Highlights:

- Bitcoin ETFs pull in $2.34B in one week, marking their third straight inflows amid BTC’s bullish sentiment.

- Ethereum ETFs attracted over $600 million in weekly net inflows, bouncing back from the net outflow in the week ending September 5, 2025.

- Despite the net inflows, Bitcoin and Ethereum recorded declines in their short-term price change variables.

Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs) attracted significant inflows, ending last week in net profits. Popular on-chain ETF tracker SosoValue reported that Bitcoin ETFs had net inflows every day between September 8 and 12, totalling $2.34 billion in weekly net inflow. This extended Bitcoin funds’ weekly gains to their third consecutive week.

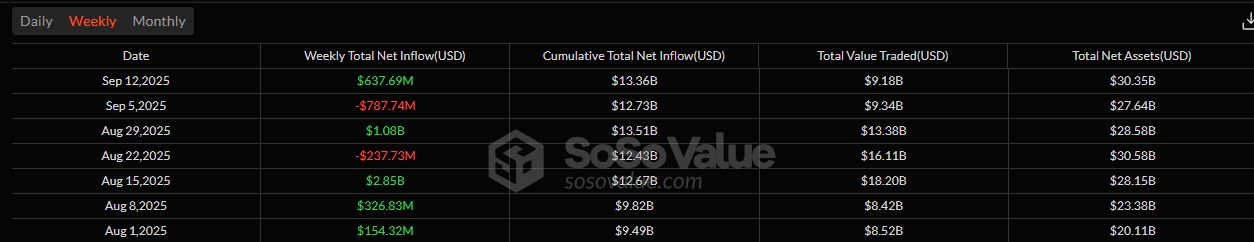

Similarly, Ethereum ETFs attracted $637.69 million in net weekly inflows. However, they recorded a net outflow on September 8, as the remaining days of last week were profitable. The latest net inflow implies that the funds have bounced back from the $787.74 million net outflow recorded in the week ending September 5, 2025.

From September 8 to September 12 (ET), Bitcoin spot ETFs recorded a weekly net inflow of $2.34 billion, with no outflows, marking the third consecutive week of net inflows. Ethereum spot ETFs saw a weekly net inflow of $638 million, also with no outflows.https://t.co/YcNXWVZGwE pic.twitter.com/bqc43cT6df

— Wu Blockchain (@WuBlockchain) September 15, 2025

BlackRock Bitcoin ETF Attracts Over 50% of Last Week’s Gain

Between September 8 and 12, BlackRock Bitcoin ETF (IBIT) recorded only inflows valued at approximately $1.037 billion. Other ETFs with over $100 million in net inflows were Fidelity Bitcoin ETF (FBTC), ARK 21Shares Bitcoin ETF (ARKB), and Bitwise Bitcoin ETF (BITB). These funds pulled in $849.6 million, $181.7 million, and $138.5 million, respectively.

Invesco Bitcoin ETF (BTCO), Franklin Bitcoin ETF (EZBC), VanEck Bitcoin ETF (HODL), and the two Grayscale Bitcoin ETFs (GBTC and BTC) had a combined weekly net inflow of $117.2 million. Throughout last week, Valkyrie Bitcoin ETF (BRRR) and WisdomTree Bitcoin ETF (BTCW) recorded neither inflows nor outflows.

Bitcoin ETFs’ cumulative net inflow rose from $54.49 billion to $56.83 billion. The total value traded and net assets valuation also recorded significant increments. The former added $3.38 billion to reach $16.65 billion, while the latter increased from $144.05 billion to $153.18 billion.

BTC Price Dips Slightly as Bitcoin ETFs Pull in $2.34B

At the time of press, Bitcoin is changing hands at about $114,887, reflecting a 1.1% upswing in the past 24 hours. The flagship crypto is fluctuating between $114,814 and $116,689. In its 7-day-to-date and 14-day-to-date price change metrics, BTC recorded upswings of about 2.5% and 4.9%, respectively. However, its month-to-date variable reflected a decline of about 2.1%.

In one of its most recent crypto news articles, Crypto2Community reported that BitMEX co-founder, Arthur Hayes predicted that BTC’s rally will extend into 2026. According to the publication, the crypto expert advised traders to discard the traditional four-year cycle, noting that it is no longer reliable for predicting BTC’s price movements. He added that global liquidity and investors’ actions are the major drivers of Bitcoin’s price trajectory.

Fidelity Ethereum ETF Tops Inflows Chart

Unlike Bitcoin, Fidelity Ethereum ETF (FETH) contributed over 50% of the ETH ETFs’ inflows for last week. The fund attracted $381.2 million, surpassing BlackRock Ethereum ETF’s (ETHA) $74.2 million gains. Other ETFs with significant inflows included the Grayscale Ethereum ETF (ETHE), with $56.8 million, the Bitwise Ethereum ETF (ETHW), with $44.6 million, and the Grayscale Mini Ethereum ETF (ETH), with $41.2 million.

The remaining ETFs, including 21Shares Ethereum ETF (TETH), VanEck Ethereum ETF (ETHV), Invesco Ethereum ETF (QETH), and Franklin Ethereum ETF (EZET), recorded $39.6 million in combined weekly net inflows. Like Bitcoin, Ethereum funds’ cumulative net inflow and total value traded recorded increments. They added $630 million to hit $13.36 billion and $2.71 billion to reach $30.35 billion, respectively. However, the total value traded slipped from $9.34 billion to $9.18 billion.

Ethereum Maintains Level Around $4,500

Ethereum is down 3.4% in the past 24 hours, trading at $4,511, with price extremes oscillating between $4,510 and $4,668. Despite the current dip, ETH’s long-term price change variables reflected increments of 4.5% 7-day-to-date and 2.3% year-to-date. Coincodex pegged Ethereum’s supply inflation at 0.32%, dominance reflected 13.67%, while volatility was medium at 3.32%.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.