Highlights:

- The price of Bitcoin Cash surges 4% to $502, reclaiming a $10 billion market cap, with a 14% spike in daily volume.

- Bitcoin Cash rises within an ascending channel, targeting $600 with strong support at $391 and $426.

- BCH sees bullish momentum, supported by liquidation levels and a market imbalance, pushing prices higher.

As of 26 June, Bitcoin Cash price (BCH) has roared back into the club of cryptocurrencies, reclaiming the $10 billion market cap. Currently, BCH is showing a splendid bullish muscle, soaring 4% to $502 mark. The daily trading volume has notably increased by 14% indicating intense market activity.

Welcome back to the $10 billion market cap club, Bitcoin Cash BCH! Congrats to all holders and hodlers. To the moon, to mars, beyond the stars, let's go! pic.twitter.com/LUbUKyUXaw

— John Galt (@JohnGaltBCH) June 26, 2025

The recent spike comes as retail traders are increasingly going short, and the aggregated funding rate has turned negative once again. Moreover, the Bitcoin price is upholding a bullish outlook. Often, other major altcoins such as Bitcoin Cash ride on the BTC wave.

Bitcoin Cash Price Shows Strength Within an Ascending Parallel Channel

In the BCH/USD daily chart, the bulls have shown intense strength, flipping the 50-day and 200-day MAs into immediate support. Moreover, Bitcoin Cash price trades well within the confines of a rising parallel channel, reinforcing the bullish outlook. The strong support at $391 and $426 gives the bulls hind wings to target higher levels. If the current momentum sustains, further upside to $600 could be plausible.

The Relative Strength Index (RSI) is at 65.00, which indicates that the BCH is experiencing intense buying pressure. Increased momentum may push the RSI towards the 70-overbought territory. Additionally, the MACD indicator presents a bullish momentum whereby it is above the orange signal line. Traders are at liberty to buy more BCH tokens, unless the MACD (in blue) changes.

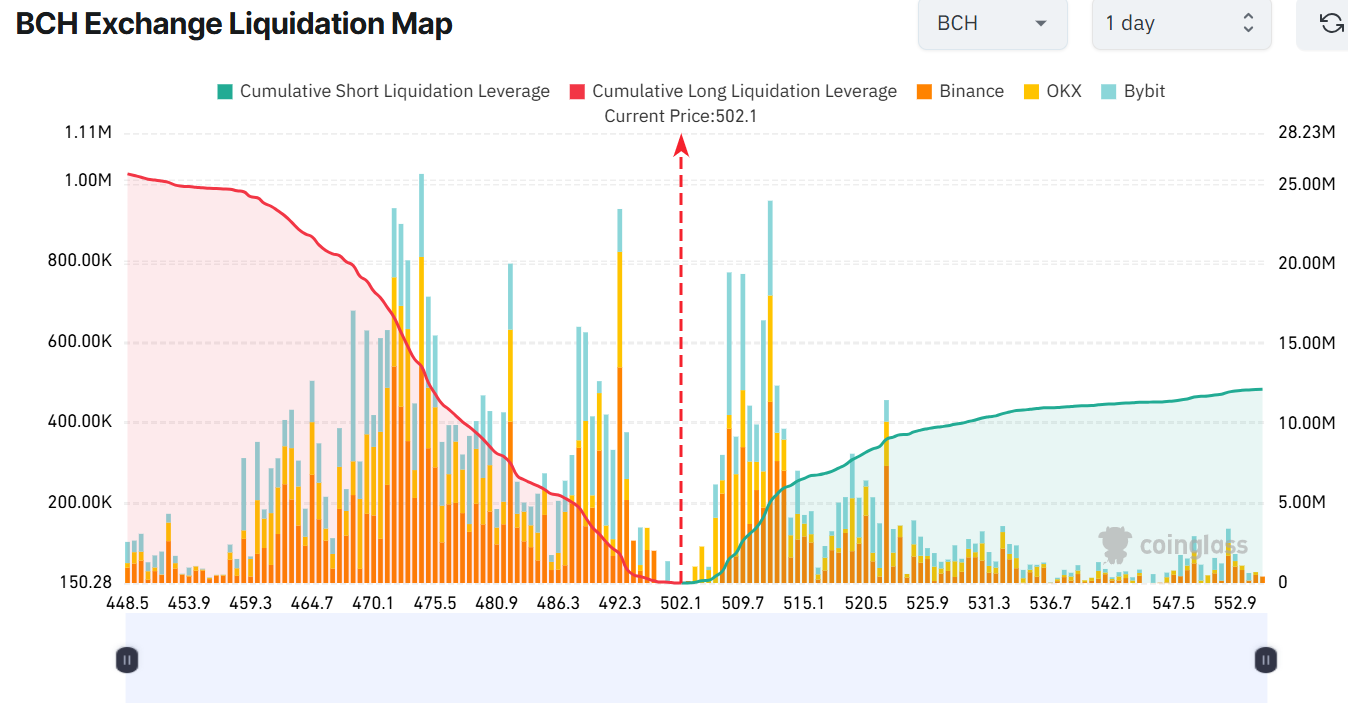

The other factor that could have led to the dramatic rise in the Bitcoin Cash price is the levels of liquidation that have been witnessed in exchanges. According to the BCH exchange liquidation map, the short positions are almost approaching the liquidation level. Aggressive shorts are facing a lot of heat with the price standing at around $502.

In other words, there is more cumulative long liquidation leverage ($25.66 million) compared to shorts ($12.16 million) in the last 24 hours. This imbalance suggests that some bullish sentiment is building in the Bitcoin Cash market, which may cause a surge to $550-$600 in the short term.

BCH Bulls Eye $800 Mark

With the bullish grip evident in the market, Bitcoin Cash could continue the upside movement. Moreover, if the support zones hold steady and a breakout to $510 takes place, a rally to $540-$567 may be plausible.

On the downside, the lower support zones range at $426- $484 may act as safety nets against any dip in the market. A break below the $426 mark will see the safety net at $391 cushion against further downside.

Meanwhile, looking at the 4% gain, the current bullish grip is rising, fueled by the recent ceasefire. If the current trend holds and traders buy more BCH, the bulls could target $540-$600 in the short term. On the other hand, if the RSI hits the overbought territory, it could trigger a dip back to $426 support zone. In the long term, breaking through the $800 mark will be a game-changer for BCH.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.