Highlights:

- Bitcoin ETFs maintained their winning streak following BlackRock’s over $500 million cash inflows.

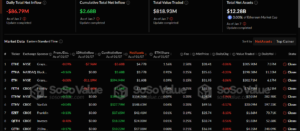

- Ethereum ETFs saw their second net outflows for the year after losing $86.79 million.

- Bitcoin and Ethereum prices have depleted significantly to align with the generalized crypto market declines.

After maintaining profitable streaks for two days in the Exchange Traded Funds (ETFs) market, Bitcoin (BTC) funds maintained the profitable trend, while Ethereum ETFs succumbed to $86.79 million in outflows. The outflow recorded by Ethereum ETFs is their second for the year, surpassing the first $77.51 million outflows recorded on January 2, 2025.

On January 7, the total net outflow of Ethereum spot ETF was 86.7917 million US dollars. Currently, the total net asset value of Ethereum spot ETF is 12.281 billion US dollars. https://t.co/Tvs2oCS03I pic.twitter.com/NMORy0Oe3j

— Wu Blockchain (@WuBlockchain) January 8, 2025

According to the popular on-chain ETF tracker, SosoValue, only three Ethereum funds were active yesterday. The three of them recorded only losses, while the remaining six did not record any activity. Fidelity Ethereum ETF (FETH) was responsible for a greater portion of the losses on January 7. The fund lost $67.64 million, which was higher than the combined amount forfeited by the two other funds that attracted losses.

The other ETH ETFs that lost money were the two Grayscale Ethereum ETFs. The mini version (ETH) forfeited $11.19 million, while the other one, ETHE, had outflows worth about $7.96 million. Overall, the January 7 losses impacted Ethereum’s cumulative net inflows by reducing the valuation from $2.77 billion to $2.68 billion. Similarly, it dropped the total net assets from $13.47 billion to $12.28 billion. On the other hand, the total value traded increased from $408.27 million to $819.94 million.

BlackRock Recorded the Only Inflows to Shield Bitcoin ETFs from Net Outflows

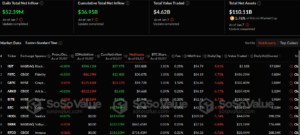

In their most recent outing, BTC ETFs attracted $52.39 million in cash inflows. Notedly, only six Bitcoin ETFs were active, as the remaining six had no inflows or outflows. Among the active funds, five experienced losses, while only BlackRock Bitcoin ETF (IBIT) saw inflows. IBIT gained $596.11 million to offset the losses from all other ETFs that lost money.

On January 7, the total net inflow of Bitcoin spot ETF was 52.3899 million US dollars, and the net inflow of BlackRock ETF IBIT was 596 million US dollars. The total net asset value of Bitcoin spot ETF is currently 110.115 billion US dollars. https://t.co/59u0BnDSW8 pic.twitter.com/MRH4P1K7jZ

— Wu Blockchain (@WuBlockchain) January 8, 2025

ARK 21Shares Bitcoin ETF (ARKB) led the losses chart after losing $212.55 million. Two other funds, including Grayscale Bitcoin ETF (GBTC) and Bitwise Bitcoin ETF (BITB), saw outflows worth over $100 million. They forfeited $125.45 million and $113.85 million, respectively. Moreover, Fidelity Bitcoin ETF (FBTC) and Franklin Bitcoin ETF (EZBC) also lost money yesterday. $86.29 million left FBTC, while EZBC registered a $5.58 million deficit.

The net inflows from yesterday’s outing had positive impacts on Bitcoin ETFs’ cumulative metrics. As per SosoValue’s data, the total net inflows increased from $36.90 billion to $36.95 billion. Similarly, the total value traded recorded increments from $3.96 billion to $4.62 billion, while the net assets valuation dropped to $110.11 billion from $116.67 billion.

Bitcoin and Ethereum Prices Turn Red

At the time of writing, the crypto market has depreciated significantly, with an 8.7% plunge in the past 24 hours. As a result of the decline, the entire crypto market valuation has dropped to $3.47 trillion. As expected, Bitcoin and Ethereum price actions have aligned with the unimpressive trend.

Bitcoin dropped by about 6.3% in its 24-hour-to-date price change variable, reflecting approximately $95,300 in selling price. Within the same time frame, the flagship cryptocurrency minimum and maximum prices fluctuated between $95,259.12 and $101,990. Therefore, it highlights BTC’s significant decrements within a short interval.

On the other hand, Ethereum witnessed a more significant 9.1% decrement in its daily time frame data. According to CoinGecko, ETH is changing hands at about $3,330. Its price extremes in the past 24 hours were $3,307.80 and $3,678.06, underscoring a marked and sudden price drop. Meanwhile, Ethereum’s market capitalization dropped to about $401.9 billion, while its 24-hour trading volume was $38.78 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.