Highlights:

- Mt. Gox transferred $784 million in Bitcoin to unknown addresses on August 20.

- Most Mt. Gox creditors are keeping their Bitcoin, with few intending to sell.

- Bitcoin price struggles to stay above $60,000 despite whale accumulation.

Defunct crypto exchange Mt. Gox transferred 13,265 Bitcoin worth a staggering $784 million to unknown wallet addresses at 11:39 pm UTC on Aug. 20, according to blockchain analytics firm Arkham. This marks its first major transaction since late July.

🛑 Here we go again 👇 Mt. Gox moves 13,265 Bitcoin https://t.co/cNSPM3rOvH pic.twitter.com/uwLfdjaAaD

— HODL15Capital 🇺🇸 (@HODL15Capital) August 21, 2024

The data showed two large transactions. Mt. Gox moved 12,000 Bitcoin, worth $709.4 million, to an empty address starting with “1PuQB.” It also transferred 1,265 BTC, worth $74.8 million, to the address starting with “1Jbez,” labeled as a Mt. Gox cold wallet on Arkham Intelligence. The funds have remained unmoved since the transfer.

Mt. Gox Transfers Billions in Bitcoin to Repay Creditors

Moreover, last week, a wallet likely linked to the cryptocurrency exchange BitGo moved most of the $2 billion worth of Bitcoin it received from Mt. Gox to a different wallet, according to Arkham on X. This significant transfer could indicate that Mt. Gox is preparing to distribute more Bitcoin to its creditors. Mt. Gox, founded in 2010, was the world’s largest Bitcoin exchange until a major breach in 2014 led to the loss of at least 850,000 BTC. Thousands of creditors have been awaiting their BTC return, a process ongoing for weeks.

In July, the defunct exchange transferred 95,523 Bitcoins, valued at $6.14 billion, to crypto exchanges like BitGo, Kraken, and Bitstamp for repayment. Despite the current transfers, Mt. Gox still holds 46,164 BTC, valued at $2.74 billion at today’s BTC price. Previous reports suggest the Japanese exchange is expected to complete the repayment process by the end of the year.

only 2.7b from mt gox left

almost there… pic.twitter.com/u660XXKPSm— hansolar (@hansolar21) August 21, 2024

Interestingly, Mt. Gox creditors seem to have defied expectations by holding onto their reacquired Bitcoin. A poll on the r/mtgoxinsolvency subreddit shows that over half of creditors plan to hold onto their Bitcoin. Only about 14% intend to sell. However, the poll may not be reliable, as opinions on selling vary greatly between those with small and large holdings. Moreover, CryptoQuant CEO Ki Young Ju noted that Bitcoin outflows on Kraken didn’t spike after Mt. Gox’s late July transfers to creditors.

Bitcoin Faces Resistance at $60K

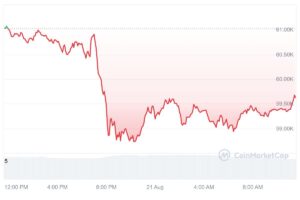

Bitcoin bulls are struggling to keep the price above $60,000, with a recent 2.36% drop to $59,666. Over the past month, Bitcoin has traded between $50,000 and $60,000. As Bitcoin miner capitulation nears its end, investors are hopeful for a post-halving rally. Meanwhile, Bitcoin whales have continued to accumulate during the recent price dips.

Blockchain analytics firm Santiment reported that Bitcoin whale wallets holding between 100 and 1,000 BTC have accumulated nearly 100,000 coins in the past six weeks. For BTC to start the next phase of the rally, it must remain above the $60,000 resistance level.

🐳 Bitcoin's whales, specifically wallets that hold between 100-1K BTC, have accumulated 94.7K more coins in the last 6 weeks. As price uncertainty has shaken many traders out of crypto, key stakeholders are loading up. pic.twitter.com/hrhlVrNqNU

— Santiment (@santimentfeed) August 19, 2024

Mt. Gox creditor reimbursements have notably pressured BTC’s price this summer. However, Alex Thorn from Galaxy Digital suggests the latest on-chain movements might not lead to significant selling pressure.

Thorn said:

“We now think that of the 13,265 BTC moved in this tx, only 1,265 ($74.5 million) is meant to distro, w/ 12,000 going to estate fresh cold storage so, very small.”