Highlights:

- Bitcoin ETFs mark 7 days of consecutive gains with $292.27 million net inflows on September 16.

- Ethereum ETFs’ five-day profitable streak ended with a $61.74 million net outflow on the same date.

- Bitcoin’s price spiked slightly as it edges close to $120,000.

According to SosoValue’s latest exchange-traded funds (ETFs) flow statistics, Bitcoin (BTC) ETFs have extended their winning streak to seven consecutive days, with $292.27 million in net inflows on September 16. On the other hand, Ethereum (ETH) funds ended their five-day net inflows streak after losing $61.74 million on the same day. Ethereum ETFs’ latest outflows elicited fresh price decline concerns among the coin’s price enthusiasts as the token struggles to maintain a price level around $4,500.

On September 16, Ethereum spot ETFs saw total net outflows of $61.74 million, with only the Bitwise ETF ETHW posting net inflows. Bitcoin spot ETFs recorded total net inflows of $292 million, marking seven consecutive day of inflows. https://t.co/SF4brkl9iI pic.twitter.com/UCcG4Ve4qZ

— Wu Blockchain (@WuBlockchain) September 17, 2025

Bitcoin ETFs Sustain Remarkable Run

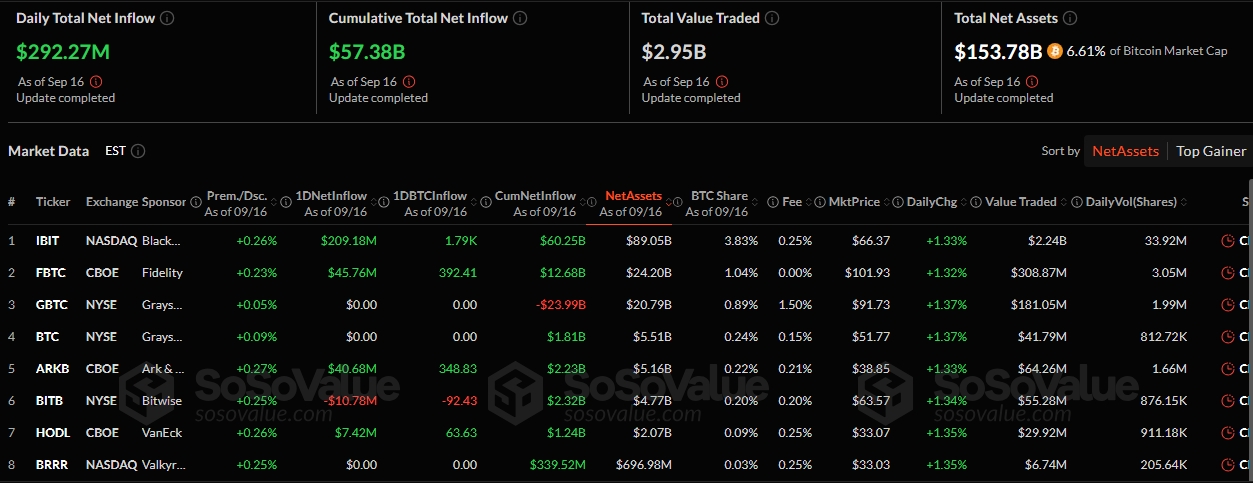

Five ETFs traded on September 16, as the remaining seven funds, including the two Grayscale Bitcoin ETFs (GBTC and BTC), had neither inflows nor outflows. Among the active ETFs, Bitwise Bitcoin ETF (BITB) recorded the only outflow, valued at about $10.78 million.

BlackRock Bitcoin ETF (IBIT) maintained its impressive record with $209.18 million in net inflows. Fidelity Bitcoin ETF (FBTC) and ARK 21Shares Bitcoin ETF (ARKB) added $45.76 million and $40.68 million, respectively. VanEck Bitcoin ETF (HODL) also contributed to the inflows with $7.42 million.

Overall, Bitcoin ETFs’ cumulative net inflows and total net assets have continued to rise. The former increased from $57.09 billion to $57.38 billion, while the latter rose from $151.72 billion to $153.78 billion. Notably, the net assets valuation now represents 6.61% of Bitcoin’s market capitalisation. Despite the inflows, the total value traded dropped from $3.03 billion to $2.95 billion.

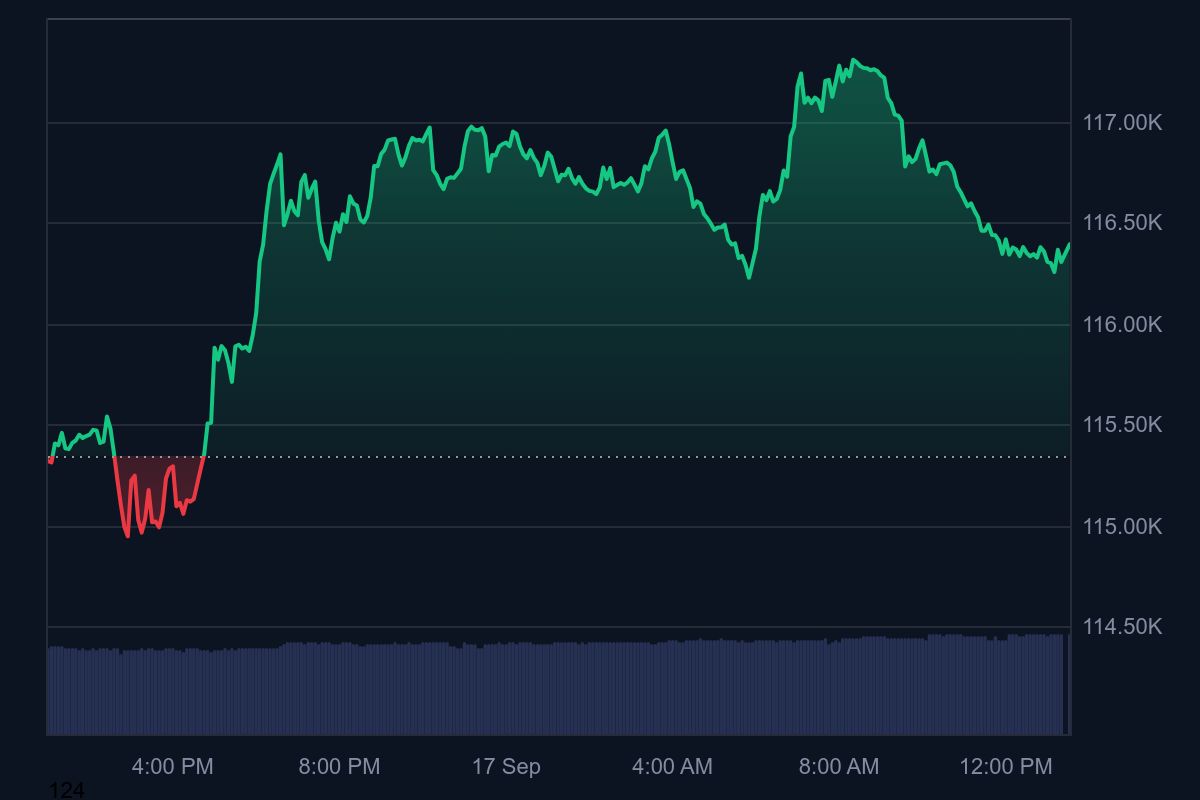

BTC Price Pushes Towards $120K as Bitcoin ETFs Mark 7 Days of Gains

At the time of press, Bitcoin price has soared by bout 0.8% in the past 24 hours. The flagship crypto is priced at $116,278, fluctuating between $114,866 and $117,292. The token’s long-term price change variable displayed upswings of about 3.5% 7-day-to-date, 1.1% month-to-date, and 96.9% year-to-date.

Despite its volatile and uncertain nature, institutional and individual investors’ interest in the asset class has continued to grow stronger. On September 16, GD Culture, an e-commerce firm, announced that it had struck a deal to purchase Pallas Capital Holding Ltd.

The agreement details include acquiring all of Pallas Capital’s assets, including its 7,500 BTC. Meanwhile, in a tweet earlier today, the renowned on-chain crypto transactions platform Lookonchain reported that a new wallet had amassed 5,817 BTC, worth roughly $678 million, from FalconX.

A newly created wallet bc1qup received 5,817 $BTC($678M) from #FalconX 8 hours ago.https://t.co/C6mTghCFQh pic.twitter.com/eWgDbUOGAB

— Lookonchain (@lookonchain) September 17, 2025

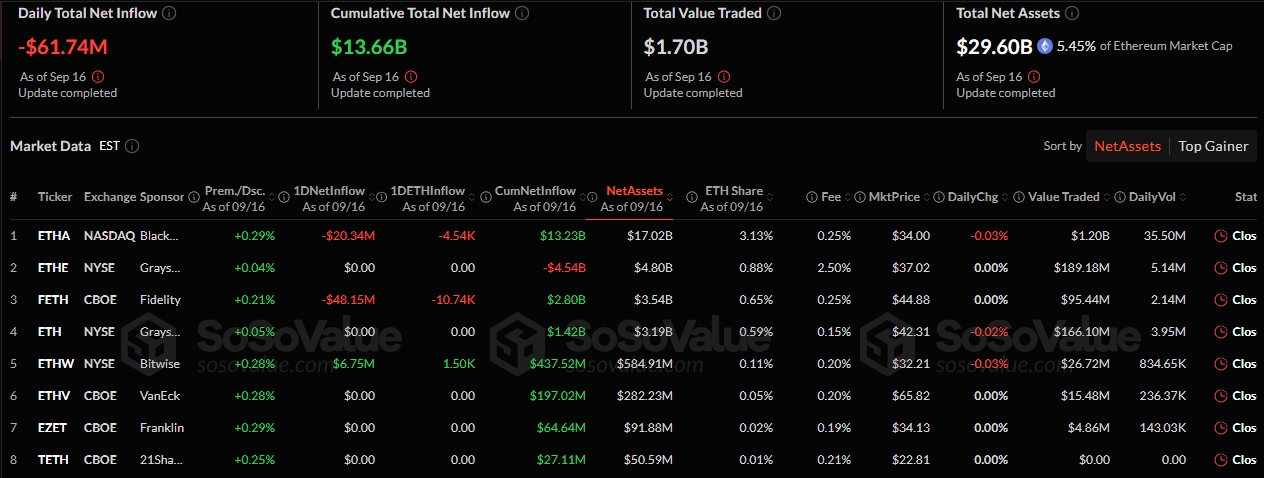

Ethereum ETFs Continue to See Reduced Activity Levels

Crypto2Community reported that only three ETFs traded on September 15. The ETFs have replicated the same pattern, with more ETFs recording outflows on September 16. Like Bitcoin, the two Grayscale Ethereum ETFs (ETHE and ETH) had zero flows yesterday. Bitwise Ethereum ETF (ETHE) was the only fund with inflows, valued at about $6.75 million. In contrast, Fidelity Ethereum ETF (FETH) and BlackRock Ethereum ETF (ETHA) recorded outflows of $48.15 million and $20.34 million, respectively.

As a result of the net outflow, the cumulative metrics dropped significantly. The total net inflows slipped from $13.72 billion to $13.66 billion, while the net assets valuation, representing 5.45% of Ethereum’s market cap, suffered a slight decrease from $29.72 billion to $29.6 billion. The total value traded suffered the worst hit, falling from $2.09 billion to $1.71 billion.

ETH’s Price Drops Slightly as Bitcoin ETFs Mark Seventh Straight Inflows

At the time of writing, Ethereum is changing hands at $4,489, following a 0.2% decline in the past 24 hours. Within the same timeframe, ETH has fluctuated between $4,431.42 and $4,553.09. Like BTC, Ethereum’s extended-period price change metrics reflected price upswings. For context, the token surged 3.8% 7-day-to-date, 5% month-to-date, and 94.3% year-to-date.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.