Highlights:

- Bitcoin and Ethereum ETFs see profits for the first time in 2025.

- BTC ETFs had over $900 million in gains to end the week in profits.

- ETH ETFs added $58.79 million but concluded the week with net losses.

After beginning the new year in losses, Bitcoin (BTC) and Ethereum (ETH) ETFs have rebounded strongly, as per their most recent flow data. On January 3, BTC funds gained $908.1 million, while ETH ETFs brought in $58.79 million. The new trend will inspire optimism about cryptocurrency price growth in 2025.

Gm traders

ETF inflows are again GREEN now

$907M into BTC and $59M into ETH inflows in a SINGLE DAY.Market's in full greed mode at 73 while $BTC keeps pushing towards $100k

Higher 🚀 pic.twitter.com/s96RmkSWb1

— Budhil Vyas (@BudhilVyas) January 4, 2025

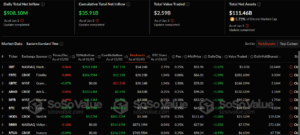

According to the reputable on-chain ETF tracker SosoValue, six funds contributed to Bitcoin ETFs’ latest profits, while the remaining six recorded no outflows or inflows. Notably, three out of the active ETFs attracted gains of over $100 million, led by Fidelity Bitcoin ETF (FBTC), which contributed $356.95 million.

The two other funds with over $100 million in profits were BlackRock Bitcoin ETF (IBIT) and ARK 21Shares Bitcoin ETF (ARKB). They attracted gains of about $253.10 million and $222.63 million, respectively. Bitwise Bitcoin ETF (BITB), Grayscale Mini Bitcoin ETF, and VanEck Bitcoin ETF also had positive contributions worth $61.13 million, $8.71 million, and $5.57 million, respectively. In their weekly-based timeframe, Bitcoin ETFs recorded net gains worth $244.99 million.

Following the funds’ profitable outing, their cumulative net inflows and net assets valuation increased. The cumulative inflows rose from $35 billion to $35.91 billion, while the assets valuation spiked from $109.43 billion to $111.46 billion. Notedly, the total value traded was $2.59 billion.

Bitcoin Adoption to Soar this Year with MicroStrategy’s New Plans

While the Bitcoin ETFs attracted profits. Institutional investors are also showing strong optimism about Bitcoin’s growth potential. Earlier today, Crypto2Community reported that the American-based investment firm is planning to raise $2 billion to fund part of its 2025 Bitcoin purchase.

The news article mentioned that the company will raise funds through public underwritten offerings of perpetual preferred stock. Worthy of mention is the fact that the $2 billion fundraiser is a small part of a bigger 21/21 Bitcoin purchase plan announced by the company in 2024.

MicroStrategy targets up to $2 billion capital raise through public offerings of perpetual preferred stock in the first quarter of 2025. $MSTR https://t.co/x1pbB8ArlH

— Michael Saylor⚡️ (@saylor) January 3, 2025

The above buying strategy will see MicroStrategy raise $42 billion to purchase more Bitcoin across three years. It will raise 50% of the total capital through equity capital, while the remaining half will come from fixed-income instruments like convertible notes, preferred stock, and debt.

BlackRock Leads Ethereum ETFs Recovery Efforts

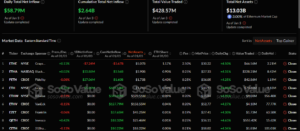

In their December 3 outing, four out of the nine ETH ETFs were active as the remaining funds experienced no activity. Grayscale Ethereum ETF (ETHE) had the only outflows worth $7.24 million. BlackRock Ethereum ETF (ETHE) and Fidelity Ethereum ETF gained above $10 million. Their positive contributions were $33.88 million and $27.06 million, respectively.

Grayscale Mini Ethereum ETF (ETH) was another profitable ETF. It had inflows of about $5.09 million. Unlike Bitcoin, ETH funds gains couldn’t save them from ending the week in net losses, valued at $38.20 million. Moreover, Ethereum ETFs’ cumulative net inflows rose from $2.58 billion to $2.64 billion. Similarly, the total value traded, and net assets valuation spiked to $428.57 million and $13.03 billion, respectively.

Market Expert Shares Opinion on the Possibilities of Altcoins ETF Approvals in 2025

Nate Geraci, President of ETF Store, recently shared his view on altcoins ETF Approvals happening within 2025. The expert posted a screenshot displaying voting odds for several ETF approvals this year. Solana dominated with 86%. Ripple’s odd was also on the high side at 70%. The voting also contained bets for other ETF approvals for cryptocurrencies like Dogecoin (DOGE) and Litecoin (LTC)

Geraci said in his tweet that he won’t agree or disagree with the odds. According to him, the SEC takes 240 days to approve 19b-4s filings for ETF approval. None of the altcoins have submitted such an application, implying that the chances for any endorsement between now and July are very slim. He, however, noted that with a change in government, there might be a reduction in approval time.

You can now bet on several alt coin ETF approvals (what a country). Not gonna say if we agree or not with these odds, but fyi there's no active 19b-4s for any yet and typically it's 240 days till approval- which would be beyond July. But, this SEC could act faster, who knows.. pic.twitter.com/4uF9khFCMz

— Eric Balchunas (@EricBalchunas) January 2, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.