Highlights:

- Bitcoin drops below $88,000 as Powell lowers expectations for immediate interest rate cuts.

- Powell’s speech reduces the likelihood of a December rate cut, dropping to 62%.

- Bitcoin faces correction as the Fed’s cautious approach makes traditional assets more attractive.

Bitcoin stumbled below the $88,000 mark after Federal Reserve Chair Jerome Powell lowered expectations for an immediate interest rate cut. During a speech in Dallas, Texas, on November 14, Powell said the economy’s strength shows no urgency for further interest rate cuts. He added that they will closely monitor the economy to keep inflation under control. The comments come as financial markets have been speculating about the possibility of rate cuts in the near future.

Powell’s statement follows two recent rate cuts of 50 and 25 basis points in September and November. The Fed’s next interest rate decision will be announced on Dec. 18. Powell said, “The economy is not sending any signals that we need to be in a hurry to lower rates. The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully.”

Just hours ago, a Fed rate cut in mid-December seemed certain, but after Powell’s speech, the likelihood has dropped to 62%, according to CME FedWatch. A day earlier, the chances were at 83%. Traditional markets, which had been strong lately, dipped a bit due to the hawkish tone. The Nasdaq fell 0.75% to a low just before the market closed.

.@jenniferisms recaps Fed Chair Powell’s speech in Dallas, TX, where he addressed the future of interest rate decisions:

“The economy is not sending any signals that we need to be in a hurry to lower rates,” he said. pic.twitter.com/qBujZg5NRx

— Yahoo Finance (@YahooFinance) November 14, 2024

Bitcoiners Eye Fed Rate Decision as Lower Rates Shift Investor Focus

Bitcoiners are watching the Fed’s interest rate decision. Lower rates make safer assets like bonds less attractive. This leads investors to consider riskier options like Bitcoin and tech stocks.

Meanwhile, US inflation data slightly exceeded market expectations. On the same day, the October US Producer Price Index (PPI) showed a 2.4% annual rise, just above the 2.3% forecast. This inflation data, close to expectations, could further reduce the need for the Fed to adjust interest rates. After the 0.25% rate cut last week, many speculated more cuts, but Jerome Powell stated the Fed will monitor data for future decisions.

Bitcoin Price Falls After Fed Chair’s Hawkish Speech

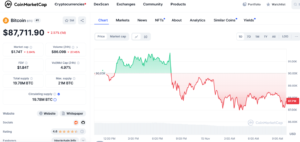

After an eventful week when Bitcoin’s price surged to an all-time high above $93,000, it is now experiencing its first significant correction. The Fed Chair’s speech has had a negative impact on investors, prompting some to cash out their profits. As of writing, Bitcoin has fallen below the $88,000 support level, trading at $87,711, marking a 2.57% decline over the last 24 hours.

Although the price of XRP reached $0.8, its highest point this year, it is quickly losing those gains. Ethereum (ETH), Solana (SOL), and Binance Coin (BNB) are also shedding their gains, following the same trend as Bitcoin. The market’s mild panic is understandable. Halting interest rate hikes could make traditional assets more appealing, reducing Bitcoin’s appeal as an inflation hedge.

Investors should keep an eye on Fed policy, miner activity, and institutional flows as key indicators for Bitcoin’s next move. The market’s response to these factors will likely decide if Bitcoin can continue its push toward $100,000 or needs a consolidation phase at current levels.