Highlights:

- Bit Digital plans 1 billion share authorization to fuel Ethereum expansion.

- The move supports its aggressive Ethereum acquisition strategy.

- The board has set a September shareholder vote for the proposal.

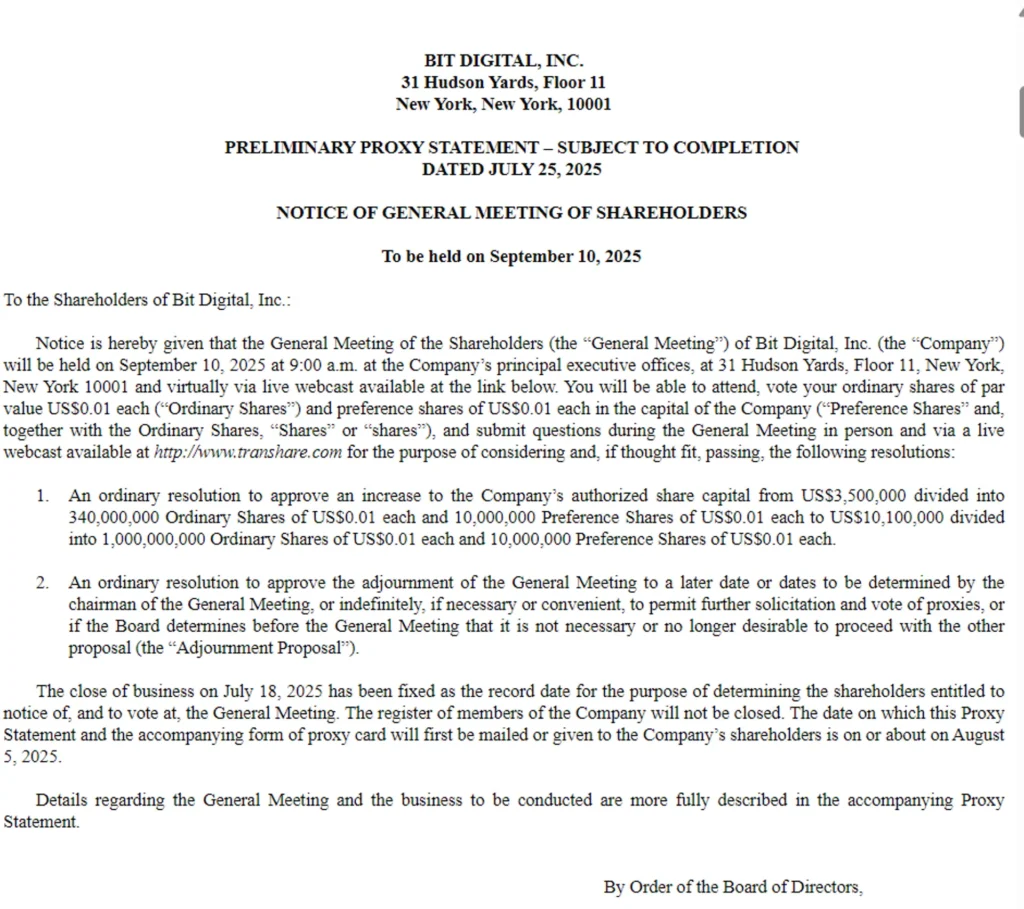

Bit Digital has unveiled a major strategic shift in its digital asset focus. The company is proposing to increase its authorized share capital to 1 billion from 340 million ordinary shares. This increase is intended to fund an aggressive expansion into Ethereum holdings. The upcoming shareholder meeting in September will determine if the proposal moves forward.

The company will keep the authorized preference shares at 10 million. The enhancement of the common shares would, however, elevate the capital stock to $10.1 million from $3.5 million. The shift will achieve the flexibility of equity raises as it sustains the Ethereum purchases.

At the moment, Bit Digital possesses more than 120,000 ETH. According to current market data, the holdings are estimated to be worth approximately $450 million. The firm recently purchased 19,683 ETH tokens worth $67.3 million on July 18. The company has quickly moved up the leaderboard of publicly traded Ethereum holders. Both Bitmine Immersion Technologies and SharpLink Gaming are currently leading the pack.

Shareholder Approval Sought for Massive Share Increase

Through an SEC filing, Bit Digital detailed its plan to move the proposal to a vote. The board fully backed the plan and asked the shareholders to vote in favor of it. In addition, it must get the consent of the vast majority of ordinary shareholders and the preferred shareholders. The forthcoming extraordinary general meeting will be a key milestone in the Ethereum strategy of the company. If shareholders approve the plan, the company can quickly raise money through equity funding. This would hasten Ethereum’s purchase and optimize its treasury of digital assets.

Furthermore, the company stated in the filing that the present authorized capital is insufficient for the implementation of its short-term growth projections. This fresh effort is meant to address that limitation and propel a quick response in the months to come.

Programmability and staking rewards, and DeFi incorporation remain attractive to investors in Ethereum. Institutions are increasingly seeing Ether as a digital financial infrastructure asset. With the increasing interest, Bit Digital is gearing up to capitalize on the shift.

Bit Digital Aligns with Growing Ethereum Market

Bit Digital planning a 1 billion share authorization aligns with more general trends in the market. Institutional demand for Ethereum is increasing steadily. U.S. spot Ether ETFs have now recorded 16 consecutive days of net inflows. ETFs brought $452.72 million on Friday, according to data from SoSoValue.

Spot Ethereum ETFs log $453M inflows, marking 16-day streak

BlackRock’s $ETHA led with $440M Friday inflow, boosting total ETH ETF AUM to $20.66B now 4.64% of Ethereum’s market cap.

Since July 2, inflows doubled from $4.25B to $9.33B.

Investor demand may soon outpace ETH… pic.twitter.com/Ep3ivyxKTs— Dreamboat (@Dreamboat_id) July 26, 2025

Of that daily inflow, BlackRock iShares Ethereum Trust contributed $440.10 million. All U.S. Ether ETFs now command a total of $20.66 billion. This makes up 4.64% of Ethereum’s current market cap, indicating the increasing institutional momentum.

In addition, the expansion plans coincide with Ethereum’s massive growth. ETH price has surged to $3,800 levels last seen six months ago and surged over 50% over the past month. As of this writing, the altcoin is exchanging hands around $3,744 with a market capitalization of $450 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.