Highlights:

- The price of Arpa has surged 19% in the past 24 hours, as its daily trading volume has spiked by 2364%.

- Despite the recent surge, ARPA faces key resistance levels at $0.021 and $0.031

- If ARPA can overcome resistance at $0.021 and $0.031, it is poised for a sharp rally targeting 112% gains.

As of July 2, the Arpa price has surged 19% to trade at $0.0216, with its daily trading volume increasing 2364% in the past 24 hours. The token is now up 12% over the past week, despite a slight 3% slump over the past month.

Meanwhile, the price of ARPA has been defying expectations and showing immense strength as it attempts to break major levels of resistance despite Bitcoin’s bearish performance. According to crypto analyst BTCUmi, the Arpa price tapped the key resistance and is now retracing in the 4-Hour chart timeframe. If the token finds support at $0.02, the bulls may attempt the $0.022 barrier once again.

While $BTC is pulling back, $ARPA is showing surprising strength on the 4H chart — nearly breaking through two layers of resistance 📈

Price just tapped the resistance zone and is now retracing. If it finds support around $0.02, another attempt at $0.022 is very possible.

But… pic.twitter.com/eqRdZuSo97

— BTCUmi (@UmiBtc) July 1, 2025

ARPA Price Remains Bearish Despite a 19% Jump

The Arpa price has been in a prolonged downtrend, trading well within the confines of a falling wedge pattern. Despite a 19% surge in the past 24 hours, the token remains trapped within the governing channel. Moreover, the bulls are facing a challenging moment, as the bears continue to hold dominance. This is evident as the bears have established an immediate resistance at $0.021 and $0.031, aligning with the 50-day and 200-day MAs, respectively.

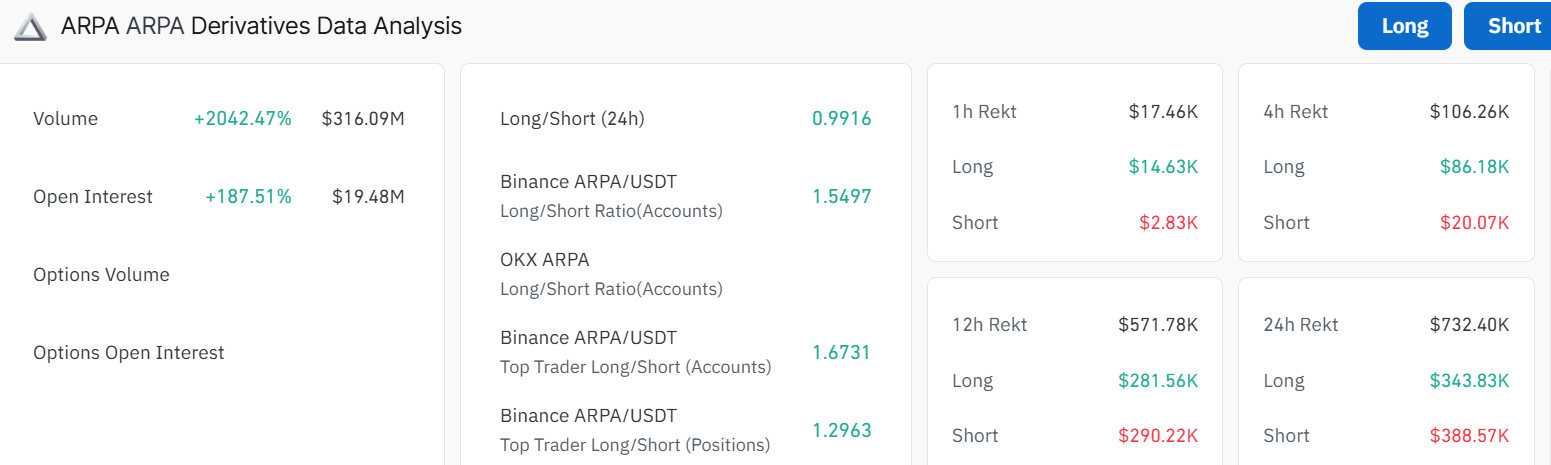

On the other hand, the increasing volume and an RSI of 56.08 suggest that the token is in the process of reaching a breakout stage. The RSI is not in the overbought region, which means there is still a possibility of gains increasing further before the index becomes overextended. Moreover, the market volume of ARPA derivatives has experienced a great explosion. The volume of trading has increased by 2042.47% to $316.09 million, whereas the open interest has risen by 187.51% to 19.48 million.

Such a steep rise in trading volume indicates that investors have confidence in the ARPA project. This contributes to the reasoning that it may reach a breakout.

Arpa Bulls Eye 112% Gains If Resistance Keys Give Way

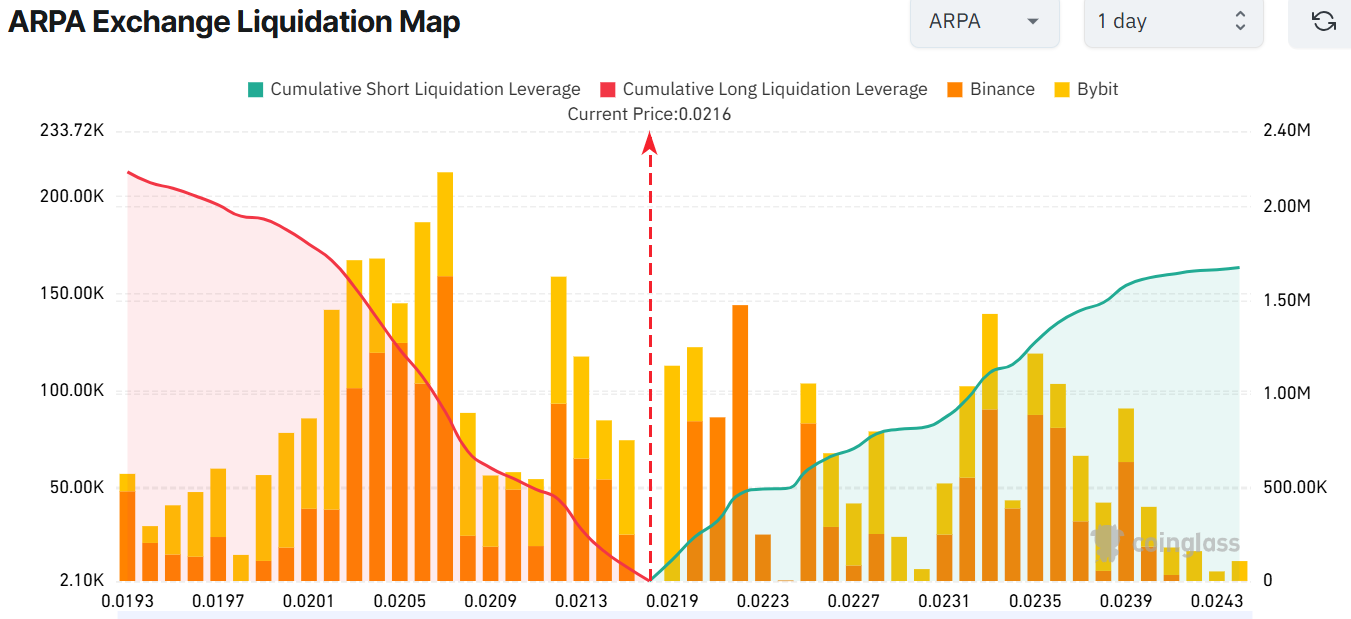

Meanwhile, the ARPA exchange liquidation map shows an important tipping point. Considering the current price of this coin at $0.0216, there is a large volume of liquidation leverage on long positions. This indicates that once the resistance zone is broken, a short squeeze will also occur, causing the price to surge even more rapidly.

In layman’s language, there is more cumulative long liquidation leverage ($2.19 million) compared to shorts ($1.68 million) in the last 24 hours. This imbalance suggests that some bullish sentiment is building in the ARPA price, which may cause a surge to $0.032-$0.040 in the short term.

The Arpa price has the potential to achieve 112% gains, provided the bulls overcome the resistance zones. A break above the $0.021 and $0.31 will call for more upside towards $0.033-$0.042. In a highly bullish scenario, the bulls are expected to reach $0.045, representing a substantial 112% gain. On the downside, if the bears continue to dominate, the Arpa price may drop or consolidate further. In such a case, the $0.018-$0.016 support zone will cushion against further downside.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.