Highlights:

- Bitcoin and Ethereum ETFs attract over $600 million in combined net inflows on September 11.

- Bitcoin ETFs led the inflows chart with $552.78 million, while Ethereum funds added $113.12 million.

- BTC and ETH saw a slight increase in price actions, underscoring positive ETF impacts.

On September 11, Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs) recorded $660 million in combined net inflows, as their winning streaks continue. SosoValue, a renowned on-chain ETF tracker, reported that Bitcoin ETFs added $552.78 million, while Ethereum funds attracted $113.12 million. The latest net inflows extended Bitcoin funds’ profitable streak to a fourth consecutive day, while Ethereum ETFs’ winning streak entered its third straight day. Overall, Bitcoin ETFs have attracted cash inflows throughout this week, while Ethereum ETFs bounced back from six consecutive net outflows on September 9.

On September 11 (ET), Bitcoin spot ETFs recorded a total net inflow of $553 million, marking the 4th consecutive day of inflows. Ethereum spot ETFs saw a total net inflow of $113 million, extending their streak to 3 consecutive days.https://t.co/Hj2Gs49bWa pic.twitter.com/LoIGc5CpjE

— Wu Blockchain (@WuBlockchain) September 12, 2025

Bitcoin ETFs Attract Massive Cash Inflows Led by BlackRock and Fidelity

Yesterday, 6 out of 12 Bitcoin ETFs were active. The remaining six, including Grayscale Bitcoin ETF (GBTC), ARK 21Shares Bitcoin ETF (ARKB), and Grayscale Mini Bitcoin ETF (BTC), had neither inflows nor outflows. BlackRock Bitcoin ETF (IBIT) and Fidelity Bitcoin ETF (FBTC) recorded inflows worth over $100 million. They brought in $366.2 million and $134.71 million, respectively.

Other funds that attracted inflows included the Bitwise Bitcoin ETF (BITB), with $40.43 million; the Invesco Bitcoin ETF (BTCO), with $5.71 million; the Franklin Bitcoin ETF (EZBC), with $3.31 million; and the VanEck Bitcoin ETF, with $2.43 million. Following yesterday’s profitable outing, Bitcoin ETFs’ cumulative net inflow rose to $56.19 billion from $55.64 billion. The total net assets valuation added $1.81 billion to reach $149.64 billion, while the total value traded slipped to $2.84 billion from $3.88 billion.

Ethereum ETFs Record Net Inflows Despite BlackRock’s Outflow

Unlike Bitcoin, 9 Ethereum ETFs traded on September 11. The remaining three, including VanEck Ethereum ETF (ETHV), 21Shares Ethereum ETF (TETH), and Invesco Ethereum ETF (QETH), had zero flows. Among the active ETFs, BlackRock Ethereum ETF (ETHA) recorded the only outflow, valued at about $17.39 million.

Ethereum ETFs that saw inflows above $10 million included the Fidelity Ethereum ETF (FETH), with $88.34 million, the Bitwise Ethereum ETF (ETHW), with $19.65 million, and the Grayscale Ethereum ETF (ETHE), with $14.58 million. Grayscale Mini Ethereum ETF (ETH) and Franklin Ethereum ETF (EZET) also recorded net inflows worth less than $5 million. They added $4.58 million and $3.36 million, respectively.

Overall, Ethereum ETFs’ cumulative net inflow slightly increased to $12.96 billion. The total net assets increased to $28.51 billion from $27.73 billion. In contrast, the total value traded dropped to $1.53 billion, forfeiting roughly $750 million.

BTC and ETH Price Records Slight Upswings

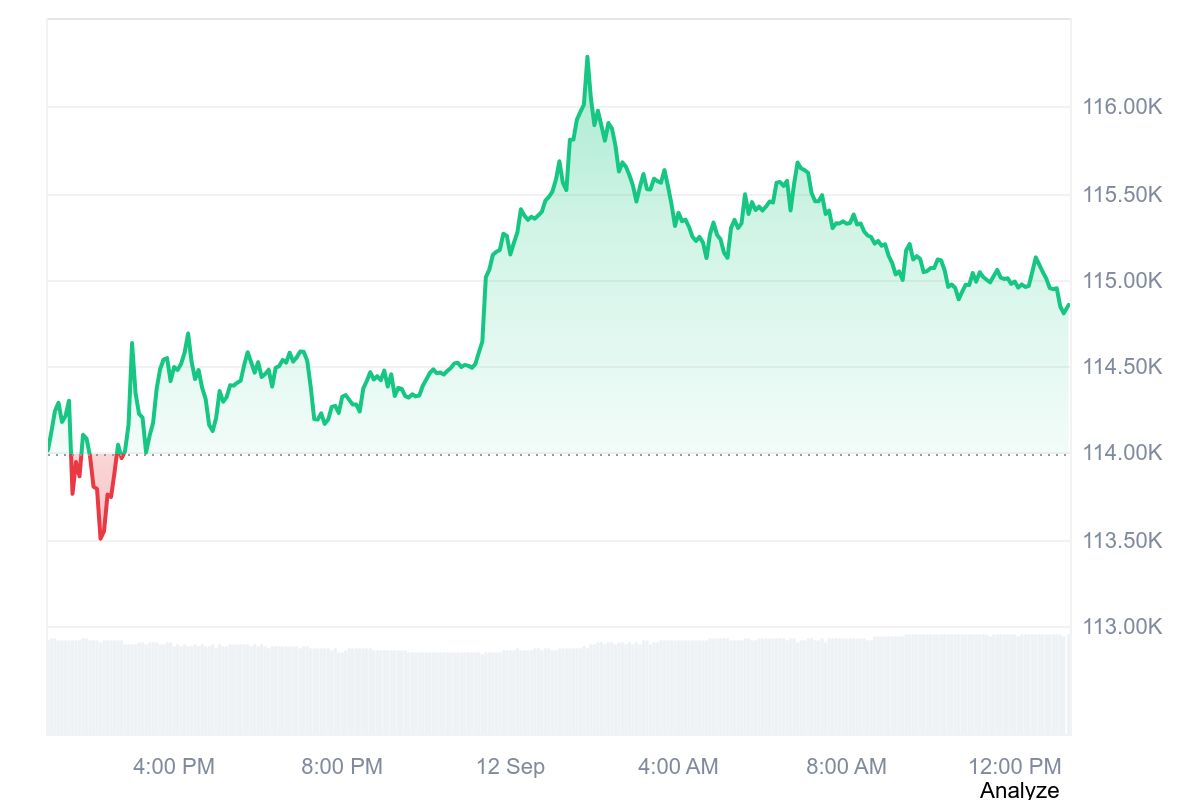

Bitcoin is up 0.8% in the past 24 hours, trading at $114,945, with price extremes fluctuating between $113,496 and $116,309. Bitcoin’s 7-day-to-date price change metric reflected a 2.4% upswing, with a minimum and maximum price range oscillating between $110,055 and $116,083, underscoring significant price recovery within the specified interval.

Similarly, Ethereum is up 2% in the past 24 hours, changing hands at $4,522, with price extremes fluctuating between $4,392.02 and $4,558.54. Coincodex data showed that Ethereum has a low supply inflation at 0.32%, volatility is medium, with a bullish sentiment, and a “Fear & Greed Index,” which reflects “Greed” at 57.

Institutional Interest in Bitcoin and Ethereum Continues to Rise

On September 10, Crypto2Community reported that QMMM Holdings, a Hong Kong-based firm, plans to establish a diversified crypto treasury worth around $100 million. The company noted that its initial treasury assets will include Bitcoin, Ethereum, and Solana (SOL). Speaking about the initiative, Bun Kwai, QMMM Holdings’ Chief Executive Officer (CEO), stated that it aligns with the company’s vision of interconnecting different asset classes.

The CEO stated:

“QMMM’s entry into this space reflects our commitment to technological innovation and our vision to bridge the digital economy with real-world applications.”

Bitcoin and Ethereum are friends @saylor @fundstrat pic.twitter.com/juiaNc3xDV

— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) September 10, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.