Highlights:

- The crypto market bounced back after a ceasefire eased tensions between Israel and Iran.

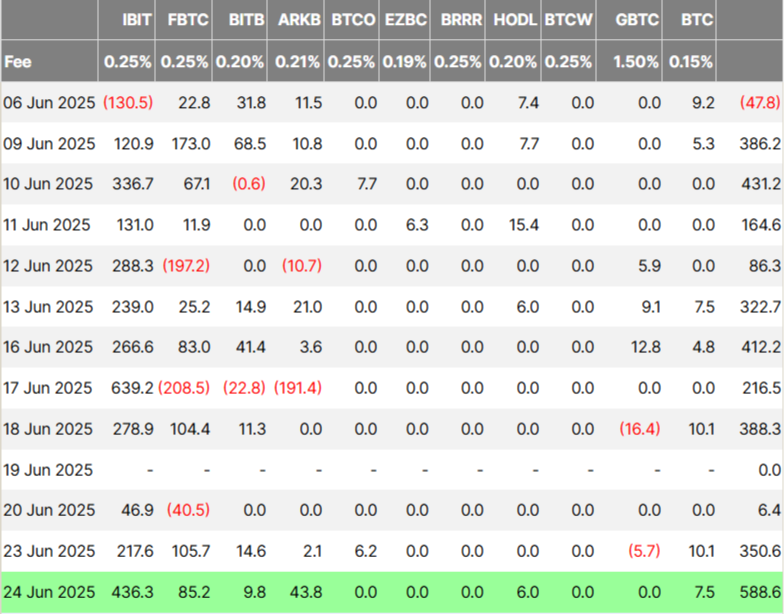

- BlackRock’s IBIT led Bitcoin ETF inflows with $436 million added in one day.

- Ethereum ETFs saw $71 million net inflow, with strong support from BlackRock’s ETHA.

The crypto market saw a sharp rebound on June 24 after the U.S. helped secure a ceasefire between Israel and Iran, helping reverse earlier declines. According to Farside, U.S.-based spot Ethereum (ETH) exchange-traded funds (ETFs) brought in $588.6 million in net inflows on June 24, which shows renewed confidence and growing interest from investors.

BlackRock’s IBIT Leads Bitcoin ETF Inflows with $436M in a Single Day

BlackRock’s iShares Bitcoin Trust (IBIT) led all Bitcoin ETFs on Tuesday with a huge daily inflow of $436.32 million. IBIT has been actively purchasing BTC, adding 4,134 BTC worth about $488 million. The ETF has now seen inflows for 11 straight trading days, bringing in $3 billion during this time. According to IBIT’s official site, the fund now holds 685,584 BTC, with total assets worth $72.3 billion.

🚨 BLACKROCK BUYS 4130 BTC

NOW HOLDS 690,000 BITCOIN pic.twitter.com/fniLZ87DeW

— Thomas Fahrer (@thomas_fahrer) June 25, 2025

Other major players also added to Tuesday’s inflows—Fidelity Wise Origin Bitcoin Fund (FBTC) gained $85.2 million, while ARK 21Shares Bitcoin ETF (ARKB) added over $43 million. Since launch, total net inflows into BTC ETFs have crossed $47.5 billion.

By Tuesday, BlackRock’s BTC ETF saw over $14 billion in 2025 inflows. It moved to 4th place on the yearly leaderboard, passing the SPDR S&P 500 ETF. Even though it’s only 1.5 years old, IBIT is now 5th in three-year flows. Bloomberg’s Eric Balchunas says this shows its fast growth and strong investor interest.

At this rate, $IBIT is destined to be first in flows.

— Michael Saylor (@saylor) June 23, 2025

ETF Store President Nate Geraci says over 400K BTC were bought by companies, governments, and ETFs in 2025. This makes up around 2% of Bitcoin’s total supply. BlackRock’s IBIT ranks just behind Michael Saylor’s Strategy (MSTR) in holdings.

Over 400,000 bitcoin purchased by governments, companies, & ETFs so far this year…

About 2% of total btc supply.

Nice breakdown of who’s buying here.

Look at Strategy & IBIT.

via @dcanellis pic.twitter.com/yNj8UqF7b7

— Nate Geraci (@NateGeraci) June 25, 2025

Ethereum ETFs See $71M Net Inflow

At the same time, spot Ethereum ETFs in the U.S. recorded a total net inflow of $71.3 million. BlackRock’s iShares Ethereum Trust ETF (ETHA) brought in $98 million, showing growing interest in Ethereum exposure. However, Fidelity’s Ethereum ETF (FETH) experienced a $26.7 million outflow, slightly pulling down the net inflow for the day. Even so, the overall demand helped lift Ethereum’s price as the market recovered from last week’s sharp downturn.

Crypto Market Rebounds as Ceasefire Eases Tensions

The cryptocurrency market experienced a solid recovery after a sharp drop triggered by the conflict between Israel and Iran. Initial fears rose among investors following a brief involvement by the United States, which intensified market uncertainty. However, the situation improved quickly when a ceasefire agreement was reached, helping reduce geopolitical tensions.

Bitcoin jumped 3% this week and is trading at $107,002, based on CoinMarketCap data. Ethereum also performed better in the same period. Since BTC and ETH lead the market, other major coins also followed and showed good profits. The total cryptocurrency market capitalization increased by 2% in the last 24 hours, reaching $3.29 trillion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.