Highlights:

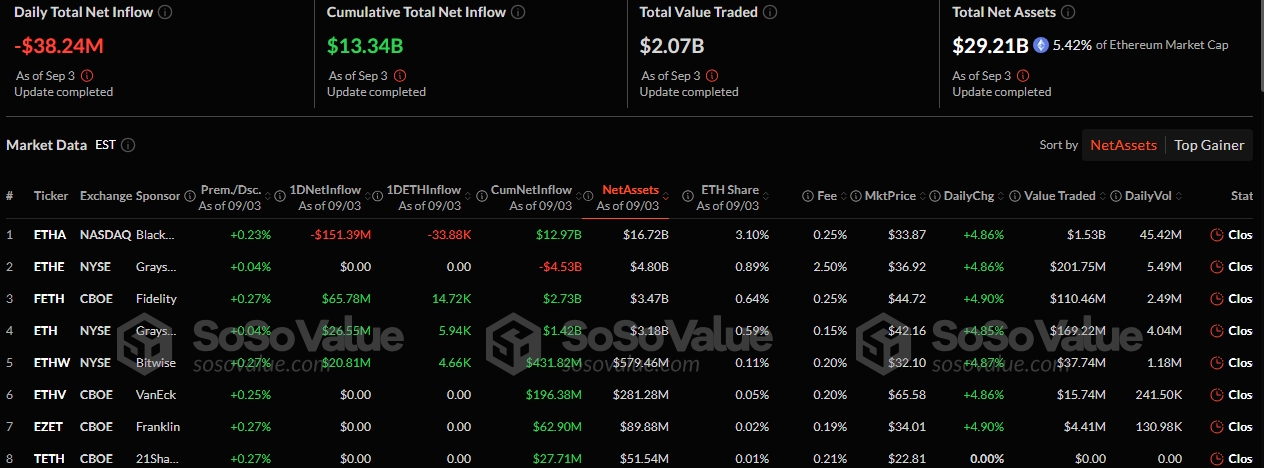

- Bitcoin ETFs pulled in $301.32 million, as Ethereum ETFs lost $38.24 million.

- Ethereum ETFs’ outflows streak persisted into the third straight day as Bitcoin ETFs’ net profits entered a second consecutive day.

- BlackRock remains dominant across Bitcoin and Ethereum ETFs.

On September 3, Bitcoin exchange-traded funds (ETFs) pulled in $301.32 million, sustaining their stellar performance since the week began. On the other hand, Ethereum ETFs succumbed to their third consecutive outflow, valued at $38.24 million.

Bitcoin ETFs will look to build on the previous week’s net inflows. For context, in the week that ended on August 29, 2025, Ethereum dominated the ETF market with over $1 billion in net inflows, while Bitcoin attracted only $441 million. Should Bitcoin ETFs maintain current momentum, chances are high that they will surpass Ethereum ETFs by the end of this week.

On September 3, spot Bitcoin ETFs recorded a total net inflow of $301 million, with only Ark Invest and 21Shares’ ARKB posting a net outflow. Spot Ethereum ETFs saw a total net outflow of $38.24 million, marking the third consecutive day of outflows.

https://t.co/Hj2Gs48E6C pic.twitter.com/iaADJSoReo— Wu Blockchain (@WuBlockchain) September 4, 2025

BlackRock Continues to Dominate as Bitcoin ETFs Pull in $301M

Yesterday, only five Bitcoin ETFs were active as the remaining seven, including Grayscale Bitcoin ETF (GBTC), Bitwise Bitcoin ETF (BITB), and VanEck Bitcoin ETF (HODL), saw zero flows. Four out of the active funds attracted cash inflows, while only ARK 21Shares Bitcoin ETF (ARKB) recorded outflows worth $27.9 million. As usual, BlackRock Bitcoin ETF (IBIT) accounted for over 90% of Bitcoin ETFs’ net inflows, bringing in $289.84 million.

Grayscale Mini Bitcoin ETF (BTC), alongside Fidelity Bitcoin ETF (FBTC), recorded gains running into millions. They added $28.3 million and $9.76 million, respectively. Valkyrie Bitcoin ETF (BRRR) contributed only $790,880. As a result of the net inflows, most cumulative metrics for Bitcoin ETFs increased, except the total value traded, which dropped from $3.93 billion to $2.78 billion. However, cumulative net inflow jumped from $54.57 billion to $54.87 billion, while total net assets rose from $143.21 billion to $145.25 billion. The net assets valuation now accounts for 6.5% of Bitcoin’s market cap.

Ethereum ETFs Net Outflows Persist

On September 3, only four of nine Ethereum ETFs had funds moving in or out. Five of the ETFs, including Grayscale Ethereum ETF (ETHE) and VanEck Ethereum ETF (ETHV), saw neither inflows nor outflows. Unlike Bitcoin ETFs, BlackRock Ethereum ETF (ETHA) was responsible for ETH funds’ net outflows. The ETF lost $151.39 million, creating a deficit that other profitable ETFs could not offset.

Fidelity Ethereum ETF (FETH) had the highest inflow, valued at about $65.78 million. Grayscale Mini Ethereum ETF (ETH) and Bitwise Ethereum ETF (ETHW) also gained $26.55 million and $20.81 million, respectively. Despite yesterday’s net outflows, the ETFs’ cumulative net inflow was $13.34 billion, following a slight decrease from $13.38 billion. However, the total value traded and net assets increased to $2.08 billion and $29.21 billion, respectively.

Bitcoin ETFs Pull in $301M as BTC Records Slight Price Decline

At the time of press, Bitcoin’s price has dropped 0.5% in the past 24 hours, trading at about $110,891, with price extremes fluctuating between $110,344 and $112,502. Other relevant statistics from Coincodex displayed low Bitcoin supply inflation at 0.84%. Dominance is 57.52%, while volatility is medium at 3.13%.

ETH Price Remains in Green with Increased Buying Pressure

Ethereum is priced at $4,427 following a 1.5% increase in the past 24 hours. Within the same timeframe, the cryptocurrency fluctuated between $4,344.91 and $4,486.12, underscoring stabilisation around the price range.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.