Highlights:

- Bitcoin price drops below $80k as the market reacts to Trump’s Strategic Reserve order.

- Arthur Hayes warns Bitcoin could fall to $75k, signaling possible market volatility.

- Fear & Greed Index drops to 20 as panic selling pressures BTC.

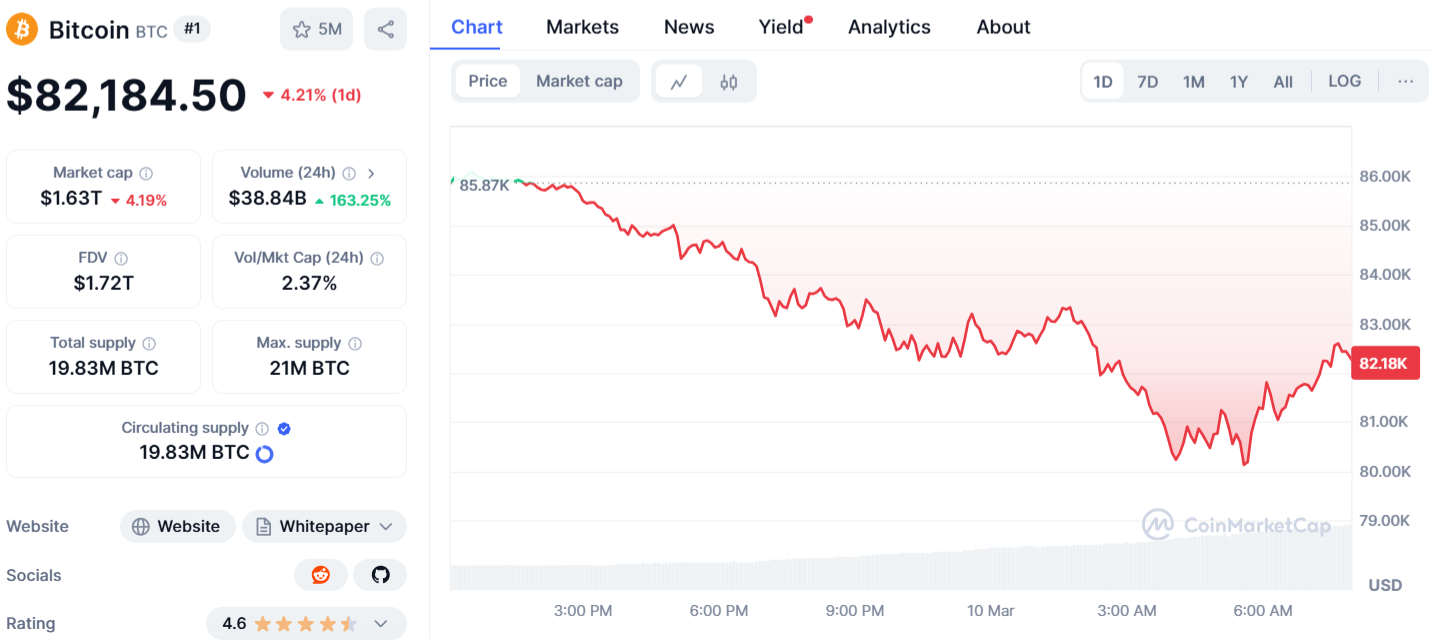

On March 10, Bitcoin dropped to just above $ 80,000 as market sentiment turned bearish. At the time of writing, BTC was trading at $82,184, showing a slight recovery from its earlier low. The cryptocurrency market dropped 4%, reaching a valuation of $2.77 trillion. Solana and XRP fell 7%, while Ethereum declined 8%, nearing $2,000. Cardano (ADA) and Dogecoin (DOGE) saw sharper losses, falling nearly 6% and 7%, respectively.

Bitcoin sold off suddenly after Donald Trump signed an Executive Order on Thursday, launching the Strategic Bitcoin Reserve. The move surprisingly caused prices to drop instead of rising.

BitMEX co-founder Arthur Hayes described this significant Bitcoin price decline as an “ugly start” to the week. He cautioned that BTC could decline below $78K again, stating, “If it fails, $75,000 is next in the crosshairs.” He also mentioned significant open interest in Bitcoin options within the $70,000 to $75,000 range. Hayes warned that a drop into this zone could lead to heightened volatility.

An ugly start to the week. Looks like $BTC will retest $78k. If it fails, $75k is next in the crosshairs. There are a lot of options OI struck $70-$75k, if we get into that range it will be violent. pic.twitter.com/q4cq0rthGJ

— Arthur Hayes (@CryptoHayes) March 9, 2025

Open interest is the total value of BTC options that are still active. Deribit data shows $696 million at the $70,000 level, $680 million at $80,000, and $659 million at $75,000. Traders are betting short on Bitcoin. Meanwhile, the Bitcoin Fear & Greed Index dropped to “extreme fear,” reaching a score of 20 on March 10.

Bitcoin Fear and Greed Index is 20. Extreme Fear

Current price: $80,602 pic.twitter.com/f5W1p1kbNE— Bitcoin Fear and Greed Index (@BitcoinFear) March 10, 2025

Bitcoin has been very volatile in the past two weeks, moving between $80,000 and $95,000 due to trade tariff news and White House crypto updates. In January, Hayes predicted BTC would drop to $75k before reaching $250k this cycle. “At least my prediction could be wrong. I hope I’m wrong,” he said at the time.

Panic Selling and Economic Uncertainty Raise Concerns for Bitcoin Price

Market research firm 10x Research says the price drop is mainly due to panic from recent buyers. With Bitcoin price falling below $80,000, around 70% of all selling came from investors who purchased within the last three months. This reflects that recent entrants are panic-selling as prices decline.

Buy The Dip? Or Stay Fully Cashed Up?

Bitcoin's Textbook correction is fully playing out…

👇1-11) Bitcoin follows the price projection outlined in our ‘Bitcoin: Textbook Correction?’ report on February 25. The support structure collapsed once Bitcoin fell below the critical… pic.twitter.com/bHZ7whPSzF

— 10x Research (@10x_Research) March 10, 2025

Recently, Timothy Peterson predicted another bear market for the crypto industry. His warning comes as the Federal Reserve stays cautious on interest rates due to ongoing economic uncertainties. Peterson warned that the market is overvalued. He said delaying US rate cuts in 2025 may push Bitcoin to $71,000.

Peterson’s comment came a day after Federal Reserve Chair Jerome Powell stressed no urgency in changing interest rates. “We do not need to be in a hurry and are well-positioned to wait for greater clarity,” Powell said in a speech in New York on March 7.

Volatility may continue this week as two key United States inflation reports are due. The Consumer Price Index (CPI) arrives on Wednesday, March 12, while the Producer Price Index (PPI) follows on Thursday, March 13. These reports are crucial as they provide insights into inflation trends, which can influence the Federal Reserve’s monetary policy decisions. If inflation stays high, the Fed may stay strict, pushing Bitcoin’s price down.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.