Highlights:

- The Avalanche price is surging, up 2% to $34.

- Avalanche is building the rails for global payments as PayPal USD is now live on the blockchain.

- AVAX now targets $41-$45 as the funding rate is favorable.

The Avalanche price has defied market correction, surging 2% to $34. Its daily trading volume is up 6% to $2.13 billion, indicating growing investor confidence. Meanwhile, PayPal USD (PYUSD) will now be available as part of Avalanche’s mission. This is to expand its payment capabilities further, leveraging its connection with LayerZero Labs.

Avalanche is making good progress in its endeavor to build scalable, secure, and fast rails for global payments. The Avalanche blockchain, renowned for its fast speeds and low transaction costs, will soon be home to PayPal’s dollar-backed stablecoin, PYUSD. Analysts say that PYUSD on Avalanche will benefit cross-border transactions.

Avalanche is building the rails for global payments. 🔺

Now, PayPal USD (PYUSD0) is live on Avalanche through @LayerZero_Labs, bringing a trusted, dollar-backed stablecoin onto rails built for speed, security, and scale. pic.twitter.com/283ZkzkUG2

— Avalanche🔺 (@avax) September 18, 2025

Avalanche employs LayerZero’s interoperability protocol to guarantee that PYUSD transactions can interact with other blockchains. This enhances the asset’s use case for businesses and consumers.

Avalanche is poised to become an essential part of the global financial infrastructure as more financial institutions adopt blockchain-based solutions. This is important because Avalanche is now positioned to capture more than just the $200 billion stablecoin market. With the US Dollar-backed asset, users will become better utilized.

Avalanche Price Surge Due to Optimism in Their Ecosystem

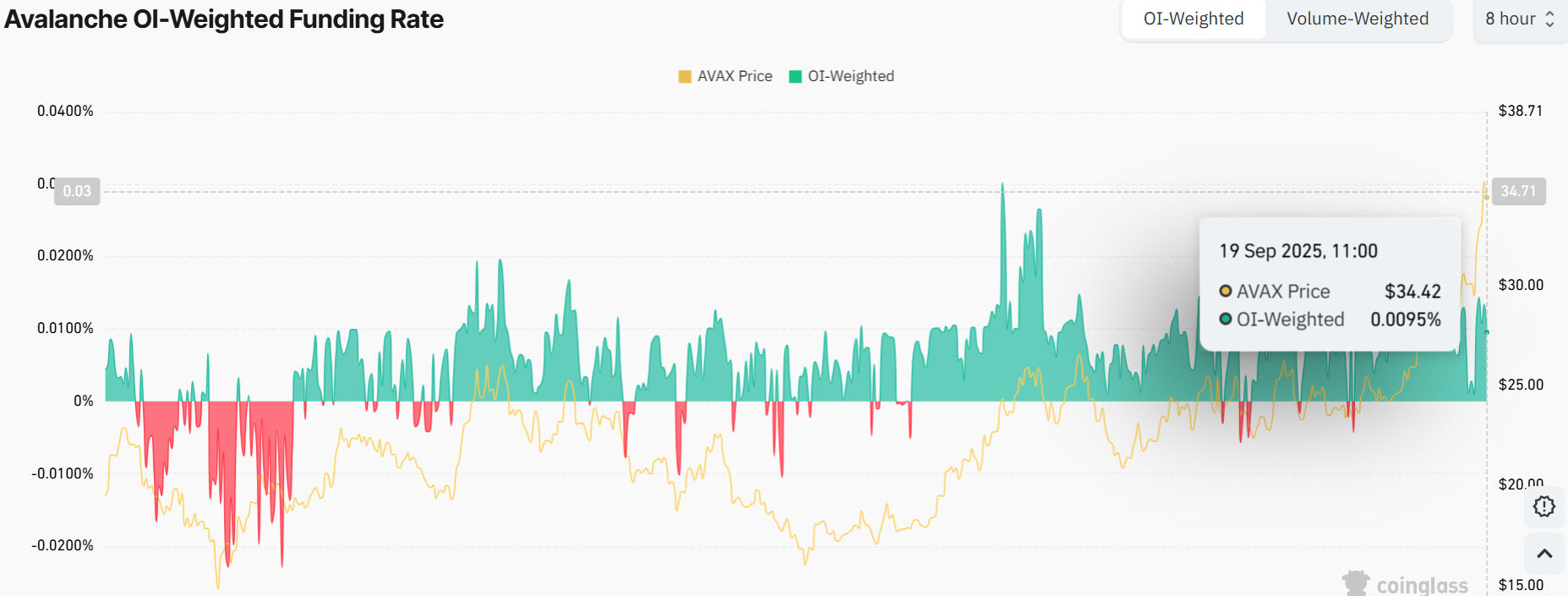

Avalanche’s native token, AVAX, has also seen a significant price surge, reflecting increasing optimism around its growing ecosystem. AVAX is trading at $34.42 on September 19, 2025, after it jumped from lower levels $29 on 2 Sep. In addition, the jump in AVAX’s open interest (OI)-weighted funding rate is a healthy signal that investors are getting more confident about AVAX.

The growing interest in AVAX is evident due to the rise in the OI-weighted funding rate to 0.0095%. It indicates that more institutional players are entering their positions, expecting further growth. Looking at the AVAX/USD daily chart, the Avalanche price has broken above two key resistance levels while forming a bullish trendline and showing momentum. The key support zones at $25 and $21 reinforce the bullish trend in the market.

Diving into the technical indicators, Avalanche price is getting overbought, as shown by its RSI of 73.84. Thus, a price correction seems likely; however, the overall trend remains bullish. Also, the MACD indicator is extremely bullish and continues to rise on the charts. This supports the bullish bias in the market, calling for more buy orders.

What’s Next for AVAX?

The 2% surge could signal the start of a rally, especially if social media hype intensifies. A break above $34 might send the Avalanche price to $41-$45. However, as the RSI sits in overbought territory, early profiteering could push the AVAX token to $29. Trading volume is spiking too, with a 6% surge in the last 24 hours, suggesting intense buying pressure that confirms bulls are in the order books.

In the short term, the Avalanche price may continue the rally to $44 if momentum holds. Meanwhile, traders will want to watch those support levels around $29-$25. If the price closes below this level, the token may drop lower to $21, erasing all the gains.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.