Highlights:

- Bitcoin ETFs lost $3.8 billion over five weeks of steady withdrawals.

- Ether ETFs recorded $123.4 million outflows last week despite brief inflows.

- Santiment reported fading $150k Bitcoin predictions, which shows retail optimism is cooling.

U.S.-listed spot Bitcoin (BTC) exchange-traded funds (ETFs) are facing steady pressure. For five weeks in a row, investors have been pulling money out. In total, more than $3.8 billion has left in these funds during this period.

Spot Bitcoin ETFs Face Record $1.49B Weekly Outflow

The heaviest weekly withdrawal came in the week ending January 30. That week alone saw $1.49 billion in redemptions. It was the largest single weekly exit since the products launched. The selling did not stop there. Last week, net outflows reached $315.9 million, according to SoSoValue. While there were a few days when money flowed back in, it was not enough to balance the overall withdrawals.

On February 12, more than $410 million was pulled out in just one day. After that, smaller outflows continued from February 17 to February 19. By Friday, there was a brief moment of relief, with $88 million in inflows. Still, the week ended negatively. Even with this recent downturn, the long-term picture remains strong. Since launch, spot Bitcoin ETFs have brought in $54.01 billion in net inflows. Their total net assets now stand at $85.31 billion. That equals around 6.3% of Bitcoin’s total market value.

On Feb. 20 (ET), total net inflows into Bitcoin spot ETFs reached $88.04 million. The Bitcoin spot ETF with the largest single-day net inflow was BlackRock's IBIT, which recorded $64.46 million in net inflows, bringing its cumulative historical net inflows to $61.303 billion.… pic.twitter.com/9OCCJnncNY

— Wu Blockchain (@WuBlockchain) February 21, 2026

Ether ETFs Also Under Pressure

Spot Ether exchange-traded funds are seeing a similar pattern. They have now recorded five straight weeks of net outflows, matching the trend seen in Bitcoin funds. Last week alone, investors withdrew $123.4 million from Ether ETFs. There were a few positive days.

On February 17, funds saw $48.6 million in inflows. Earlier, on February 13, another $10.3 million came in. But those gains were small compared to the overall selling. In the end, the heavier redemptions outweighed the inflows. The week still closed in negative territory.

Santiment Highlights Fading Bullish Predictions

Blockchain analytics firm Santiment has observed a clear drop in aggressive bullish predictions around Bitcoin. In its latest update, the platform said fewer traders are now calling for fresh all-time highs. Forecasts targeting $150k to $200k, as well as broader ranges like $50k to $100k, are becoming less common.

According to Santiment, this shift may actually support a healthier market structure. The firm noted that hype driven behavior, including FOMO and flashy “Lambo” narratives, has cooled down. That fading retail excitement suggests speculative pressure is easing. When crowd-driven optimism slows, price action can become more stable and less reactive.

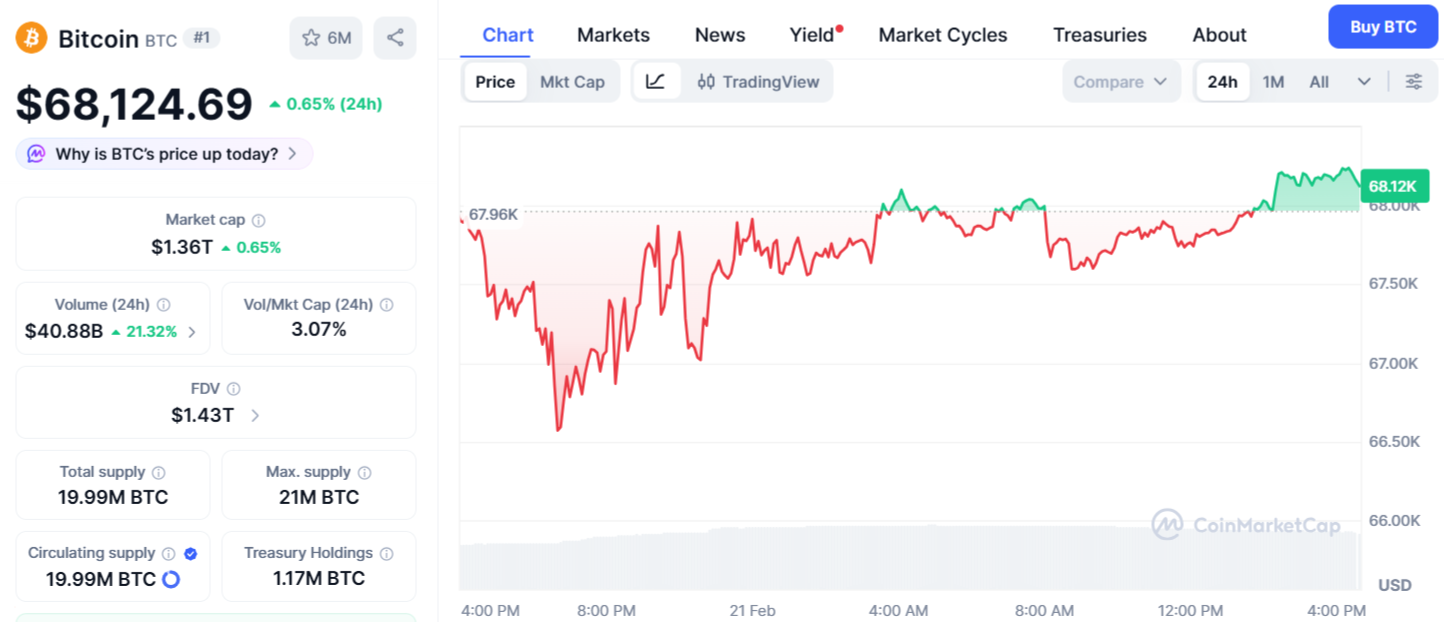

Bitcoin fell to nearly $60,000 on February 6 but quickly rebounded. At the time of reporting, it traded close to $68,129, according to CoinMarketCap.

Even with this recovery, the overall mood in the market has not turned fully positive. Santiment reported that sentiment has shifted from extreme bearishness into neutral territory. This middle ground often creates uncertainty because neither buyers nor sellers holds clear control, which makes signals harder to read. The firm advised traders to act cautiously in such conditions.

Santiment also noted a decrease in network activity. Transaction volumes, active wallet addresses, and network growth are all trending downwards. These are a measure of how often the blockchain is being used and how quickly new participants are joining. The decrease in these areas indicates a decrease in activity, which could impact the near-term price action.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.