Highlights:

- The price of Avalanche has risen 4% to $21.22, with a 34% surge in daily trading volume signaling strong market activity.

- AVAX is trading within a wedge pattern, suggesting a potential breakout to $71, according to an analyst.

- Short-term bubble risk is bearish with a 0.916 score, indicating possible volatility despite mid-term optimism.

Avalanche price has skyrocketed 4% to trade at $21.22 in the past 24 hours. Its daily trading volume has soared 34%, indicating intense market captivity. This comes as the crypto market regains momentum, led by BTC, which has reclaimed the $105K mark. According to Solberg Invest, a popular analyst, he believes that at the moment, AVAX is correctly holding on to important support lines. As the token is trading sideways, the analyst has noted that this could be the right time for accumulation, in which a breakout may send the Avalanche price to $71.

$AVAX Update:

Price has been consolidating between support and resistance for months — and it looks like a breakout is getting closer. 🔥

We’re holding support well, so this could be a solid time for accumulation.

Breakout target: $71 📈 pic.twitter.com/HtClsCk8w3

— Solberg Invest (@SolbergInvest) June 3, 2025

AVAX is forming a wedge pattern and its price moves between the lower resistance line and the upper support line. Such patterns usually happen before major price jumps, and the coming trend points to a steady rise toward $71. If this price trajectory occurs, it would be a big improvement from present prices and might mean AVAX’s upward waves have started again after being quiet for a while.

Short-Term Bubble Risk Analysis Highlights Bearish Sentiment Despite Mid-Term Optimism

Even though the medium-term prediction is optimistic, Into The Cryptoverse’s bubble risk chart highlights a note of caution. The current indicator score is 0.916, which indicates bears are ahead, with shaky stability in the financial markets. If we look at history, such readings have frequently been followed by corrections in prices or volatility spikes.

$AVAX Short Term Bubble Risk pic.twitter.com/8GjM3kDe84

— Into The Cryptoverse (@ITC_Crypto) June 1, 2025

It shows times of over-excited markets (marked as red and yellow) alternating with more stable periods (blue and green). Even as accumulation goes on, investors in AVAX should be careful about possible short-term drops. It shows how market behavior usually sees short-term traders face volatility, while those who hold for the long run focus on progress.

Avalanche Price Outlook

A quick look at the Avalanche price daily chart, the bears have established some resistance at $21.95 and $29.09, cushioning the bulls against further upside. Moreover, this shows that the bears have the upper hand, painting a bigger picture bearish. According to the Relative Strength Index (RSI), the momentum right now is neutral, not overbought or oversold at 44.32.

The MACD shows a slight decrease, indicating that prices might fall, but a change could happen as the lines come together. Currently, the market appears to be in a holding pattern until new positive influences show up, which could strengthen it.

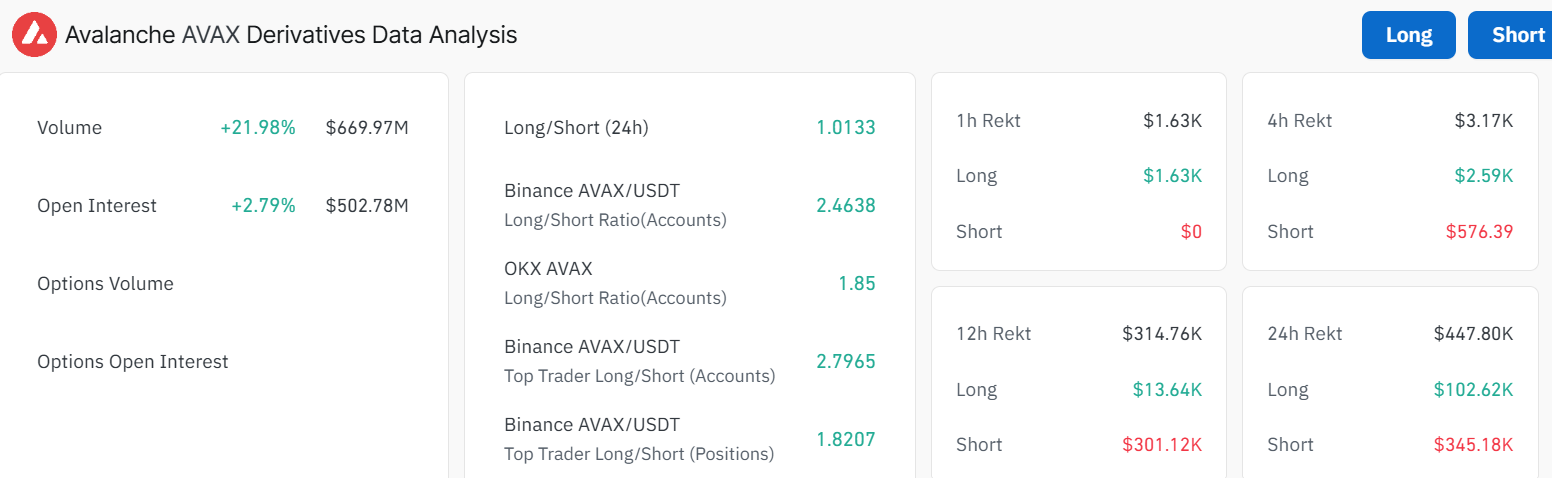

On the other hand, traders are getting more involved as total volume has risen by 21.98%, and open interest rose by 2.79%. Binance AVAX/USDT strong long positioning is shown by top traders, who keep ratios near 2.8, signaling they believe the prices will go up.

According to recent data, there has been a slight drop in long positions, but short position activity is only small, which signals the market is leaning bullish with some uncertainty. All this adds to the narrative of consolidation and even makes a breakout to the upside look likely.

What’s Next for AVAX?

If the bulls regain strength and push above the 50-day resistance at $21.95, it may rekindle a slight short-term rally. In such a case, the bulls will rally the Avalanche price towards $23, $25, and $29. A close above the $29o zone will open the door towards further upside, to $35.

On the downside, if the bears keep dominating, the Avalanche price could keep consolidating or drop further. In the case of downward movement, AVAX price could hit the $19 and $16 support zones. In general, AVAX is showing signs of being bought and held in the longer term, but short-term conditions require attention.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.