Highlights:

- Bitcoin and Ethereum funds added over $600 million in their most recent outing on September 15.

- Bitcoin ETFs have recorded net inflows for the sixth consecutive time, while Ethereum funds have recorded daily gains for the fifth straight day.

- BlackRock saw a combined net inflow of about $625 million across Bitcoin and Ethereum ETFs

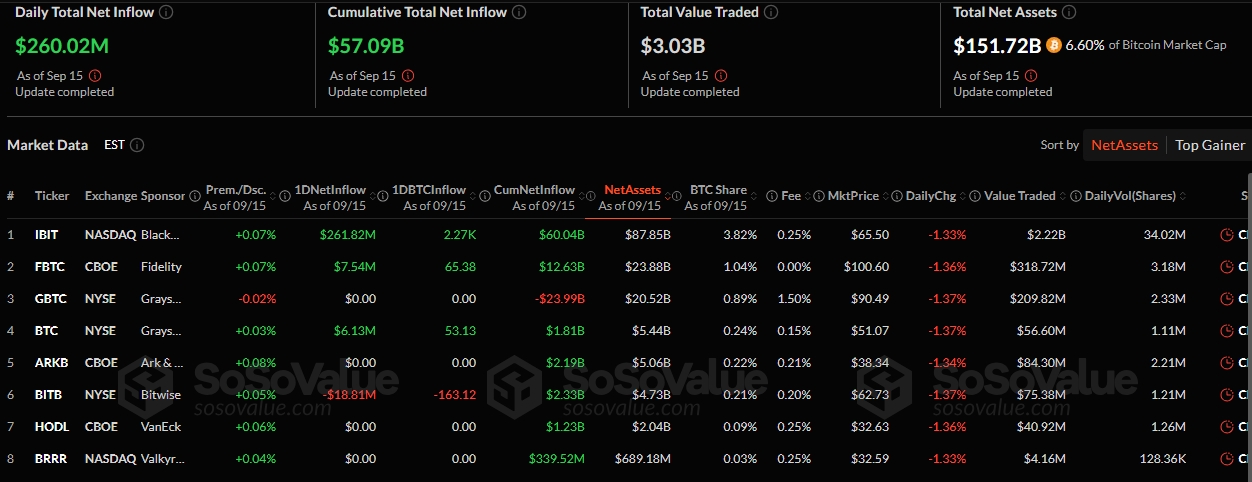

On September 15, Bitcoin and Ethereum exchange-traded funds (ETFs) added over $600 million in net inflows to extend their winning streaks. Popular ETF tracker SosoValue reported that Bitcoin ETFs added $260.02 million, marking their sixth consecutive daily net inflows. Similarly, Ethereum funds gained $359.73 million, marking their fifth straight daily inflows.

On September 15, Ethereum spot ETFs saw total net inflows of $360 million, marking the 5th consecutive day of inflows. Bitcoin spot ETFs recorded total net inflows of $260 million, their 6th consecutive day of inflows.

https://t.co/Tvs2oCSxTg pic.twitter.com/fJvUScQVvb— Wu Blockchain (@WuBlockchain) September 16, 2025

Bitcoin ETFs Maintain Remarkable Run

Yesterday, five Bitcoin ETFs were active, as the remaining seven, including Grayscale Bitcoin ETF (GBTC) and ARK 21Shares Bitcoin ETF (ARKB), had zero flows. Among the active funds, Bitwise Bitcoin ETF (BITB) recorded outflows worth $18.81 million. As usual, BlackRock Bitcoin ETF (IBIT) topped the inflows chart with $261.82 million.

Other profitable ETFs include the Fidelity Bitcoin ETF (FBTC), the Grayscale Mini Bitcoin ETF (BTC), and the Franklin Bitcoin ETF (EZBC). They added $7.54 million, $6.13 million, $3.34 million, respectively. Despite the net inflow, Bitcoin ETFs’ total value traded and net assets valuation forfeited $860 million and $1.46 billion, respectively. However, the cumulative net inflow reached $57.09 billion from $56.83 billion.

BTC Spikes Slightly as Bitcoin and Ethereum ETFs Maintain Persistent Inflows

At the time of writing, Bitcoin is priced at $115,692, following a 0.7% uptick in the past 24 hours. The flagship crypto is oscillating between $114,509 and $115,995, highlighting potential price stabilisation around the price range. Notably, BTC’s market metrics have remained impressive despite Peter Schiff’s most recent criticism.

On September 14, the popular Bitcoin critic tweeted that the Fed is on the verge of making a significant policy mistake by cutting rates into rising inflation. He noted that gold and silver have broken out, while Bitcoin continues to lose strength.

Schiff stated:

“Gold and silver have broken out, with the rally finally confirmed by mining stocks leading the way. Yet instead of breaking out, Bitcoin is topping out. Time to change horses, HODLers.”

Despite continuous criticism, Crypto2Community reported on September 16 that Next Technology plans to expand its Bitcoin treasury through a $500 million common stock sale. Strive also unveiled its new leadership board and fundraising programs aimed at establishing one of the largest Bitcoin treasuries.

BlackRock Drives Ethereum ETFs Inflows

Only three Ethereum ETFs traded on September 15. The remaining six, including Grayscale Mini Ethereum ETF (ETH), Bitwise Ethereum ETF (ETHW), and VanEck Ethereum ETF (ETHV), had neither inflows nor outflows. BlackRock Ethereum ETF (ETHA) and Grayscale Ethereum ETF (ETHE) added $363.19 million and $10 million, respectively. In contrast, Fidelity Etherum ETF (FETH) lost $13.46 million.

Overall, Ethereum ETFs’ cumulative net inflow slightly increased from $13.36 billion to $13.72 billion. However, other cumulative metrics, including the total value traded and total net assets, dropped from $2.55 billion to $2.09 billion and $30.35 billion to $29.72 billion, respectively.

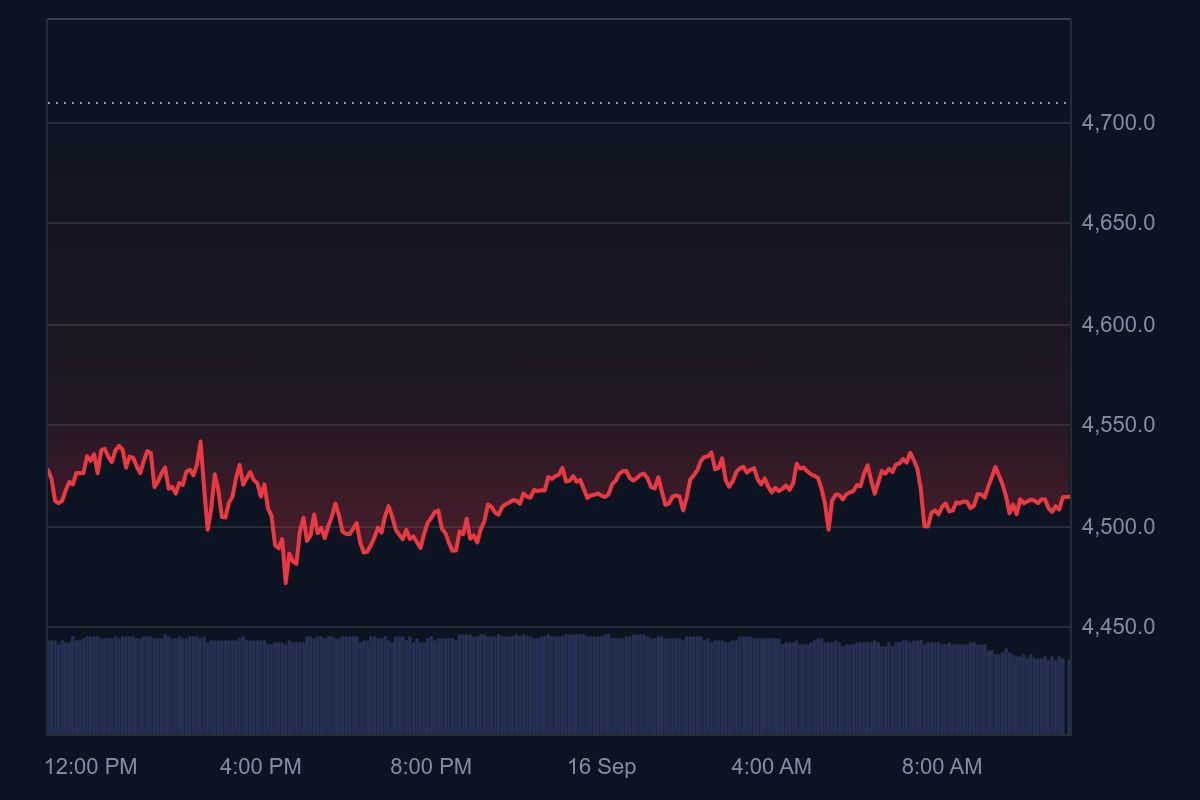

ETH Records Slight Drop

Despite Bitcoin and Ethereum ETFs’ consistent daily net inflows, ETH is down 0.5% in the past 24 hours. It is trading at $4,506 and fluctuating between $4,476.73 and $4,538.16. Ethereum’s Fear & Greed Index has remained neutral, with a bullish sentiment, and a medium volatility at 3.35%.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.