Highlights:

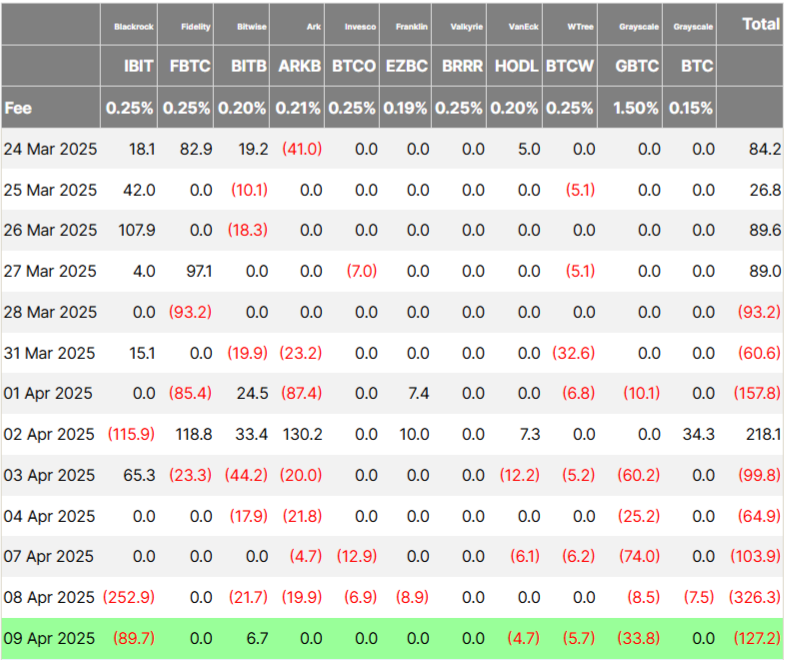

- U.S. Bitcoin ETFs see $127.2M in outflows amid market rally after tariff pause.

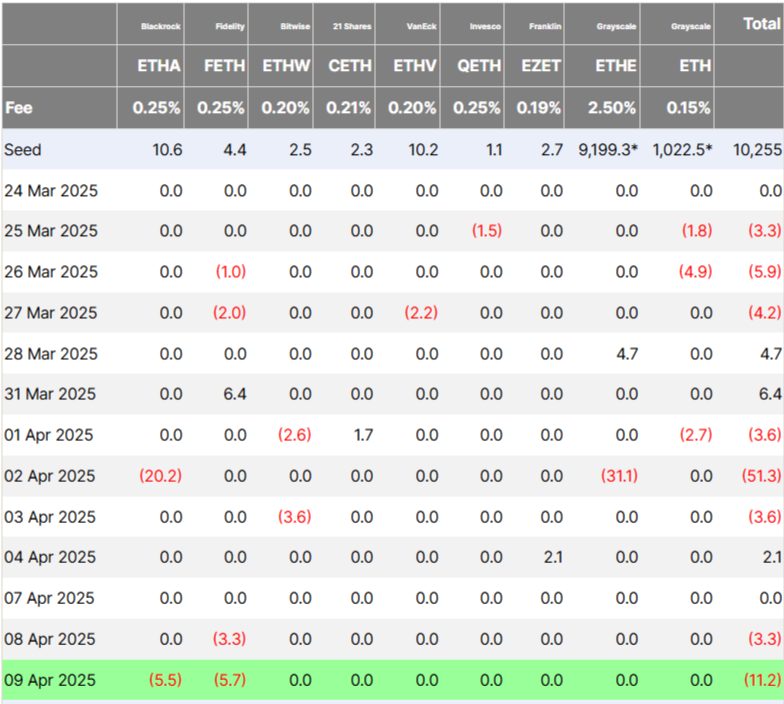

- Spot Ethereum ETFs face $11.2M outflows, led by BlackRock’s and Fidelity’s funds.

- U.S. stocks and crypto surge, with Bitcoin hitting $82K and Coinbase up 16.91%.

On April 10, U.S. spot Bitcoin (BTC) Exchange-Traded Funds (ETFs) experienced net outflows totaling $127.12 million, despite a market rally following Donald Trump’s 90-day tariff pause. BlackRock’s iShares Bitcoin Trust (IBIT) saw $89.7 million in outflows, while Grayscale’s Bitcoin Trust (GBTC) experienced $33.8 million in withdrawals. VanEck Bitcoin ETF (HODL) and WisdomTree Bitcoin Fund (BTCW) also recorded outflows. of $4.7 million and $5.7 million, respectively.

Bitwise’s Bitcoin ETF (BITB) was the only spot Bitcoin ETF to see inflows, with $6.7 million entering the fund. The outflows on Wednesday marked the fifth consecutive day of negative flows for these ETFs.

On April 9, Spot Ethereum ETFs witnessed a total net outflow of $11.2 million. The outflows were led by BlackRock’s ETHA, which recorded a withdrawal of $5.5 million, followed by Fidelity’s FETH, which saw $5.7 million in outflows. All other ETFs recorded no inflows or outflows.

Tariff Pause Sparks Crypto Comeback

The outflows from the ETFs occurred concurrently with significant rallies in both traditional financial (TradFi) and cryptocurrency markets. This market surge followed Donald Trump’s announcement on April 9 of a 90-day suspension of most tariffs. During this period, reciprocal tariffs were reduced to 10% for the majority of countries, while tariffs on Chinese imports were increased to 125%.

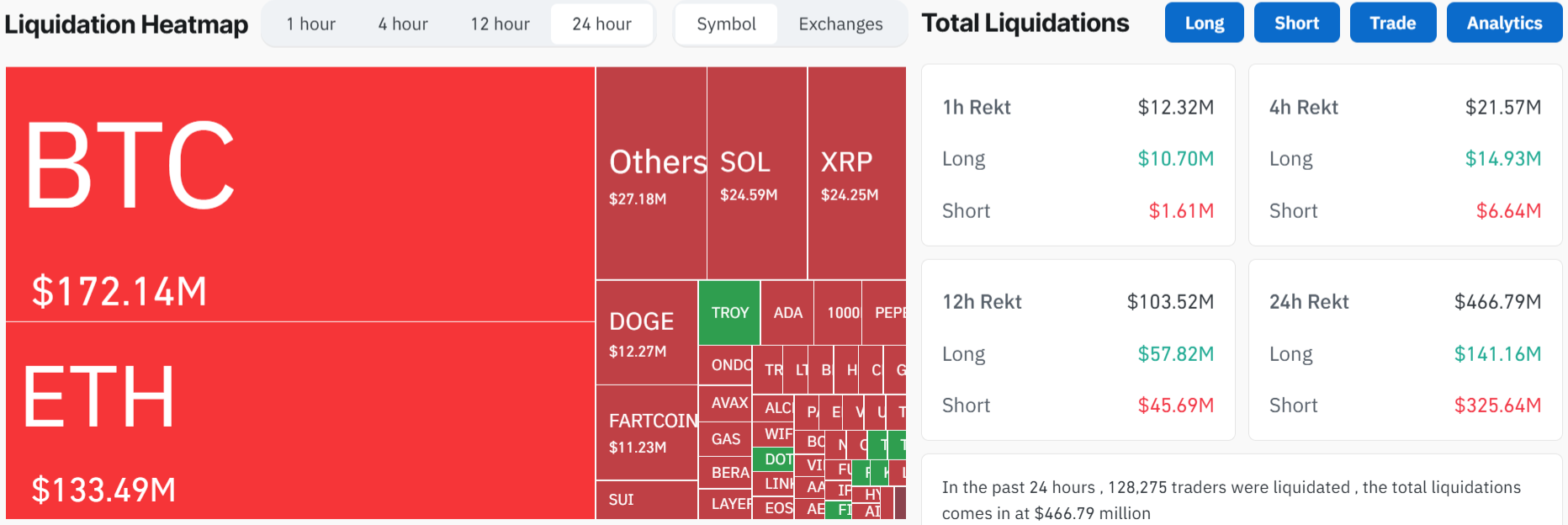

As Trump announced a 90-day suspension of the tariff war with most countries, the cryptocurrency market rose sharply, with ETH rising 15% to over $1,600 and XRP rising 15.3% to over $2. The liquidation amount in 24 hours reached $587 million, and the short position liquidation…

— Wu Blockchain (@WuBlockchain) April 9, 2025

After weeks of downward pressure from increasing tariffs, the crypto market finally saw relief. Bitcoin surged from $76K to $82K in a few hours, reaching levels not seen since Sunday. Ethereum rose 14% to surpass $1,600, while XRP gained 15%, crossing $2. Total liquidations over the past 24 hours reached $466.79 million, with $325.64 million coming from short positions, according to Coinglass.

Prior to the announcement, the crypto market was in decline. Bitcoin had dropped to $74,000, its lowest point in five months, following Trump’s tariffs on almost all U.S. trade partners. Ethereum and XRP also fell by over 20%. However, when news of the 90-day tariff pause emerged, the market quickly reversed course.

U.S. Stocks Surge on Trade Deal Hopes, Coinbase Jumps 16.91%

U.S. stocks, including those tied to the crypto sector, surged sharply following the announcement. They reclaimed a portion of the losses sustained over the past week. The Dow Jones Industrial Average leapt by 7.87%. The S&P 500 surged an impressive 9.52%. The Nasdaq soared 12.16%, marking its largest single-day gain since January 2001, according to CNBC. Shares of Coinbase jumped 16.91%. Strategy (formerly MicroStrategy) ended the day with a 24.76% increase.

Jeff Mei, COO at BTSE, told CoinDesk the market is rising due to hopes of trade deals with the U.S. This could help avoid a major trade war. However, he warned that U.S.-China tariffs may reshape global trade. He added that BTSE will stay cautious until the effects become clearer.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.