Highlights:

- Fed Chair Powell hints at rate cuts, sparking crypto and market gains.

- Bitcoin price surged to $65,021; $176M was liquidated in the last 24 hours.

- Institutional interest in Bitcoin ETFs rises; altcoins also see significant gains.

Federal Reserve Chair Jerome Powell hinted at possible interest rate cuts during his speech at the Jackson Hole Symposium earlier today. This news sparked a rise in financial markets, with cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) seeing notable gains. Powell projected that the Fed is nearing a point where it may lower interest rates, though he didn’t specify a timeline. He stated, “The time has come for policy to adjust,” signaling a potential shift in response to current economic conditions.

The CME FedWatch tool now indicates a 76% chance of a 25 basis point rate cut in September, up from 63% the previous day. Despite this, many analysts still anticipate the Fed will lower rates by up to 100 basis points by year-end. As a result, US Treasury yields fell, and the dollar weakened to its lowest point in 14 months, which typically tends to increase Bitcoin’s value.

Bitcoin Price Surge Drives Crypto Market Rally

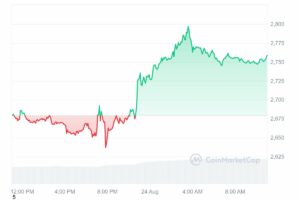

Bitcoin, the world’s largest cryptocurrency by market capitalization, is clearly spearheading the current rally. At the time of writing, BTC was trading at $65,021, reflecting a 5.5% increase in the past 24 hours. Meanwhile, daily trading volumes have skyrocketed by an impressive 67%, now standing at a staggering $43.1 billion.

In the past 24 hours, Coinglass data reveals that over $176 million has been liquidated across the cryptocurrency market, with more than $140 million of that amount coming from short liquidations. Therefore, it appears that conditions are ripe for Bitcoin’s price to potentially surge to $70,000 over the weekend.

Institutional Interest in Bitcoin ETFs Soars After Powell’s Speech

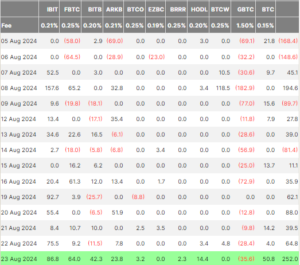

After Jerome Powell’s speech following the Jackson Hole meeting on Friday, institutional interest in spot Bitcoin ETFs surged significantly. After Jerome Powell’s speech following the Jackson Hole meeting on Friday, institutional interest in the US-listed spot Bitcoin exchange-traded funds (ETFs) surged significantly. The BTC ETFs reported $252 million in net inflows on August 23, extending their streak of positive flows to seven days.

BlackRock’s iShares Bitcoin Trust (IBIT), the largest spot BTC ETF by net assets, topped the list with about $86.8 million in net inflows. Fidelity’s Bitcoin fund (FBTC) saw approximately $64 million in net inflows, while Grayscale’s Bitcoin Mini Trust (BTC) received nearly $50.8 million in new investment. On Friday, daily trading volumes in spot Bitcoin ETFs exceeded $3 billion. Additionally, the Bitcoin Fear and Greed Index rose from the fear zone to the neutral range, reaching 56/100.

Altcoin Market Rises Significantly

With Powell suggesting a shift towards monetary easing, the altcoin market is expected to gain the most from the increased currency supply. During this crypto market rally, Ethereum has seen a gain of over 3% and is currently trading at approximately $2,759, with a market capitalization of $330 billion.

Additionally, Ethereum’s daily trading volume has increased by 63%, reaching $16.7 billion. Consequently, Ethereum bulls may soon set their sights on a target of $3,000. Earlier this week, well-known market analyst IncomeSharks suggested that a 5-10% move in Ethereum could spark a 50-100% rally in some lesser-known altcoins.

Think if we see $ETH make a 5 to 10 % move up we'll see some utility microcaps pull a 50 to 200% move. Some decent entries I'm looking at.$APES – Risk management platform$CNDL – Automated trading with fund#M87 – AI GPU nodes and decentralized apps$SHEZMU – Defi and lending pic.twitter.com/9POPnzPvrV

— IncomeSharks (@IncomeSharks) August 20, 2024

Other altcoins, including Dogecoin (DOGE), Solana (SOL), and Shiba Inu (SHIB), have also surged by 5% each in the crypto market rally. Meanwhile, Tron (TRX) and Cardano (ADA) have each increased by 4%. This could signal the start of an altcoin season, with investors potentially loading up on altcoins.