Highlights:

- Arthur Hayes believes Bitcoin could rally if the US increases market liquidity.

- He closed his Bitcoin short position with a 3% profit, completely shifting away from his earlier sub-$50K forecast.

- Bitcoin’s September decline aligns with past halving cycles and patterns.

In a September 8 post on X, Billionaire crypto investor and BitMEX co-founder Arthur Hayes revealed that he closed his short position on Bitcoin (BTC) price, securing a 3% profit from the recent market downturn. Hayes predicts that Bitcoin’s price could surge as early as next week, fueled by increased U.S. dollar liquidity from the Federal Reserve. He suggests that economic and market weakness could prompt this action.

Hayes stated:

“Closed my $BTC short, made 3% profit, enough to cover my food and bar tab for KBW. With Bad Gurl Yellen watching mrkts and releasing a weekend statement, if stuff continues to puke next week $BTC *MIGHT* rise anticipating more $ liq.”

On Sept. 6, Hayes cautioned that Bitcoin could dip below the $50,000 psychological level over the weekend. He took a short position to profit from the anticipated decline.

$BTC is heavy, I’m gunning for sub $50k this weekend. I took a cheeky short. Pray for my soul, for I am a degen.

— Arthur Hayes (@CryptoHayes) September 6, 2024

Furthermore, Peter Brandt has shifted from his earlier prediction of a $46K low for Bitcoin. Responding to BTC critic Peter Schiff, the seasoned trader noted that Bitcoin is bullish compared to gold, highlighting a massive inverted head and shoulders pattern forming. Notably, crypto market sentiment has slightly improved, moving from “extreme fear” to “fear” within the past day. The Crypto Fear & Greed Index rose from 23 to 29 today.

US Money Printing May Boost Bitcoin Price

The anticipation of additional liquidity injections from the world’s largest economy could greatly boost investor sentiment and Bitcoin price action. In a Sept. 7 X post, the crypto elite predicts that further declines in traditional markets might prompt Treasury Secretary Janet Yellen to inject liquidity into the market.

He stated:

“Bad Gurl Yellen is watching, if markets go down more she will definitely pump up the jam by printing more money.”

Bad Gurl Yellen is watching, if markets go down more she will definitely pump up the jam by printing more money. pic.twitter.com/L81vc07as9

— Arthur Hayes (@CryptoHayes) September 7, 2024

Moreover, Jamie Coutts, chief crypto analyst at Real Vision, suggested that the M2 money supply—encompassing all cash and short-term bank deposits in the U.S.—could drive the next Bitcoin rally. He made this observation in a May 16 X post.

Coutts noted:

“This is due to a high correlation with $BTC bull cycles. Of the big 3 I track in my Bitcoin/Liquidity framework, Global M2 appears to capture the most of the moves.”

Crypto traders remain uncertain about a market recovery with the upcoming consumer price index (CPI) on Wednesday and producer price index (PPI) on Thursday. Additionally, the spot Bitcoin ETF market has faced a lack of institutional support, with nearly $700 million in net outflows last week amid September challenges.

September’s Bitcoin Decline Mirrors Historical Patterns

Bitcoin’s downturn in September aligns with past halving cycles, according to analyst Rekt Capital in a Sept. 6 X post. In September 2021, Bitcoin retraced by 7% but rallied by 39% the following October. Currently, Bitcoin is down 9% this September. September has historically been a month of downside volatility, with average BTC returns at -4.69%.

When Bitcoin retraced -7% in September in 2017…

Bitcoin rallied +47% in the following October

When BTC retraced -7% in September in 2020…

BTC rallied +27% in the following October

When BTC retraced -7% in September in 2021…

BTC rallied +39% in the following… https://t.co/sBgeS2Lafi pic.twitter.com/5N3T9wwatG

— Rekt Capital (@rektcapital) September 6, 2024

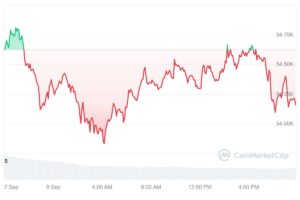

As of press time, the BTC price is trading 0.88% down at $54,156 with a market cap of $1.069 trillion.