Highlights:

- Bitcoin and Ethereum ETFs struggled, with $593.33 million in combined net outflows on October 16.

- Bitcoin ETFs led the outflows with $536.44 million, while Ethereum forfeited $56.88 million.

- All active Bitcoin ETFs recorded outflows as none attracted cash inflows.

On October 16, Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs) recorded $593.33 million in net outflows amid the crypto market downturns. SosoValue, a renowned on-chain ETF tracker, reported that Bitcoin ETFs led the outflows with $536.44 million, while their Ethereum counterparts lost $56.88 million.

Yesterday’s flow data implies that Ethereum ETFs recorded net outflows after registering two consecutive daily gains. On the other hand, Bitcoin ETFs extended their losing streak to a second straight day. If the funds maintain current momentum, they might end the week in net outflows, compounding Bitcoin and Ethereum price outlooks.

On October 16 (ET), spot Bitcoin ETFs saw a total net outflow of $536 million, with none of the twelve ETFs recording net inflows. Spot Ethereum ETFs had a total net outflow of $56.88 million, with only BlackRock’s ETHA posting a net inflow.https://t.co/Hj2Gs48E6C pic.twitter.com/iTOhEBRS34

— Wu Blockchain (@WuBlockchain) October 17, 2025

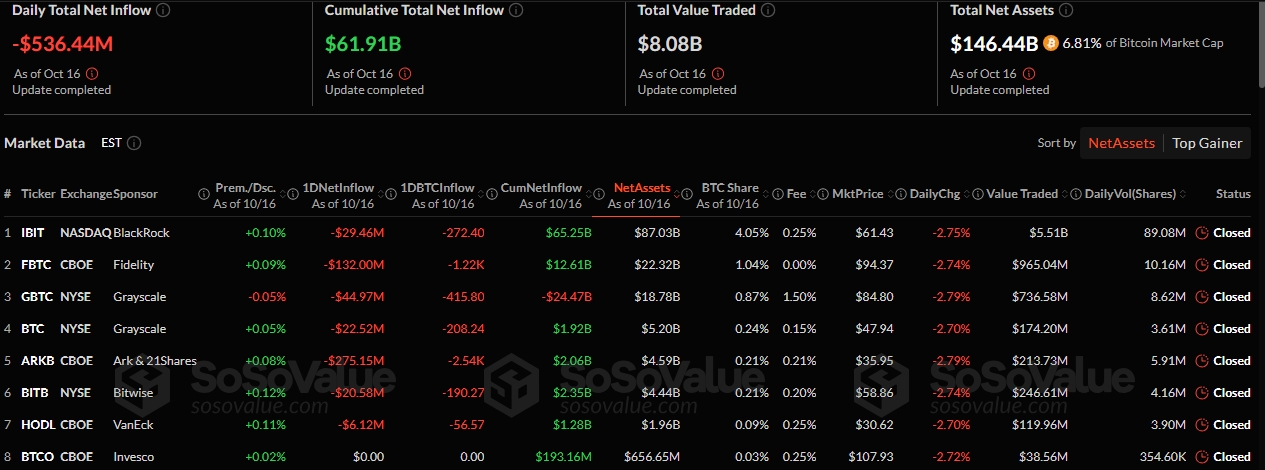

Bitcoin ETFs Attract only Outflows

On October 16, eight Bitcoin ETFs were active, as the remaining, including Invesco Bitcoin ETF (BTCO), Franklin Bitcoin ETF (EZBC), and WisdomTree Bitcoin ETF (BTCW), attracted neither inflows nor outflows. All active funds recorded outflows, led by the ARK 21Shares Bitcoin ETF (ARKB), with $275.15 million, and the Fidelity Bitcoin ETF (FBTC), with $132 million.

Other Bitcoin ETFs with significant outflows worth over $20 million included the Grayscale Bitcoin ETF (GBTC), the BlackRock Bitcoin ETF (IBIT), the Grayscale Mini Bitcoin ETF (BTC), and the Bitwise Bitcoin ETF (BITB). These funds lost $44.97 million, $29.46 million, $22.52 million, and $20.58 million, respectively. VanEck Bitcoin ETF (HODL) and Valkyrie Bitcoin ETF (BRRR) also lost $6.12 million and $5.65 million, respectively.

As a result of the outflows, Bitcoin ETFs’ cumulative net inflow and net asset valuation recorded significant declines. The former fell from $62.44 billion to $61.91 billion, while the latter dropped from $151.32 billion to $146.44 billion. In contrast, the total value traded rose from $4.55 billion to $8.08 billion.

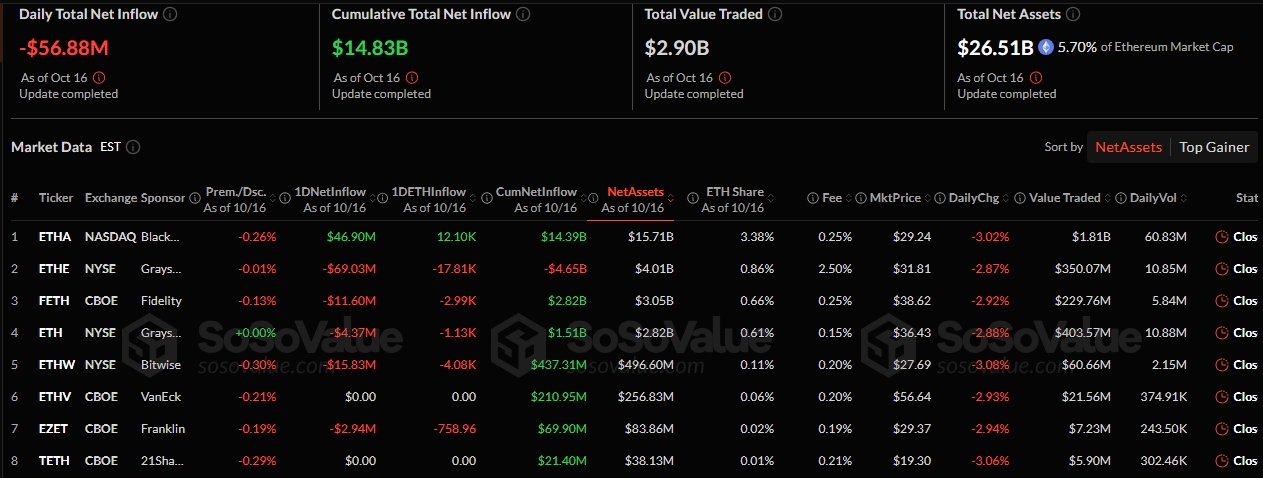

ETH ETFs Slump to Net Outflows as Total Value Traded Nears $3B

Yesterday, all except VanEck Ethereum ETF (ETHV), 21Shares Ethereum ETF (TETH), and Invesco Ethereum ETF (QETH) were active. Among the active funds, only BlackRock Ethereum ETF (ETHA) recorded inflows, valued at about $46.9 million. Grayscale Ethereum ETF (ETHE), Bitwise Ethereum ETF (ETHW), and Fidelity Ethereum ETF (FETH) topped the outflows with $69.03 million, $15.83 million, and $11.6 million, respectively.

Other Ethereum ETFs that recorded outflows were Grayscale Mini Ethereum ETF (ETH) and Franklin Ethereum ETF (EZET). These funds lost $4.37 million and $2.94 million, respectively. Like Bitcoin, Ethereum ETFs’ total net inflows and net assets valuation dropped to $14.83 billion and $26.51 billion, respectively. However, the total value traded added $760 million to reach $2.9 billion.

Bitcoin and Ethereum ETFs Outflows Compound the Crypto Market Outlook

Despite reaching over $4 trillion at some points in the past few weeks, the crypto market is down 4.9% in the past 24 hours, with a market cap of $3.665 trillion. CoinGecko data showed that the market has a 24-hour trading volume of $233.61 billion. Meanwhile, Bitcoin remains the most dominant crypto at 57.6%, while Ethereum follows at 12.4%.

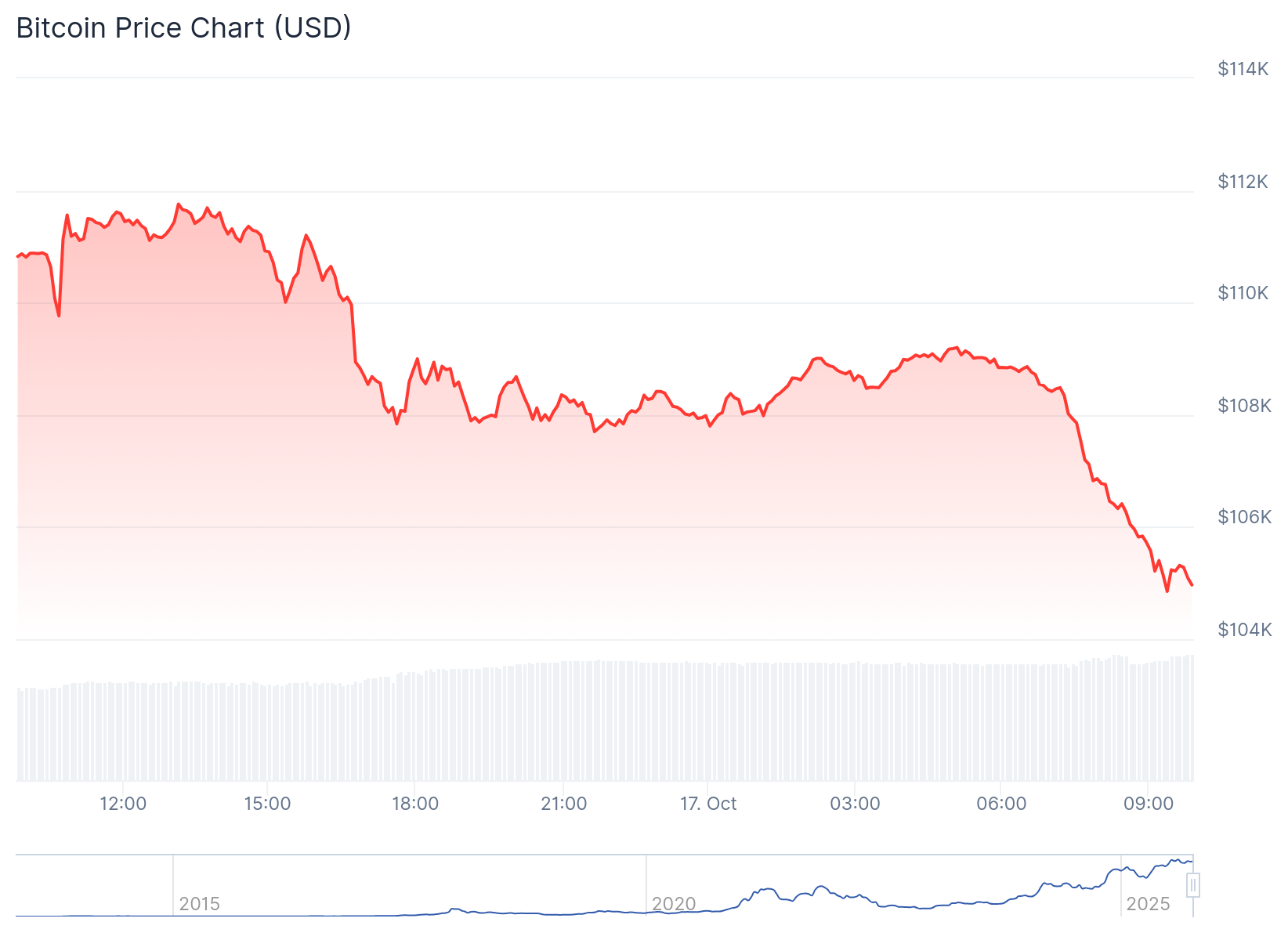

Mirroring the crypto market, BTC is changing hands at approximately $104,950, following a 5 3% decline in the past 24 hours. Within the same timeframe, BTC oscillated between $104,853 and $111,758, highlighting significant price slumps within a short interval. Bitcoin’s supply inflation is low at 0.87% with a 59.2% dominance and a medium volatility at 3.96%. Meanwhile, sentiment has remained bearish with a “Fear & Greed Index” that reflected extreme fear at 22.

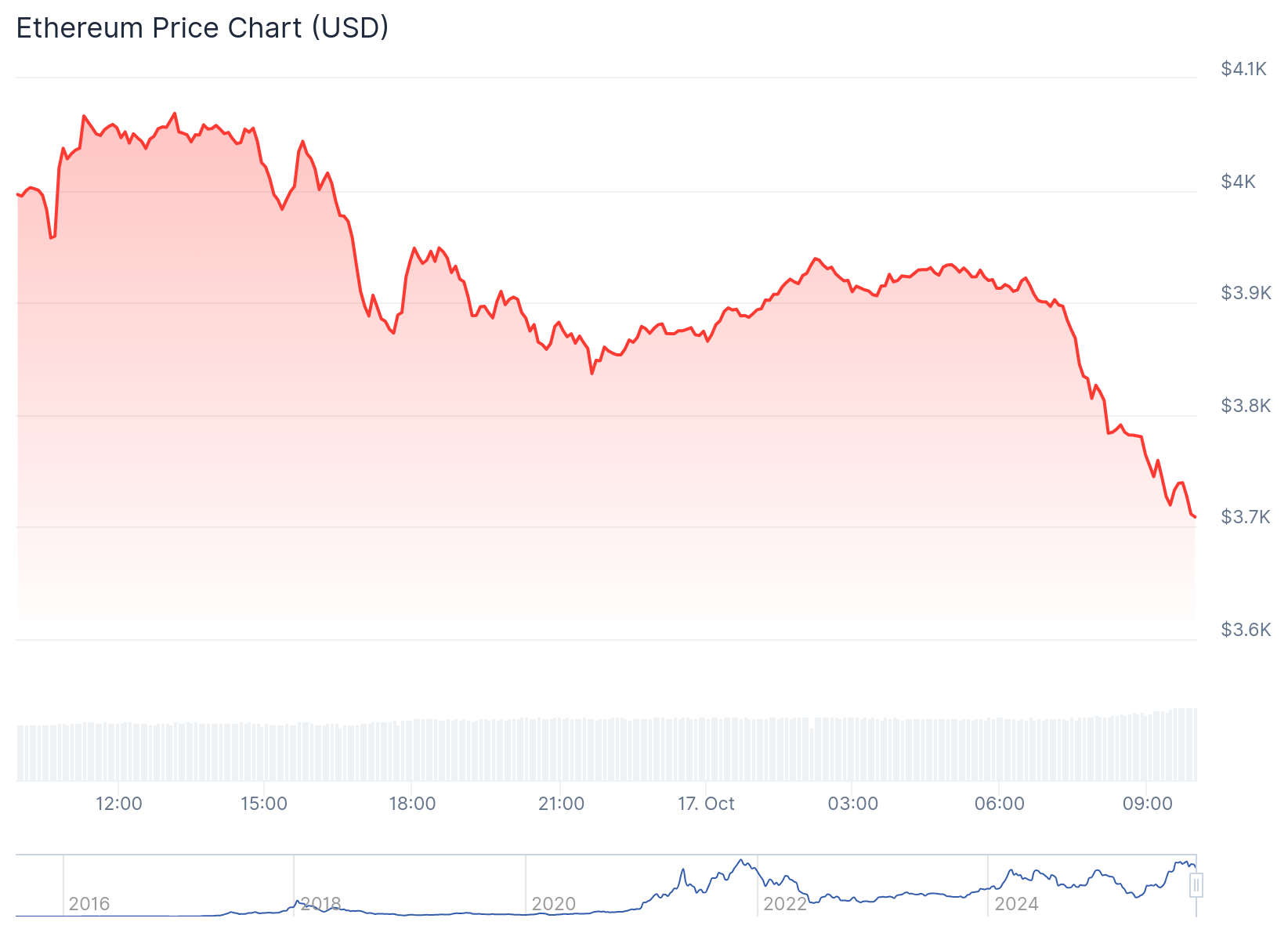

On its part, Ethereum is down 7.2% in the past 24 hours, trading around $3,700. ETH’s 7-day-to-date, 14-day-to-date, and month-to-date variables also reflected declines of 14.3%, 16.8%, and 18.4%, respectively. Ethereum’s market cap dropped to $447.67 billion, while its trading volume appreciated 32.49% to reach $58.54 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.