Highlights:

- LINK is gaining attention after its Data Streams upgrade and could see a recovery as social activity and interest keep rising.

- TRX reclaimed the $0.297 area and now looks strong above $0.308 with room to move toward $0.319 and higher.

- XLM is finding support near $0.215 and may attempt another move toward $0.230 if buyers stay active.

The crypto market has continued the 7-day drop of 6.41% today, driven by the unwinding of leveraged positions. The spot volume is down 38% while the derivatives volume fell 36% to $779.22B over the past day. Meanwhile, according to CryptoQuant data, BTC may be entering a bear zone after on-chain metrics shifted from profit realization to loss recognition. According to the data, Bitcoin holders have recorded net realized losses for the first time since 2023.

As of press time, the overall market cap is down 0.6% to $3.02 trillion. In addition, the trading volume is down 28.91% to $99.31 billion. The fear and greed index has shifted from the neutral zone to the fear zone at an index of 34. The market is awaiting a fresh catalyst that will lead to a breakout after the latest attempt by BTC failed, according to Glassnode data.

The slowing momentum has triggered over $196.30 million in liquidations over the past day, according to CoinGlass data. As the market awaits a fresh catalyst to move the market, here are the best cryptocurrencies to buy today.

Best Cryptocurrencies to Buy Today

1. Chainlink (LINK)

LINK, the native token of the leading decentralized oracle network, is currently trading at $12.28, with a 1.29% decrease in the last 24 hours. The trading volume of the coin has decreased by 45.8% to $283 million, while the market cap stands at $8.7 billion. The token is slightly up 1% on the monthly chart.

Despite the small pullback today, LINK is set to rally in the short term. Recent data shows that LINK has reached a five-week high in social volume. This surge comes after Chainlink’s upgrade to its Data Streams product. The upgrade now delivers near real-time US stock and ETF prices.

🌉📊 Chainlink just brought real-time U.S. stock & ETF prices on-chain. With $80T in equities now accessible to DeFi, LINK is positioning itself as core infrastructure for tokenized finance. We deep dive $LINK metrics and explain why this move matters. 👇https://t.co/8yBF7T5Izo pic.twitter.com/INw7KiSbe9

— Santiment (@santimentfeed) January 22, 2026

It also covers pre-market, regular after-hours, and overnight sessions. As a result, DeFi platforms can better mirror traditional markets on-chain. Santiment data also shows attention is high despite the recent market weakness. Bearish sentiment has increased, which often appears near accumulation phases. Hence, LINK is positioning for a recovery and is likely going higher over time.

2. TRON (TRX)

The native coin of the TRON blockchain is trading at $0.3082, a 2.7% increase in the past day. In addition, its trading volume is up by 3.28% to $719.97 million. Meanwhile, the market cap stands at $29.19 billion. The coin has gained 9.25% on the monthly chart.

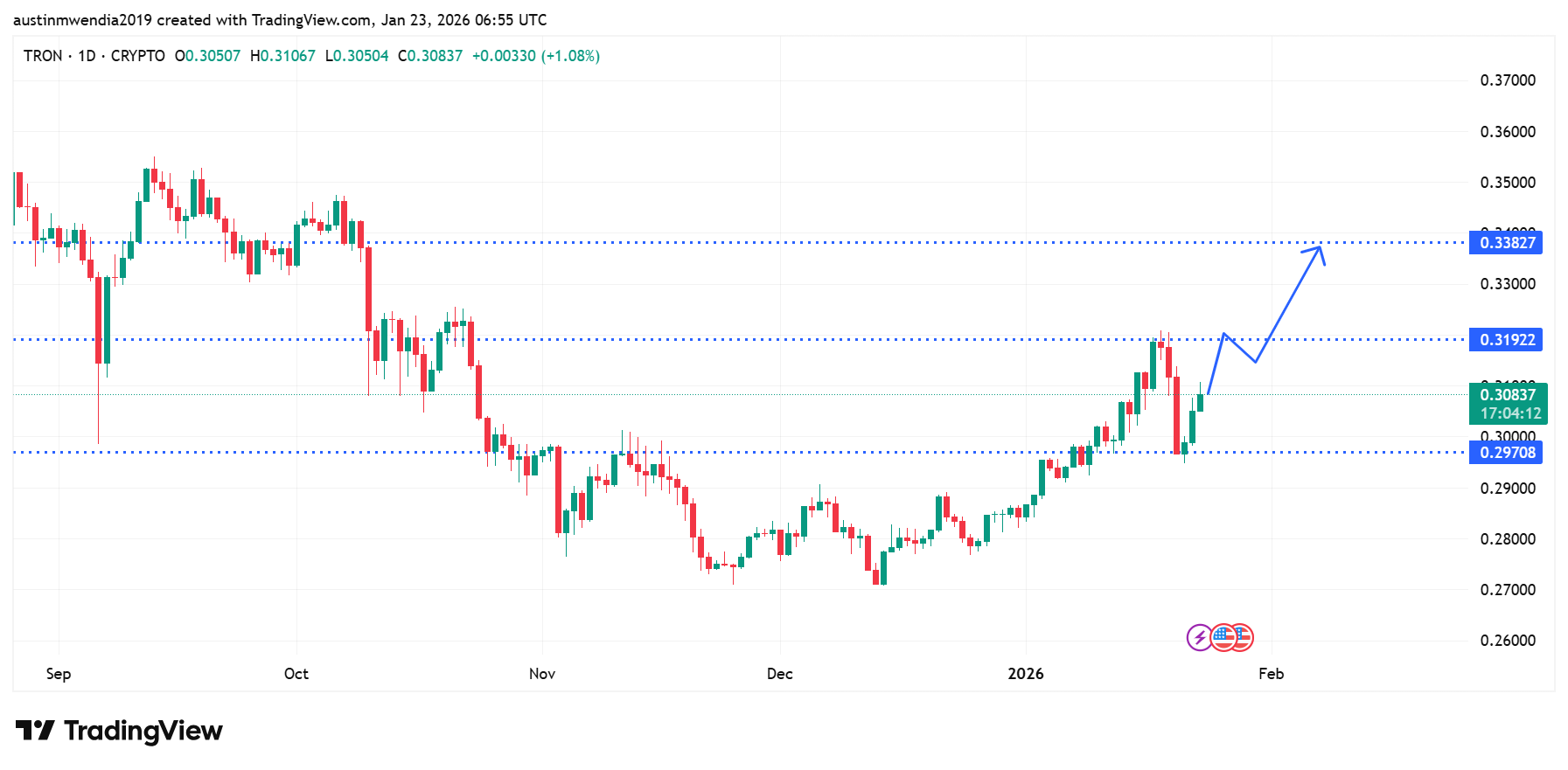

TRON is trading in a recovery phase on the daily chart after forming a clear higher low structure. The price has reclaimed the $0.297 support zone, which now acts as a key demand area. In addition, the price is consolidating above $0.308, which signals short-term strength. The next resistance stands near $0.319, where sellers previously reacted.

A clean hold above this zone opens room toward $0.338. Moreover, the recent pullback respected the former resistance that turned into support. The momentum structure is improving with higher highs forming.

3. Stellar (XLM)

XLM, the native token of the Stellar network, is currently trading at around $0.2110, with a 1.28% decrease in the past day. The trading volume of the coin is down by 37.15% to $116.9 million, while the market cap stands at $6.84 billion.

Stellar is trading within a short-term corrective phase after a strong impulsive rally. The price has repeatedly rejected the $0.245 resistance zone. This area remains a key supply level. Meanwhile, the price has respected the $0.215 to $0.218 support zone multiple times. This zone has been attracting demand for several days.

$XLM is stuck in a bearish structure, repeatedly rejected at $0.30. After multiple failed attempts to reclaim the $0.30 psychological level, XLM’s price has slid lower and now trades near $0.21, reflecting the broader market downturn.

Even a major network upgrade has failed to… pic.twitter.com/VuAr1ZjRRB

— ՏᗩᗰIᑌᒪ (@zzsami69) January 23, 2026

The XLM structure shows lower highs but stable lows, which signals consolidation. A clean hold above the $0.215 will keep the recovery intact. However, a break above $0.230 would shift momentum toward $0.245 again.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.