Highlights:

- Bitcoin and Ethereum ETFs witnessed net profits on January 6, marking their first consecutive gains.

- BTC ETF profits surge was led by FBTC, with an over $350 million input.

- ETH ETFs gained from only two funds.

Bitcoin (BTC) and Ethereum (ETH) Exchange Traded Funds (ETFs) have recorded profits in their second straight outing. The new positive trend aligned with the crypto market’s recent resurgence that resulted in most cryptocurrencies appreciating slightly in their short-term interval price actions.

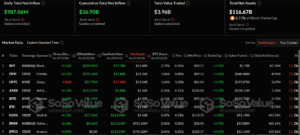

According to the on-chain ETF tracker SosoValue, the Bitcoin funds brought in gains of about $987.06 million on January 6. The new profit comes after the ETFs attracted $908.01 million on January 3, marking their first consecutive cash inflows for 2025.

Bitcoin spot ETFs had a total net inflow of $987 million on January 6, Fidelity ETF FBTC had a net inflow of $370 million, and BlackRock ETF IBIT had a net inflow of $209 million. https://t.co/59u0BnEqLG pic.twitter.com/0W2UDq35vW

— Wu Blockchain (@WuBlockchain) January 7, 2025

BTC ETFs Detailed Outing Statistics

In their most recent outing, nine out of the twelve Bitcoin funds were active, underscoring a markedly busy market. Notably, all the active entities registered only profits, led by Fidelity Bitcoin ETF’s (FBTC) $370.24 million contribution.

FBTC’s new addition raised its cumulative net inflows to $12.48 billion, as it maintains its position as the second most valuable ETF behind BlackRock Bitcoin ETF (IBIT), which boasts $37.38 billion in net inflows. Aside from FBTC, IBIT and ARK 21Shares Bitcoin ETF (ARKB) were the other funds that attracted over $100 million in profits. IBIT gained $209.08 million, while ARKB contributed $152.92 million.

Notedly, another four separate funds brought in gains worth over $10 million. These ETFs include Grayscale Mini Bitcoin ETF (BTC), Grayscale Bitcoin ETF (GBTC), Bitwise Bitcoin ETF (BITB), and VanEck Bitcoin ETF (HODL).

The above four ETFs attracted profits of about $75.32 million, $73.79 million, $71.19 million, and $17.33 million. Other profitable funds were Valkyrie Bitcoin ETF (BRRR) and Franklin Bitcoin ETF (EZBC). They had gains of approximately $8.38 million and $8.88 million, respectively. As a result of the new inflows, Bitcoin ETFs’ cumulative net inflows increased from $35.91 billion to $36.90 billion. The total value traded, and net assets also increased to $3.96 billion and $116.67 billion, respectively.

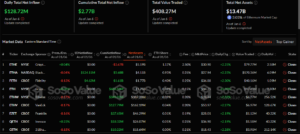

Ethereum ETFs Record Low Activeness

Unlike Bitcoin, Ethereum ETFs had activities from only two funds. They were BlackRock Ethereum ETF (ETHA) and Fidelity Ethereum ETF (FETH). ETHA had $124.11 million profits, while FETH gained $4.62 million. Both entities accounted for ETH ETFs’ $128.72 million most recent net inflows.

Ethereum spot ETF had a total net inflow of $129 million on January 6, and BlackRock ETF ETHA had a single-day net inflow of $124 million. The current total net asset value of Ethereum spot ETF is $13.466 billion. https://t.co/Tvs2oCSxTg pic.twitter.com/crX2UICz7M

— Wu Blockchain (@WuBlockchain) January 7, 2025

With their positive inputs, ETHA and FETH have maintained their positions as the top two most valuable Ethereum ETFs. BlackRock boasts roughly $3.68 billion in cumulative net inflows, while Fidelity has a $1.61 billion valuation.

Overall, the new gains raised ETH ETFs’ cumulative net inflows from $2.64 billion to $2.77 billion. The total net assets valuation also spiked from $13.03 billion to $13.47 billion. On the contrary, the total value traded dropped from $428.57 million to $408.27 million.

Bitcoin and Ethereum Prices Have Broken Above Potential Resistance

At the time of writing, Bitcoin’s price is up by about 2.2% in the past 24 hours. The slight upswing saw the price break above $100,000, with roughly $101,800 in selling price. Within a day, the flagship crypto reflected minimum and maximum prices ranging between $98,688.25 and $102,512. Therefore, it highlights BTC’s commendable jump and potential for greater price appreciation.

On its part, Ethereum witnessed a slight 0.3% increment in its 24-hour-to-date price change data. However, it was able to break above $3,500 and now trades at approximately $3,670. Its market capitalization soared to about $442.3 billion, while its 24-hour trading volume is up by 40.33% with a $22.14 billion valuation.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.