Highlights:

- Bitcoin ETFs inflow hit $430M, as profitable streak extends to second consecutive day.

- Ethereum ETFs also recorded their second straight gains with $127 net inflows on September 30.

- Bitcoin and Ethereum prices reclaimed key levels amid consistent inflows into ETFs.

On September 30, Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs) attracted $557.43 million in combined net inflows to close September with net profits. SosoValue reported that Bitcoin ETFs closed last month with $3.53 billion in net inflows, while Ethereum funds gained $285.74 million.

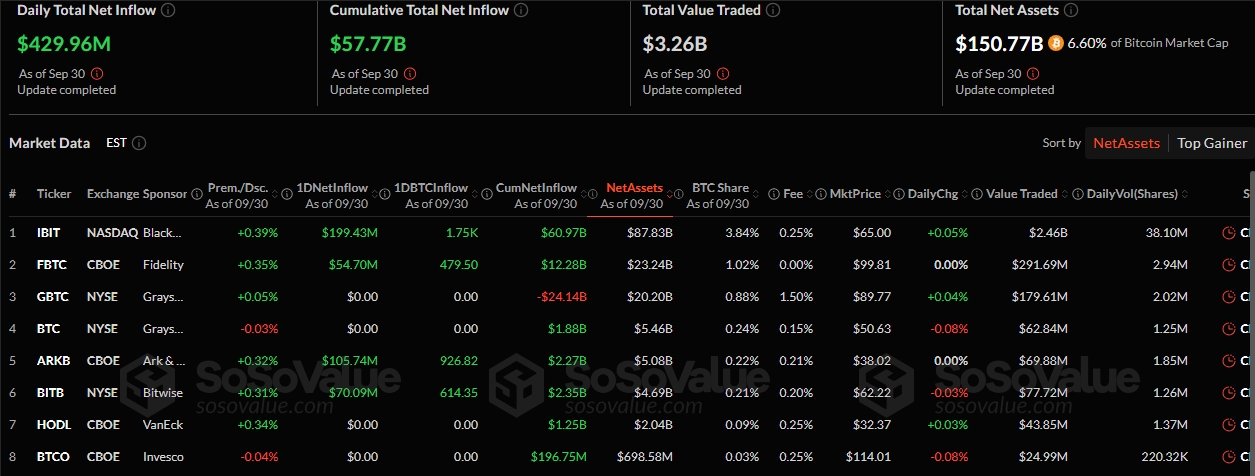

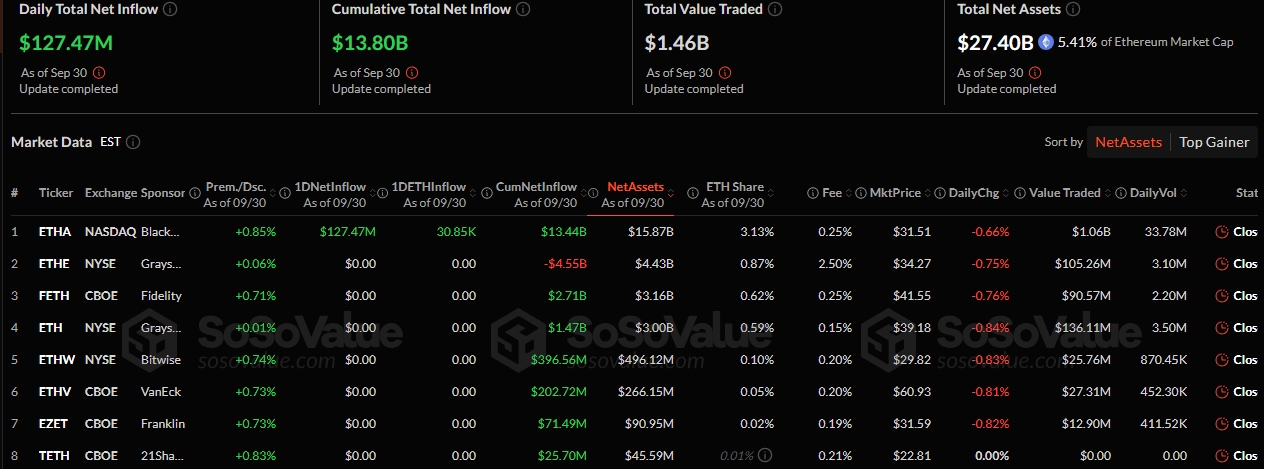

Yesterday, Bitcoin ETFs added $429.96 million, extending their profitable trend to the second consecutive day and recovering from the $902.5 million net outflows recorded in the week ending September 26. Similarly, Ethereum ETFs gained $127.47 million on September 30, marking its second consecutive daily profit after succumbing to a weekly net outflow of $795.56 million in the week ending September 26.

On September 30, spot Bitcoin ETFs saw a total net inflow of $430 million, while none of the twelve ETFs saw a net outflow. Spot Ethereum ETFs recorded a total net inflow of $127 million, while none of the nine ETFs saw a net outflow. https://t.co/BmieKfQjuL pic.twitter.com/8VdTa4wynM

— Wu Blockchain (@WuBlockchain) October 1, 2025

Bitcoin ETFs Inflow Nears $1 Billion within 2 Days

On September 29, Bitcoin ETFs attracted $518 million, increasing their gains for the current week to $947.96 million. Meanwhile, on September 30, four ETFs were active, as the remaining, including the VanEck Bitcoin ETF (HODL) and the two Grayscale Bitcoin ETFs (GBTC and BTC), had zero flows.

BlackRock Bitcoin ETF (IBIT) and ARK 21Shares Bitcoin ETF (ARKB) led the inflows with $199.43 million and $105.74 million, respectively. Bitwise Bitcoin ETF (BITB) and Fidelity Bitcoin ETF (FBTC) also added $$70.09 million and $54.7 million, respectively.

Overall, Bitcoin ETFs’ cumulative net inflow rose from $57.34 billion to $57.77 billion, while the total net assets valuation reached $150.77 billion from $150.41 billion. The new net assets valuation now represents 6.60% of Bitcoin’s market cap of $2.28 trillion. On the other hand, the total value traded dropped from $4.61 billion to $3.26 billion.

Ethereum ETFs Record Minimal Activity

Yesterday, only Black Ethereum ETF was active, attracting $127.47 million in inflows. The remaining eight Ethereum funds recorded neither inflows nor outflows. Despite the net inflow, Ethereum ETFs’ total value traded and net assets dropped slightly. The former fell from $1.89 billion to $1.47 billion, while the latter slipped from $27.54 billion to $27.4 billion. In contrast, the cumulative net inflow rose from $13.67 billion to $13.8 billion.

BTC and ETH Prices Spike Slightly Amid Ethereum and Bitcoin ETFs Inflow

At the time of writing, Bitcoin is trading at $115,391, following a 1.66% surge in the past 24 hours, with price extremes fluctuating between $112,736 and $115,207. Extended period price change metrics showed that BTC gained 2.5% 7-day-to-date and 6.7% month-to-date. Despite the slight price upswing, BTC’s 24-hour trading volume dropped 8.47% to $56.42 billion.

On its part, Ethereum is up 2.46% in the past 24 hours, trading at $4,276 with a market cap of $516.13 billion. In the past seven days, ETH spiked 1.7%, fluctuating between $3,846.41 and $4,226.03. This price range highlights the token’s remarkable recovery within a short interval. Ethereum is currently trading near its cycle high and above its 200-day Simple Moving Average (SMA), with high liquidity based on its market cap.

Bitcoin and Ethereum Continue to Attract Investors’ Interest

Meanwhile, individual investors and institutional interest in Bitcoin and Ethereum have continued to grow. Telegram founder Pavel Durov recently shared an ambitious $1 million price target for BTC. He based his assertion on Bitcoin’s limited supply. He also admitted to investing a few million dollars in BTC back in 2013. The Telegram founder purchased the tokens at an average cost of $700 before they dropped to about $200, which made many ridicule him. However, Durov maintained faith in BTC, which eventually rewarded him in the long run.

The Telegram founder stated:

“I’m not going to sell it. I believe in this thing. I think this is the way money should work. Nobody can confiscate your Bitcoin from you. Nobody can censor you for political reasons.”

On September 30, SharpLink Gaming, one of the world’s leading Ethereum holders, announced that it earned 457 ETH in staking rewards. “That lifts our cumulative rewards to 4,272 ETH since starting the ETH treasury strategy on June 2, 2025,” SharpLink added. Notably, 1,825 ETH came from native staking, while the remaining 2,447 ETH came from liquid staking.

NEW: SharpLink earned 457 ETH in staking rewards last week.

That lifts our cumulative rewards to 4,272 ETH since starting the ETH treasury strategy on June 2, 2025.

Breaking it down by source:

– 1,825 ETH from native staking

– 2,447 ETH from liquid stakingWith our ETH… pic.twitter.com/WpD04wW40Q

— SharpLink (SBET) (@SharpLinkGaming) September 30, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.