Highlights:

- Bitcoin and Ethereum ETFs had inflows to close the year.

- BlackRock was the most profitable ETF for BTC and ETH in 2024.

- Bitcoin and Ethereum prices fell slightly despite the fresh inflows.

Bitcoin (BTC) and Ethereum (ETH) ETFs had inflows on December 31 as they both ended the year positively. They had outflows on December 30, so this is a reversal of the trend. If it continues, it can be a good sign for market participants hoping to start making profits.

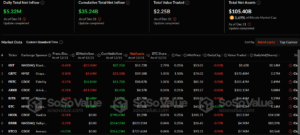

Meanwhile, according to the on-chain ETF tracker SosoValue, the latest outing resulted in Bitcoin ETFs attracting one of their lowest cash inflows, valued at $5.32 million. Relatively, one can assert that yesterday’s outing was comparatively insignificant.

On December 31, the total net inflow of Bitcoin spot ETF was $5.3181 million. The net inflow of Fidelity ETF FBTC was $36.8115 million. The total net asset value of Bitcoin spot ETF is currently $105.401 billion. https://t.co/59u0BnEqLG pic.twitter.com/5jf9agRkVV

— Wu Blockchain (@WuBlockchain) January 1, 2025

For context, BTC ETFs’ total net inflows did not change from $35.24 billion on December 30. But other stats changed. The total value traded dropped from $3.14 billion to $2.25 billion. Total net assets, which is 5.69% of Bitcoin’s market cap, depreciated from $106.24 billion to $105.40 billion.

Detailed Statistics of Bitcoin ETFs’ Latest Outing

Six Bitcoin ETFs had activity yesterday, while six experienced zero flows. Three of the active ones were profitable. Fidelity Bitcoin ETF (FBTC) was the top one, with $36.81 million gains. Bitwise Bitcoin ETF (BITB) and Grayscale Mini Bitcoin ETF (BTC) had profits of about $8.68 million and $4.14 million, respectively.

For losers, BlackRock Bitcoin ETF (IBIT) witnessed the highest. It forfeited $23.45 million in outflows. Despite the loss, IBIT is still the most profitable Bitcoin ETF, with $37.25 billion in total net inflows. FBTC is second with $11.72 billion.

Other Bitcoin funds that had outflows were ARK 21Shares Bitcoin ETF (ARKB) and Grayscale Bitcoin ETF (GBTC). ARKB shed $11.23 million, and GBTC forfeited $9.63 million. GBTC is still the worst-performing ETF, with $21.50 billion in outflows in 2024.

Ethereum ETFs Conclude 2024 with Over $2.5 Billion Cumulative Net Inflows

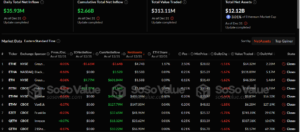

On December 31, ETH ETFs had $35.93 million in inflows. Only three commodities witnessed activities, as six had zero flows. Fidelity Ethereum ETF (FETH) and Grayscale Mini Ethereum ETF (ETH) attracted $31.77 million and $9.77 million, respectively.

As usual, Grayscale Ethereum ETF (ETHE) contributed the only outflow by shedding $5.61 million. Like its Bitcoin counterparts, ETHE concluded the year as the most wasteful ETF after forfeiting $3.64 billion in over five months.

Ethereum spot ETF had a total net inflow of $35.9324 million on December 31, and Fidelity ETF FETH had a single-day net inflow of $31.7719 million. The current total net asset value of Ethereum spot ETF is $12.116 billion. https://t.co/Tvs2oCSxTg pic.twitter.com/CaxglOiI1T

— Wu Blockchain (@WuBlockchain) January 1, 2025

Similarly, despite witnessing zero flows on the last day of the year, BlackRock Ethereum ETF (ETHA) ended the year as the most profitable commodity, with $3.52 billion in cumulative net inflows. FETH followed ETHA closely, with $1.58 billion.

Meanwhile, following the latest positive flow contributions, Ethereum ETF cumulative net inflows spiked from $2.62 billion to $2.66 billion. On the other hand, the total value traded, and net assets dropped slightly. The value traded depreciated from $336.26 million to $313.11 million, while net assets valuation plunged from $12.27 billion to $12.12 billion.

BTC and ETH Prices Record Slight Dip Amid ETF Inflows

At the time of press, Bitcoin is changing hands at about $93,650, reflecting a 1.2% decline in the past 24 hours. It boasts a market capitalization of $1.85 trillion with a 24-hour trading volume of approximately $33.6 billion. On the other hand, Ethereum has dropped by 1.7% in the past 24 hours. It boasts roughly $3,340 in selling price and a $402.7 billion market cap.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.