Highlights:

- Bitcoin is experiencing a bullish trend, with potential for all-time highs in Q4 2024.

- Market catalysts, including liquidity from FTX, may drive significant activity in Bitcoin.

- Key levels to watch include the previous cycle high and the 21-week moving average.

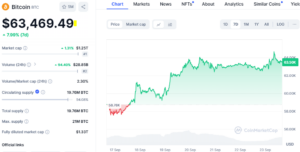

As market sentiment increasingly turns bullish, Bitcoin (BTC) is following suit. With an 8% increase over the past week, the cryptocurrency is eyeing levels that could generate significant profits for its holders. According to cryptocurrency research and analysis firm 10x Research, Bitcoin (BTC) could reach an all-time high in the fourth quarter of 2024.

Critical Period: October to March

10x Research founder and CEO Markus Thielen mentioned that the likelihood of a major breakout rises as we approach the October-to-March period. The report suggests that this trend may recur this year, especially in light of the market cycles seen in 2014, 2017, and 2021.

He added.

“Bitcoin’s 2024 performance has once again followed its seasonal pattern – just as it did in 2023. This is why traders should anticipate a major breakout, potentially reaching new all-time highs in Q4 2024.”

#Bitcoin Set to Smash New All-Time Highs in Q4 2024!

👇1-14) Following our bullish Bitcoin report at $54,800 on September 9, we appeared on #CNBC the next day to discuss potential catalysts for a year-end rally. The market structure has shown improvement, with increased… pic.twitter.com/JntgFnEO1h

— 10x Research (@10x_Research) September 23, 2024

Catalysts and Cautions for Bitcoin’s Year-End Performance

The report examines various external factors that could catalyze Bitcoin’s end-of-year (EOY) performance. Liquidity is anticipated to bolster the bullish momentum. Macroeconomic conditions, including Federal Reserve interest rate decisions, inflation concerns, and dynamics related to the US election, are potential catalysts for BTC’s price.

Moreover, the bankrupt crypto exchange FTX is set to distribute $16 billion to creditors. Many market analysts believe this liquidity will flow back into Bitcoin and the broader crypto market, potentially sparking significant activity in the space.

While there are several bullish catalysts for BTC, the report warns investors to remain cautious, noting the asset’s history of drawdowns of up to 70% in previous cycles. 10x Research stated that BTC must retest two crucial levels before the prediction can be confirmed.

Thielen wrote:

“The two key levels to watch for Bitcoin are the previous cycle high of $68,330 and the 21-week moving average. Dropping below the moving average could signal the end of the current cycle, while breaking above it— especially if the previous cycle high comes into play — could indicate an extension.”

As BTC rises, market analysts believe Altseason is just weeks away. Ethereum has already demonstrated strength, with its price gaining 16% over the past week. However, rising deposits from Ethereum whales have left analysts uncertain about ETH’s next direction. Meanwhile, Bitcoin ETFs are gaining momentum again. In the past week, BTC ETFs experienced $397 million in inflows, with Fidelity’s FBTC leading the way.

Bitcoin Rally Amid Gold Surge

Gold prices have reached new highs after the Fed’s rate cut last week, while Bitcoin has surged over 8% to $63,500. On September 23, gold hit a record high of $2,629 per ounce, gaining 5% in the past 15 days. The Fed’s 50 basis point rate cut has boosted gold’s appeal as an inflation hedge, making it more attractive compared to short-term government bonds.

Additionally, demand for gold investments has been rising due to increasing geopolitical risks, including the ongoing conflicts between Russia and Ukraine, as well as Israel and Hamas. The uncertainty surrounding the 2024 US elections also contributes to this trend.

Recently, Goldman Sachs reported that central bank gold purchases have tripled over the past two years amid the Russia-Ukraine war. With more Fed rate cuts anticipated this year, Goldman Sachs researchers forecast the gold price to reach $2,700 by early next year.