Highlights:

- Macroeconomic factors are temporary; markets can recover, says Binance CEO.

- Interest rate cuts and geopolitical issues may cause market fluctuations. Teng advises vigilance

- Teng urges investors to stay informed, research thoroughly, and focus on long-term growth

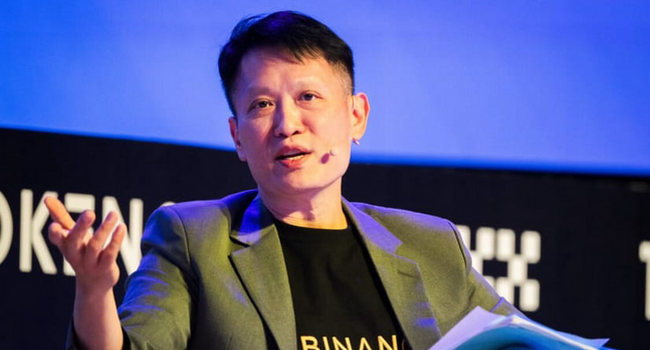

Binance CEO Richard Teng has stated that the recent crash in the cryptocurrency market is primarily due to macroeconomic factors and does not indicate a long-term negative trend. With Bitcoin dropping to the $50,000 level, Teng pointed out that possible interest rate cuts by the Federal Reserve and current geopolitical issues could cause big changes in the market. He advised investors to stay informed, conduct thorough research, and build portfolios.

Recent sharp drops in crypto & equity prices are influenced by macroeconomic factors. We do NOT believe it’s indicative of a long-term negative trend.

With potential Fed rate cuts & geopolitical volatility, there's still significant potential for market fluctuations.

Reminder…

— Richard Teng (@_RichardTeng) August 5, 2024

Teng Urges Informed Investing Amid Market Uncertainties

The sudden decline in cryptocurrency and equity prices has raised concerns among investors. According to Teng, these sharp declines are driven by global economic fluctuations and central bank monetary policies. He pointed out that the expectation of potential interest rate cuts by the Federal Reserve and geopolitical uncertainties have contributed to investors’ cautious behavior.

Teng emphasized that these factors are temporary and part of the broader economic environment, including global economic fluctuations and central bank policies. He reassured investors that these declines are temporary adjustments caused by macroeconomic conditions and do not indicate a long-term negative trend. He pointed out that potential interest rate cuts by the Federal Reserve and geopolitical uncertainties are key contributors to the recent market volatility.

Navigating Market Fluctuations

Despite recent setbacks, Teng is optimistic about the market’s ability to recover. He believes the impact of macroeconomic factors is temporary and that markets will bounce back. This view might reassure investors who are worried about recent market volatility.

The anticipated Federal Reserve interest rate cut is a key reason for potential market fluctuations. Interest rate cuts can increase investors’ risk appetite, leading to market movements. Additionally, geopolitical uncertainties, such as the recent sharp declines in Japanese and Taiwanese stock markets, can cause sudden market dynamic shifts.

Given the recent market conditions, Teng urged investors to research and stay informed. He stressed the importance of understanding the risks involved in cryptocurrency investments and continuously monitoring market developments. Teng’s call to “continue building” aims to encourage investors to maintain their focus on long-term growth and development.

Teng Offers Guidance

Teng’s comments come at a time when the cryptocurrency market is facing significant challenges. However, his positive view and focus on the temporary nature of these economic factors offer a balanced perspective for investors during these uncertain times.

Binance CEO Richard Teng believes these declines do not indicate a long-term negative trend. He highlighted that global economic fluctuations significantly impact market volatility. Potential interest rate cuts by the Federal Reserve are also critical drivers.

Teng advises investors to stay informed and do thorough research. He encourages them to keep building their portfolios, reflecting a balanced approach to market uncertainties. He believes the market will recover. Investors should stay vigilant, understand risks, and focus on long-term growth. Teng’s insights provide valuable guidance for navigating these challenging times as the cryptocurrency market evolves.