Highlights:

- Bitcoin ETFs have ended its four days of consecutive gains with its most recent statistics, recording net outflows above $50 million.

- Ethereum ETFs recorded another net outflow, bringing the losses trend to the third day.

- Despite the losses, Bitcoin and Ethereum recorded slight price upswings in several market action variables.

Bitcoin’s Exchange Traded Funds (ETFs) have recorded net outflows in its most recent flow statistics. The latest losses occurred after a four-day inflows streak. On the other hand, Ethereum (ETFs) sustained its outflow trend for the third consecutive day.

Renowned cryptocurrency ETFs flow tracker Spotonchain captured the statistics in one of its most recent posts. According to the tweet, Bitcoin ETFs recorded $52.7 million in losses. Similarly, Ethereum ETFs saw net outflows of roughly $9.8 million. Interestingly, the commodities from both entities witnessed minimal activities, highlighting a largely dull ETF market.

🇺🇸 Spot ETF: 🔴$52.7M to $BTC and 🔴$9.8M to $ETH

🗓️ Sep 18, 2024👉 The net flow for BTC ETFs turned negative after 4 days with inflows.

👉 10/11 BTC ETFs saw non-positive flows yesterday, led by the #21Shares (ARKB).

Follow @spotonchain and check out the latest updates about… pic.twitter.com/WR3D8utE8e

— Spot On Chain (@spotonchain) September 19, 2024

ARKB Leads the Losses for Bitcoin ETFs

Only Grayscale Mini Bitcoin ETF (BTC) saw inflows from among BTC’s eleven ETFs. Notedly, it witnessed about $2.7 million in profits. Worryingly, seven recorded zero activities, while only three incurred losses. ARK 21Shares Bitcoin ETF (ARKB) recorded the highest decline, with $43.4 million in net outflows. Grayscale Bitcoin ETF (GBTC) and Bitwise Bitcoin ETF (BITB) followed closely with $8.1 million and $3.9 million, respectively.

Despite the net outflows recorded, most cumulative variables appeared slightly affected, considering the volume of the previous inflow. However, Bitcoin ETFs continue to trail the $1.2 billion losses recorded from the previous week as they have yet to recover even 50%.

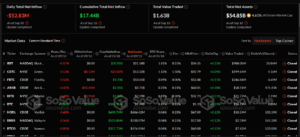

For context, Bitcoin ETF cumulative net inflow read approximately $17.44 billion. The total value traded was $1.63 billion, while total net assets reflected $54.85 billion. Interestingly, the total net assets value represented 4.61% of Bitcoin’s market capitalization.

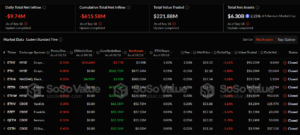

Ethereum ETFs Record Activities from Only Two Entities

Ethereum ETFs saw inflows from only BlackRock Ethereum ETF (ETHA), with approximately $4.9 million in profits. On the other hand, Grayscale Ethereum ETF (ETHE) witnessed the only outflows at roughly $14.7 million. According to SosoValue’s statistics, Ethereum ETFs’ cumulative netflow continues to plunge in losses of about $615.58 million. The total value traded reflected $221.88 million, while total net assets were $6.3 billion.

Bitcoin Price Soars Slightly Amid Latest ETFs Net Outflows

Contrary to expectations from the ETF losses, Bitcoin recorded price upswings, mirroring the general crypto market that is up by about 1.9% with a $2.2 trillion valuation. At the time of writing, Bitcoin is changing hands at approximately $62,000, reflecting a 2.8% upswing from the previous day.

In the past 24 hours, BTC saw minimum and maximum prices fluctuating between $59,212.14 – $62,508.63. Therefore, it highlights the gradual rebound from the previous day, which reflected levels around $61,000 as its 24-hour interval peak.

Bitcoin’s 24-hour trading volume registered an above 10% upswing, with a $47.4 billion valuation. While it is safe to assert that Bitcoin market actions were promising despite the ETF losses, chances abound that the United States Federal Reserve’s decision to slash rates by 50 basis points could influence the remarkable run.

BREAKING: The Federal Reserve has cut interest rates by 50 basis points in their first rate cut since March 2020.

This officially marks the most surprising Fed decision since 2009. pic.twitter.com/j83SrtnllH

— The Kobeissi Letter (@KobeissiLetter) September 18, 2024

Ethereum Records a More Significant Short-Term Price Surge

Like Bitcoin, Ethereum registered a subtle upswing in its 24-hour-to-date variable. However, ETH’s price upswing was slightly higher, with a 3.7% spike, bringing the coin’s selling price to about $2,400. Its 7-day-to-date price change data also recorded a slight 1.8% increment.

Ethereum’s 24-hour trading volume is also up by approximately 26.41%, with a $20.28 billion valuation. Meanwhile, the coin’s $290.15 billion market capitalization has remained significantly buoyant to sustain the coin’s most valuable altcoin title.