Highlights:

- Bitcoin climbed above $109,000 after the U.S. postponed tariffs on European goods.

- Altcoins like Ethereum, XRP, and Solana also gained after the tariff delay news.

- BTC’s value neared gold, fueling debate over digital gold and wealth potential.

On Sunday evening, Bitcoin (BTC) rose above $109,000 after United States President Donald Trump postponed planned high tariffs on European Union imports. Trump initially disclosed on Friday his intention to impose a 50% tariff on all EU imports starting June 1. He cited trade imbalances and regulatory challenges as key reasons behind his decision. Following a phone conversation with European Commission President Ursula von der Leyen on Sunday, Trump agreed to delay the implementation of these tariffs until July 9 to allow time for renewed trade negotiations.

Good call with @POTUS.

The EU and US share the world’s most consequential and close trade relationship.

Europe is ready to advance talks swiftly and decisively.

To reach a good deal, we would need the time until July 9.

— Ursula von der Leyen (@vonderleyen) May 25, 2025

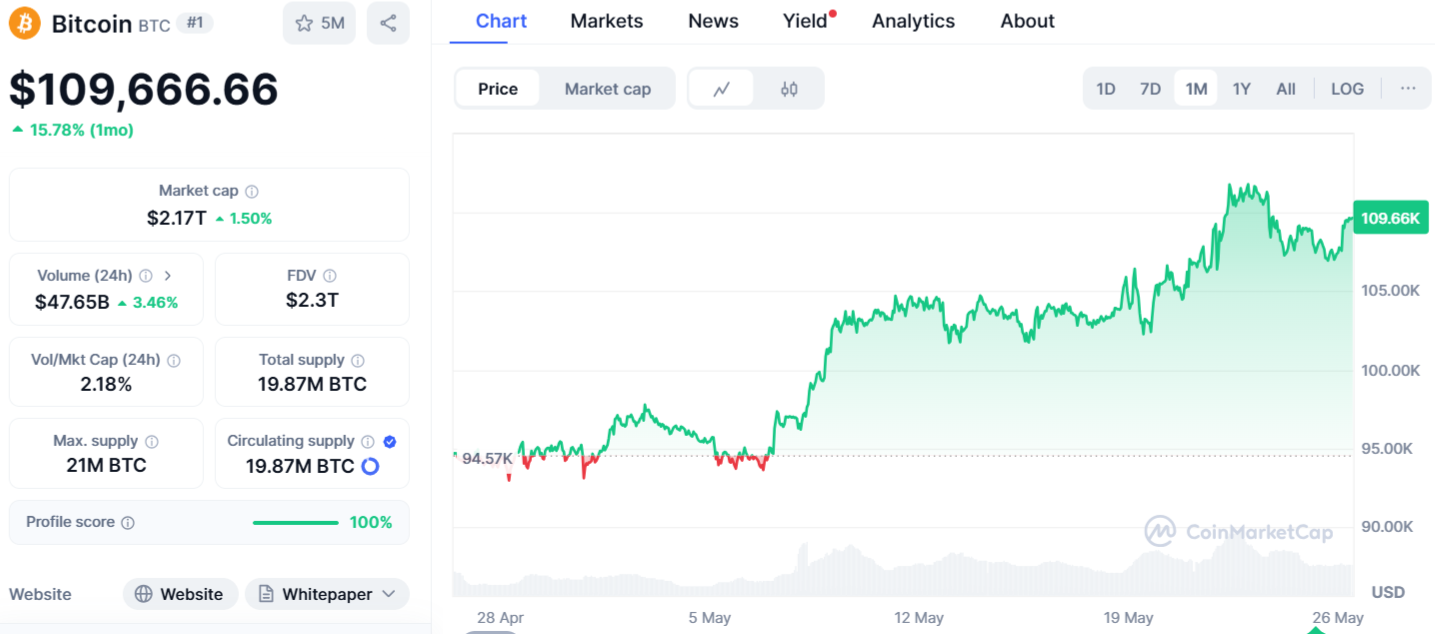

At the time of reporting, Bitcoin was trading at $109,666, showing a 2.14% in the past 24 hours. The rise in Bitcoin’s price sparked gains across other major cryptocurrencies as well. Ethereum (ETH), XRP, and Solana (SOL) all saw positive movement following Trump’s announcement, according to data from CoinMarketCap.

Growing Demand and Institutional Interest Drive Bitcoin’s Recent Surge

Bitcoin’s recent movement reflects a deeper trend of growing structural demand. Just last week, it briefly reached a new peak of $111,814, driven by steady inflows from both exchange-traded funds and corporate investors. Between May 19 and May 23, spot Bitcoin ETFs recorded net inflows totaling $2.75 billion, according to SoSoValue. During the same timeframe, Ethereum ETFs attracted $248 million in new funds, with no outflows reported.

Over the last 18 months, Bitcoin has outperformed the S&P 500 by over 100 percentage points. This performance highlights its status as a high-beta asset that tends to attract investment during bullish market phases. Institutional investors are increasingly following examples set by corporate leaders like MicroStrategy’s Michael Saylor, who has played a key role in making large-scale Bitcoin purchases more mainstream among institutions.

Monday’s rally shows that Bitcoin reacts strongly to big economic news. Changes in US trade policy affect it a lot. The easing of tensions helped the market for now. But investors stay careful. They know feelings can change fast with new political actions.

BTC’s Rise Sparks Debate Over Digital Gold and Wealth Potential

Robert Kiyosaki, author of “Rich Dad Poor Dad,” made a strong prediction about BTC. The cryptocurrency is rising fast to new highs. Kiyosaki says now is the easiest time to get rich. He claimed that even 0.01 Bitcoin could become priceless within two years and potentially bring significant wealth.

I cannot believe how easy Bitcoin has made getting rich…so easy.

Why everyone is not buying and holding Bitcoin is beyond me.

Even .01 of a Bitcoin is going to be priceless in two years…. and maybe make you very rich.

Sure Bitcoin goes up and down….but so does real life.…

— Robert Kiyosaki (@theRealKiyosaki) May 26, 2025

The debate between BTC and gold has lasted for years. Investors often argue about which is better. Some prefer gold, while others like Bitcoin. Peter Schiff, a strong Bitcoin critic, said gold is safer. Recently, he explained why many governments choose gold over Bitcoin for reserves.

The debate grew stronger as the price of 1 Bitcoin got very close to the value of 1 kilogram of gold. This surprising match sparked more talks among investors. It led to comparisons between Bitcoin’s digital scarcity and gold’s physical rarity as valuable assets.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.