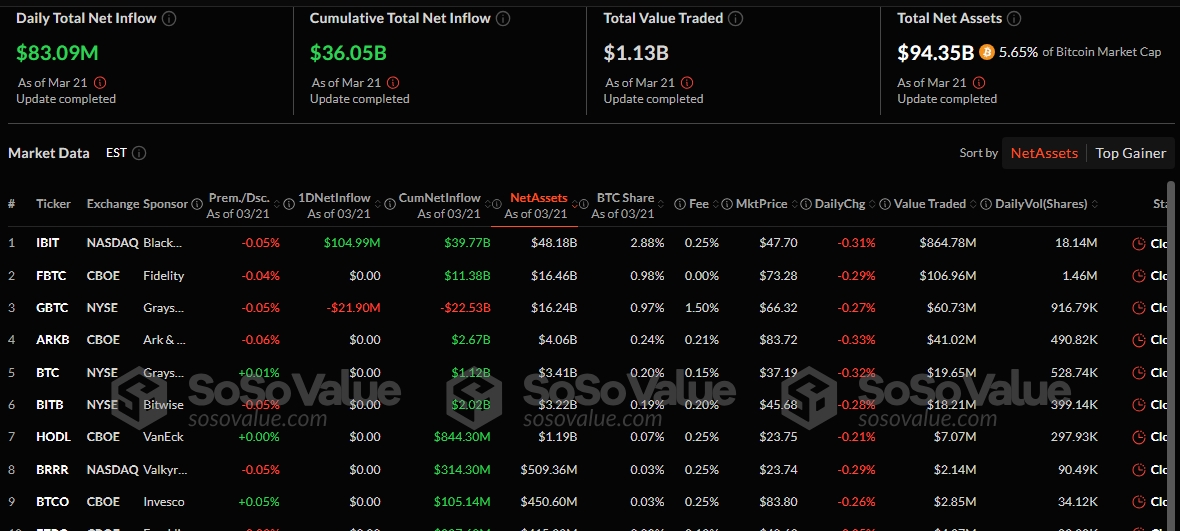

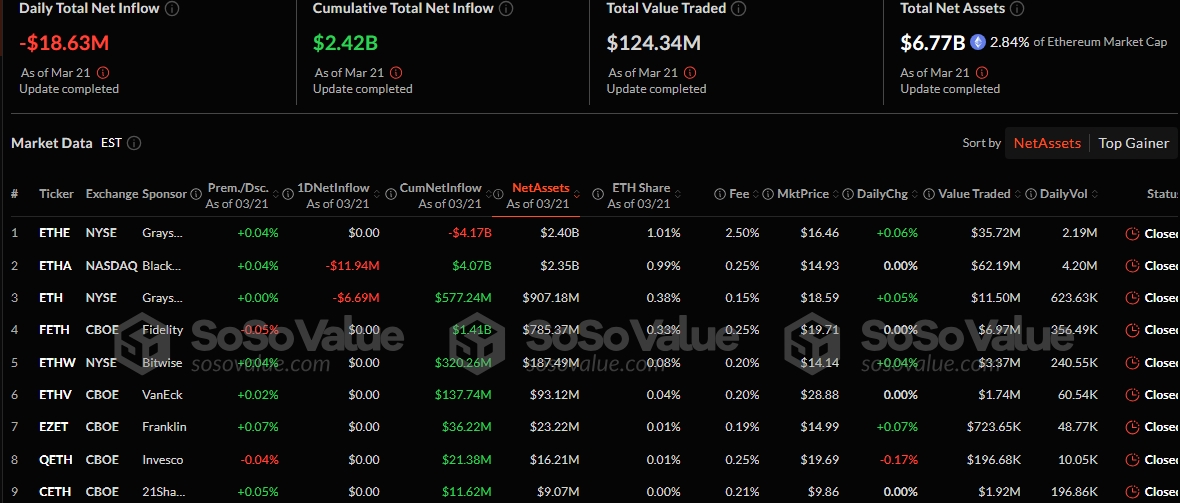

On March 21, Bitcoin (BTC) and Ethereum (ETH) Exchange Traded Funds (ETFs) recorded their last trading day of this week. Bitcoin ETFs attracted $83.09 million in cash inflows, while Ethereum ETFs lost about $18.63 million.

Bitcoin ETFs’ most recent gains marked the funds’ sixth consecutive net inflows. In contrast, Ethereum ETFs’ persistent net outflows entered a thirteenth straight day. As a result of the consistent profits, Bitcoin ETFs recorded their first weekly gains in six weeks.

Spotonchain’s data shows that Bitcoin funds had $744.3 million in net inflows between March 17 and 21. Within the same period, Ethereum ETFs posted $102.9 million in net outflows. “ETH ETFs have seen 13 consecutive net outflows (2.5 weeks), totaling -$389.2M,” Spotonchain added.

🇺🇸 Spot ETF: 🟢$744.3M to $BTC and 🔴$102.9M to $ETH

🗓 Week: 17 to 21 Mar 2025👉 BTC ETFs have recorded 6 consecutive net inflows, totaling $785.6M.

👉 ETH ETFs have seen 13 consecutive net outflows (2.5 weeks), totaling -$389.2M.

Follow @spotonchain and check out the latest… pic.twitter.com/buCPOmXVQs

— Spot On Chain (@spotonchain) March 22, 2025

Bitcoin ETFs Record Minimal Activities

Only two funds saw flows on March 21. BlackRock Bitcoin ETF (IBIT) contributed $104.99 million in gains, while Fidelity Bitcoin ETF (FBTC) lost $21.9 million. The remaining ten ETFs saw neither inflows nor outflows.

As a result of their most recent gains, Bitcoin ETFs’ cumulative net inflows increased from $35.97 billion to $36.05 billion. On the other hand, the total value traded dropped from $1.83 billion to $94.47 billion to $1.13 billion. The total net assets, which represent 5.65% of Bitcoin’s $1.67 trillion market cap, also dipped from $94.47 billion to $94.35 billion.

Bitcoin’s Price Records Slight Recovery in its Short-Term Statistics

At the time of press, Bitcoin is up 0.6% in the past 24 hours, trading at approximately $84,330. In its 7-day-to-date statistics, Bitcoin’s price surged by 0.2%, with price extremes fluctuating between $81,259.86 and $86,815.44. The price range highlights Bitcoin’s recovery after falling below $80,000 at some point this month.

Despite the slight upswing, Bitcoin’s extended-period price change data remains red. Its 14-day-to-date and month-to-date variables reflected declines of about 2.4% and 13%, respectively. Traders and analysts believe the positive trend could push BTC back above $90,000.

Ethereum ETFs Negative Flow

Like Bitcoin, only two Ethereum ETFs were active on March 21. However, both experienced outflows, while the remaining seven funds had zero flows. BlackRock Ethereum ETF (ETHA) and Grayscale Mini Ethereum ETF (ETH) lost about $11.94 million and $6.69 million, respectively.

Ethereum ETFs’ cumulative net inflows dropped from $2.44 billion to $2.42 billion. The total value traded plummeted from $193.65 million to $124.34 million. The total net assets also plunged from $6.79 billion to $6.77 billion. This new net assets valuation represents 2.84% of Ethereum’s $239.36 billion market cap.

Ethereum Price Remains Below $2,000 as Accumulations Intensify

Like Bitcoin, Ethereum is up 9% in the past 24 hours, trading at approximately $1,980. In the last seven days, ETH surged by about 3.4%, oscillating between $1,872.10 and $2,060.73. The price extremes highlight Ethereum’s recent struggles amid a general market downturn. Ethereum’s 24-hour trading volume dropped 23.36% to about $9.17 billion.

Despite the downtrends, whales’ interest in Ethereum remains strong. In a tweet, renowned crypto market chartist Ali Martinez disclosed that large investors bought 120,000 ETH within 72 hours. This shows that whales see the current market dip as a prime opportunity to accumulate ETH at discounted prices. The accumulation trend signifies strong faith in Ethereum, which could be bullish for the token’s future.

Whales bought over 120,000 #Ethereum $ETH in the last 72 hours! pic.twitter.com/kuZY6u9drS

— Ali (@ali_charts) March 21, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.