Pioneer decentralized cryptocurrency, Bitcoin (BTC), recently dropped below $65,000, sparking wild spread concerns among crypto faithful, as the dip could only culminate in further declines, which invariably implies more losses amid an already precarious state.

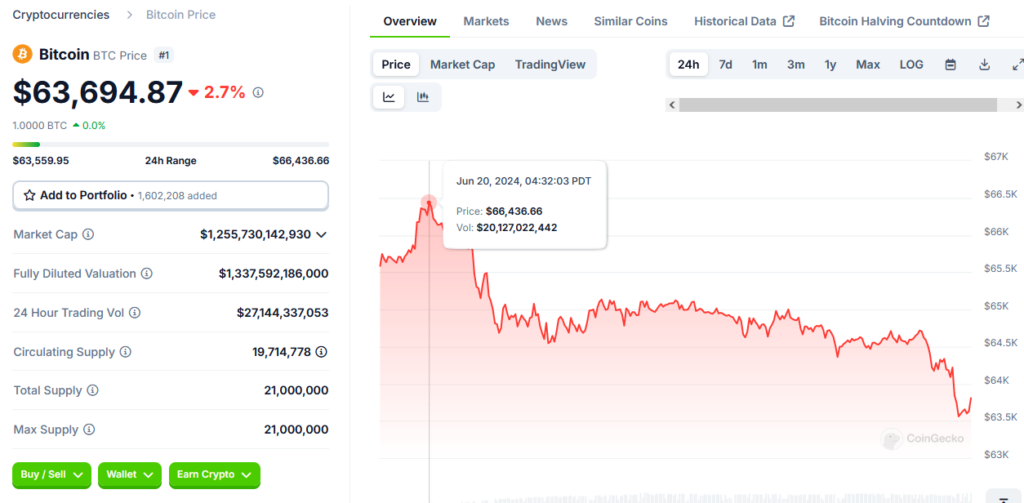

At the time of press, CoinGecko’s price statistics revealed that the flagship crypto asset is trading at about $63,690, having registered a 2.7% decline in the past 24 hours and recording minimum and maximum prices between $63,559.95 – $66,253.45, respectively.

In the past week, Bitcoin registered prices ranging between minimum and maximum prices of approximately $63,594.27 and $67,037.90, respectively, underscoring the coin’s gradual decline, which does not appear to be correcting any moment from now.

Expert Wade’s Into The Reasons For BTC’s Declines Debate

Amid the price plunges, a renowned market expert with the pseudonym “TedPillows” recently took to his verified X handle to sensitize his over 114K users on how FED liquidity and other factors are fuelling Bitcoin’s unusual declines in the past few weeks.

The remaining part of this insight shall dwell on Ted’s analysis of why Bitcoin appears to be dropping longer than expected. In addition, the market expert analysis also answered questions on when to anticipate BTC’s price rebound. Hence, it underscores why Ted’s analysis has been making rounds on the microblogging social platform.

FED Liquidity Flows

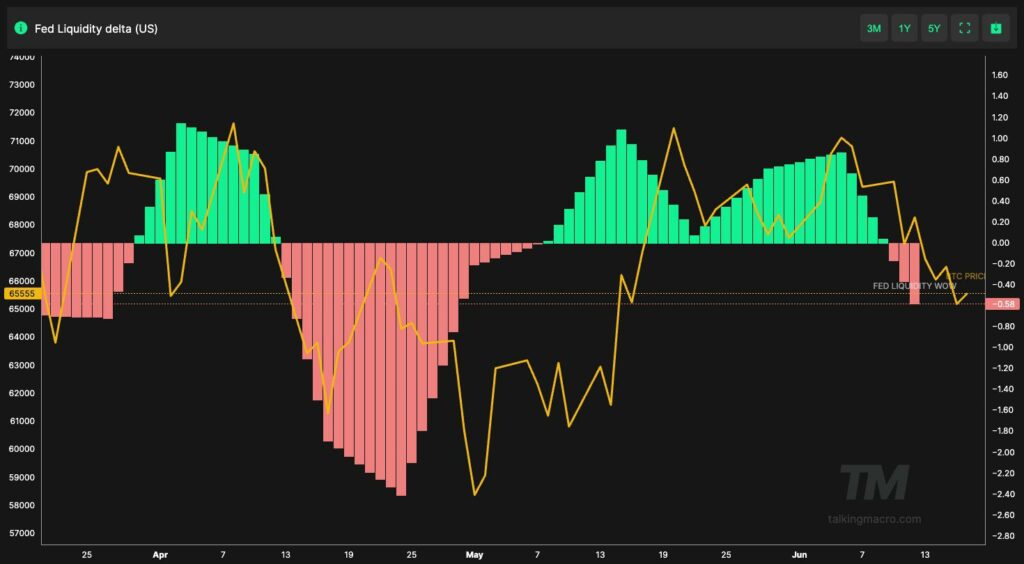

According to Ted, one of the most significant factors driving Bitcoin’s dwindling market actions in recent times reportedly stems from the Federal Reserve System (FED) liquidity flows, which turned negative last week, marketing BTC’s local top.

For context, the FED serves as the United States Central Bank, responsible for dictating the American nation’s financial outlook. Hence, considering the United States leading position in the global financial sector, it becomes safe to say that the impact would affect every monetary system, including cryptocurrencies.

ETF Outflows

The second factor spotlighted as a potential driver of Bitcoin’s price drops was the net outflows record in the coin’s Exchange Traded Fund (ETF) markets.

Notably, popular analytical platform Lookonchain statistics as of June 20, 2024, reported net outflows across all ETFs in their 7-day and 1-day indices. Per the data on the data analysis handle, there was a net outflow of about 1,290 BTC worth about $83.7 million in a 1-day statistics. On the other hand, the 7-day variable recorded a net outflow of about 10,022 BTC valued around the $650.25 million price region.

Jun 20 Update:

9 ETFs decreased 1,290 $BTC(-$83.7M).#Fidelity decreased 1,290 $BTC(-$83.7M) and currently holds 168,862 $BTC($10.95B).#Blackrock and #Grayscale did not update their latest BTC holdings.https://t.co/gXIi5SUqpx pic.twitter.com/vgiPski8c6

— Lookonchain (@lookonchain) June 20, 2024

When net flows begin to gear towards a negative direction, it has only one implication that investors might be losing interest in the digital asset involved.

Don’t Miss: Bitcoin ETFs See $200M Net Outflows Prior to Crucial Fed Inflation Data; Crypto Liquidations Exceed $183M

Crypto Liquidity Slowdown

Crypto Liquidity Slowdown was the final factor highlighted by the market expert. It implies that investors have reduced their spending rates to accumulate more tokens. Hence, the negative price actions and sell-offs seem to become more dominant.

The above has a wild spread impact on the entire crypto ecosystem price actions, as funds will invariably get to Bitcoin first before eventually trickling down to other less valuable crypto assets. Hence, it justifies why altcoins are also struggling with unimpressive market actions.

FED Liquidity Must Improve Before BTC’s Pumping Action

Predicting when he anticipates Bitcoin’s pumping action, TED stated that it will only happen if the FED liquidity ceases being negative and starts reading positive values.

According to TED, FED liquidity, turning positive, will likely happen in a week or two weeks from now. However, before BTC’s ascent to a new all-time high (ATH), it will record an initial bottom, Ted added.

Learn More

- Binance Enables USDT Transactions on Toncoin Network

- 20 Top Cryptocurrencies to Watch for 2024 – Detailed Reviews

- DePIN Crypto Projects to Watch In 2024 – Top 10 DePIN Coins to Buy

- Next Cryptocurrency to Explode in 2024

Disclaimer: Cryptocurrency is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.