Highlights:

- The Avalanche price has spiked 10% to $34, as bullish indicators signal a potential rally to $45 soon.

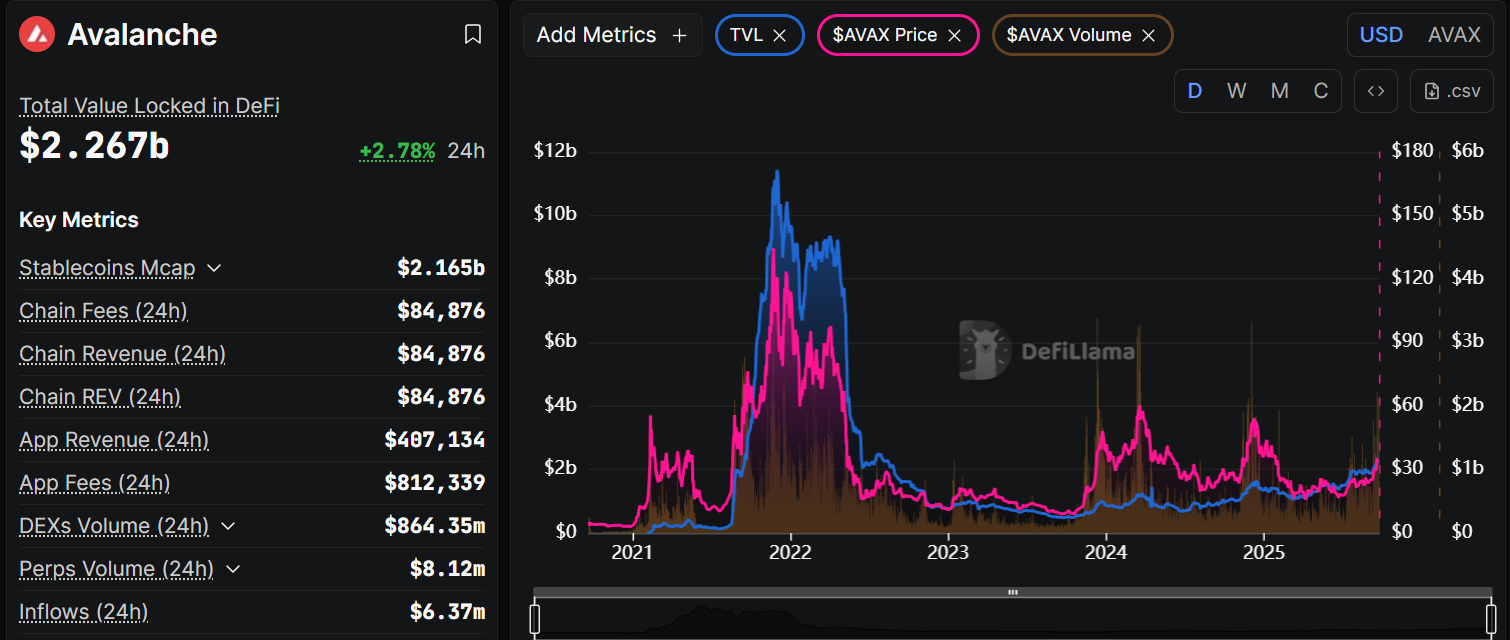

- Avalanche has surpassed 2 billion DeFi TVL, the highest since August 2022, indicating growing investor confidence.

- Anthony Scaramucci has revealed a $300 million investment in a significant development, specifically tokenized hedge funds.

The Avalanche price is nearing a critical breakout, surging 10% to $34 mark. Accompanying the price movement is its daily trading volume, which has soared 111% to $2.96 billion. Recently, Anthony Scaramucci has revealed a $300 million investment in a significant development, specifically tokenized hedge funds. The release of the AVAX-focused treasury is part of a $550 million investment at Avax’s partner, HiveMind Capital.

Scaramucci is doubling down on Avalanche. After announcing $300M in tokenized hedge funds, @Scaramucci is now the strategic advisor for AVAX One — a $550M AVAX-focused digital asset treasury alongside @HivemindCap. pic.twitter.com/XF05sucSIJ

— Avalanche🔺 (@avax) September 22, 2025

Avalanche is the platform to go to, and it has mass peer review, which is truly amazing. Hoping Avax becomes a leader in the decentralized part of banking. Anthony Scaramucci’s position within the AVAX ecosystem, combined with his experience in digital and traditional assets, has had a significant impact on the blockchain.

Avalanche DeFi TVL Hits Its Highest TVL

Recent metrics show a positive trend for Avalanche’s decentralized plans. The amount of DeFi money locked on AVAX sits at $2.27 billion, marking a 2.78% increase. The value of stablecoins is now exceptionally high at $2.165 billion. Recently, people have observed that while the values of other currencies are declining, the value of Avax has been rising.

Avalanche DeFi hit its highest TVL since August 2022. pic.twitter.com/1iO0jTp9ae

— Avalanche🔺 (@avax) September 22, 2025

Taking a closer look at the blockchain’s numbers, it becomes evident that Avalanche’s performance is primarily driven by its high trading volume, reaching $864.5 million within 24 hours. The new figures for Avalanche show that users are actively engaged in the network, indicating that the internet plays a significant role.

A quick look at the Avalanche price daily chart frame shows a steady rise within a rising channel. Furthermore, the bulls have established strong key support zones at $26 and $22, giving the bulls wings for more upside. Meanwhile, the token is attempting to break the $40 critical zone, in which it raly towards the $44-$45 area.

Diving into the technicals, the Relative Strength Index at 71.71 indicates that the Avalanche price is overbought. This cautions traders not to be too greedy, as a pullback could be imminent. Furthermore, the Moving Average Convergence Divergence (MACD) indicator also demonstrates that the momentum is strong. This is evident as the blue MACD line sits well above the signal line, marking a bullish crossover.

What’s Next for Avalanche Price?

In the short term, the Avalanche price may test the $33-$28 support level if the early profiteering commences in the market. A break below the current immediate support around $28 could drag it to the recent low of $26 or even $22, where bargain hunters might swoop in. However, if bulls continue the upside momentum, the Avalanche price could see a rebound toward $41-$45, especially if the entire market turns green again. The $45-$50 zone will be a key point to watch.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.