Highlights:

- The BCH token has risen 0.2% to $585.

- The liquidation chart indicates that a potential short squeeze in BCH is imminent, as the short position is taking the lion’s share.

- Bullish technical indicators signal that a potential rally to $700 could be imminent.

The Bitcoin Cash price is poised for a significant increase, currently trading at $585, which marks a 0.2% surge. However, the daily trading volume has dropped 7% to $411 million, indicating a decrease in market activity. Meanwhile, Grayscale Investments, a leading cryptocurrency investment products firm, has recently submitted paperwork to the U.S. Securities and Exchange Commission (SEC) to launch three new cryptocurrency Exchange-Traded Funds (ETFs).

This filing, dated September 9, 2025, includes the formation of ETFs of Hedera (HBAR), Bitcoin Cash (BCH), and Litecoin (LTC). This is a strategic step that Grayscale is taking to capitalise on the escalating demand for such alternative digital assets and their prospects of mainstream integration.

🚨 Greyscale has just filed paperwork for 3 Spot ETFs. An S-1 has been filed for an Hedera $HBAR ETF whiel S-3's filed for a Bitcoin Cash $BCH ETF, and a Litecoin $LTC ETF (S-3) pic.twitter.com/FuAUxUmikD

— ALLINCRYPTO (@RealAllinCrypto) September 9, 2025

Bitcoin Cash, specifically, has been in the limelight owing to the increasing significance in the wider crypto market. The application of BCH ETF implies that the cryptocurrency is regarded as a viable investment tool with high demand. Since Bitcoin Cash is a derivative of Bitcoin, its reduced transaction costs and high processing rates have rendered it more popular among users and traders.

The ETF filings may open the door to increased institutional flows into such assets. Conventionally, ETFs are an easier, regulated entry point into the cryptocurrency market in which investors can be exposed to the market without necessarily holding the actual digital coins.

BCH Liquidation Data Market

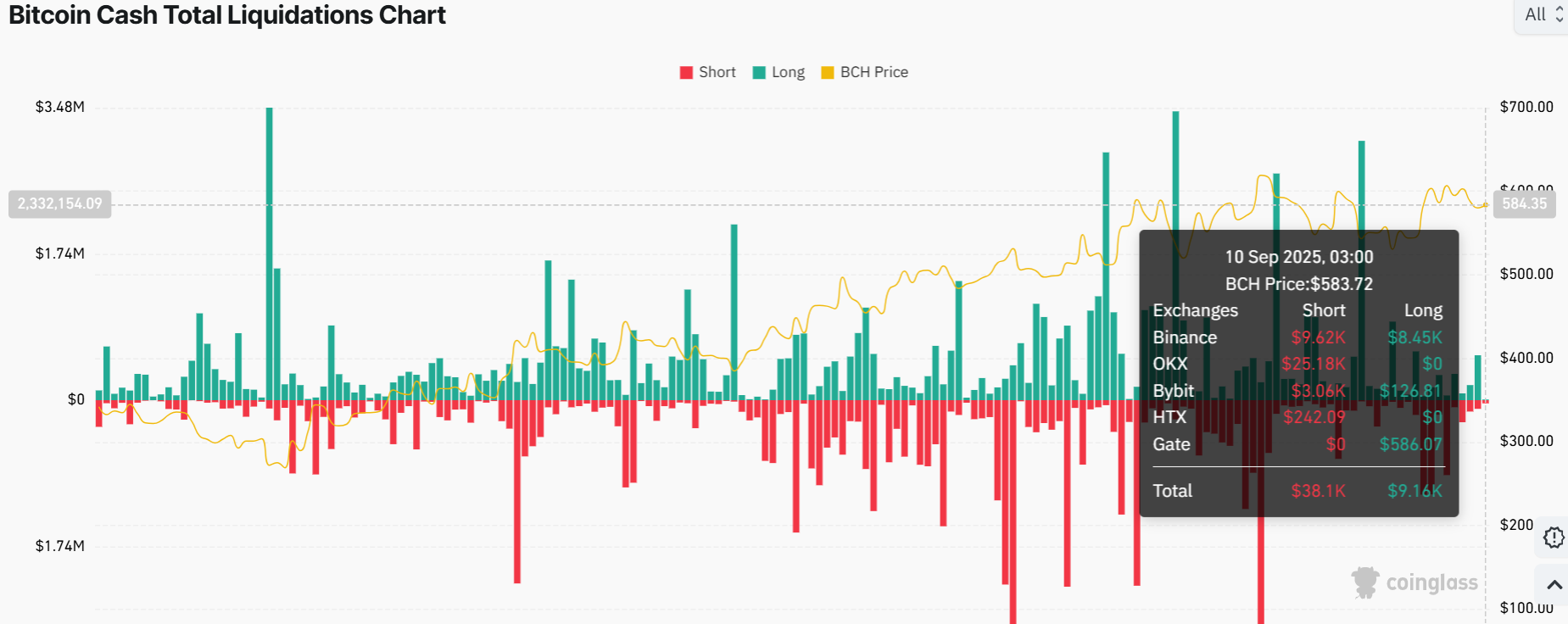

Based on the latest liquidation statistics, the recent developments in the Bitcoin Cash price market are a picture of high volatility. The September 10, 2025, liquidation chart indicates a radical imbalance between short and long positions. This serves to demonstrate a significant market sentiment change.

Bitcoin Cash has seen approximately $38.1 million in liquidations over the last 24 hours. The short positions have garnered the lion’s share of a staggering $38.1 million. The long positions have taken the remaining $9.16 million, indicating a potential short squeeze. The high-spiralling green bars (long positions) and red bars (short positions) on the chart are indicators of significant price movements, and traders are taking advantage of them.

Bitcoin Cash Price Outlook

The BCH/USD 1-day chart technical outlook shows a clear bullish movement, as the bulls eye a breakout above the wedge. Currently, the token is sitting above the $580 critical support, with immediate support at $570 and $438.

The technical indicators, such as the Relative Strength Index (RSI) at 52.64, indicate that BCH is neutral with more room for the upside. On the other hand, the Moving Average Convergence Divergence indicator (MACD) is indicating a bullish signal, calling for traders to continue buying BCH tokens.

Looking ahead, the short-term forecast is bullish. If Bitcoin Cash price holds above $580 and volume turns positive, the asset may jump to $600-$620. In the long term, if this momentum continues, $700 isn’t off the table by the end of September. But traders will want to watch out, as the declining volume signals caution. In case of a drop, the Bitcoin Cash price token may retest the $570 safety net.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.