Highlights:

- Bitcoin and Ethereum ETFs have registered positive netflows for the second successive day.

- BlackRock Led the inflows in BTC and ETH ETFs, while Grayscale led the outflows.

- The crypto market has displayed considerable strength, evidenced by the market actions of Bitcoin and Ethereum.

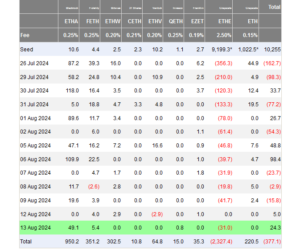

For the first time since July 23, Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs) have reported back-to-back inflows. Interestingly, the recent trend preceded a day that saw Grayscale Ethereum ETF (ETHE) record zero flows for the first time. However, in the most recent flow statistics, ETHE resumed its outflow trends. It was the only Ethereum ETF that witnessed losses.

🚨 US #ETF 13 AUG: 🟢$39M to $BTC and 🟢$24M to $ETH

🌟 BTC ETF UPDATE (final): +$39M

• The net flow has been positive for 2 consecutive days.

• BlackRock (IBIT) had the largest inflow yesterday at $34.6M while Grayscale (GBTC) saw the largest outflow at $28.6M.

🌟 ETH ETF… pic.twitter.com/mxWpwruRxo

— Spot On Chain (@spotonchain) August 14, 2024

BlackRock Led Inflows

Aside from ETHE, which recorded losses, only three other ETFs were active on August 13. The remaining five were inactive with zero flows. Per Farside data, BlackRock Ethereum ETF (ETHA) registered the highest inflows with about $49.1 million. Fidelity Ethereum ETF (FETH) followed closely with a lesser profit of $5.4 million. Surprisingly, Invesco Ethereum ETF (QETH) witnessed $0.8 million in inflows, ending twelve consecutive days of recording zero flows streak.

In Ethereum ETFs with zero flows for August 13, 21Shates Ethereum ETF (CETH) stretched its successive days with zero flows to nine days. Similarly, Grayscale Mini Ethereum ETF (ETH) extended its no-activity streak to two days. Meanwhile, Bitwise Ethereum ETF (ETHW), Franklin Ethereum ETF (EZET), and VanEck Ethereum ETF (ETHV) all recorded zero flows. However, unlike CETH and ETH, theirs were not for consecutive days.

As earlier stated, only ETHE witnessed losses among the nine Ethereum ETFs with $31 million. Consequently, the total netflow for ETHE remained in losses at roughly $2.3 billion. Similarly, the nine Ethereum ETFs boast a combined net negative flow of approximately $377 million. On the other hand, the netflow for August 13 was positive, with about $24.3 million.

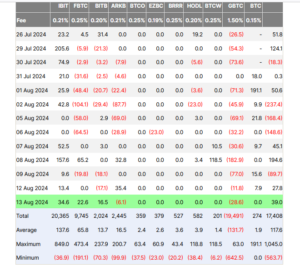

Bitcoin ETFs Record Over $30 Million in Profits

In its August 13 netflow data, Bitcoin ETFs recorded $39 million in gains, bringing its total ETFs valuation to about $17.4 billion. Like Ethereum ETFs, BlackRock Bitcoin ETF (IBIT) and Fidelity Bitcoin ETF (FBTC) led inflows with $34.6 million and $22.6 million, respectively. Bitwise Bitcoin ETF (BITB) also registered profits of about $16.5 million.

For outflows, Grayscale Bitcoin ETF (GBTC) topped the chart with $28.6 million in outflows. ARK 21Shares (ARKB) also witnessed $6.1 million in outflows. Meanwhile, the remaining six Bitcoin ETFs all had zero flows. Invesco Bitcoin ETF (BTCO) and Valkyrie Bitcoin ETF (BRRR) sustained over 12 days of zero flows.

VanEck Bitcoin ETF (HODL) and WisdomTree Bitcoin ETF (BTCW) also maintained zero flows. However, theirs were only for three consecutive days. Franklin Bitcoin ETF (EZBC) zero activities imply it sustained the trend for five days. On its part, Grayscale Mini Bitcoin ETF (BTC) zero flows happened after two days of back-to-back inflows.

Bitcoin Reclaims $70,000 as Ethereum Targets $3,000

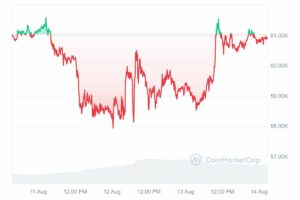

At the time of writing, Bitcoin is changing hands at about $60,900, reflecting a 3.1% upswing in the past 24 hours. The flagship crypto asset mirrored the global crypto market, which is equally up by the same percentage within the same timeframe. Despite its remarkable market actions, BTC’s 24-hour trading volume is down by roughly 18.22% with a $28.7 billion valuation.

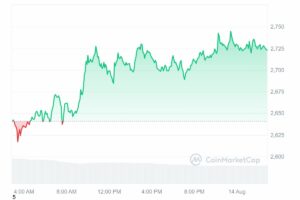

Like Bitcoin, Ethereum is up by 3.4% in the past 24 hours with an approximate $2,700 selling price. The world’s most valuable altcoin is displaying strength with gradual recovery from a $2,200 low attained in early August. In its 24-hour trading volume, Ethereum is also down by 29.84% with a $15.14 billion valuation.