Highlights:

- Apecoin’s price has plunged 14%, with the governance token of the Bored Ape Yacht Club ecosystem trading at $1.19.

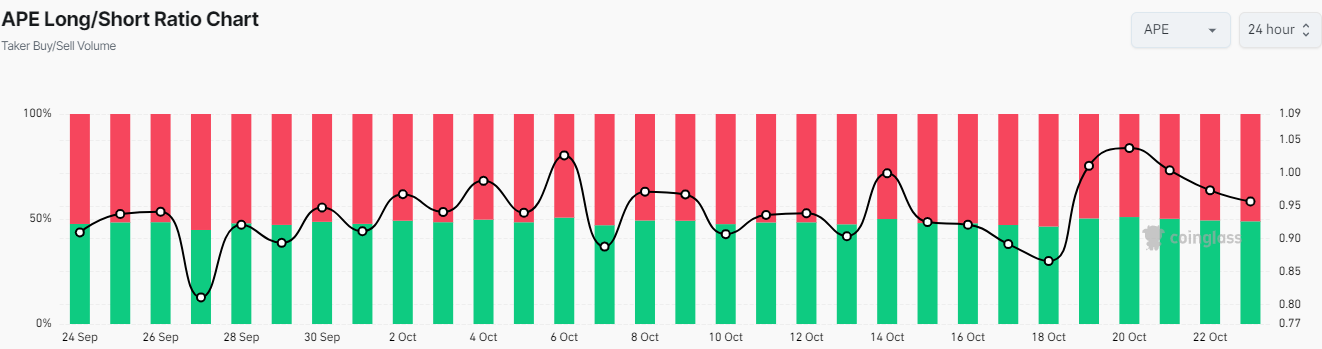

- According to Coinglass data, the APE Long/Short Ratio has plunged below 1, currently at 0.95.

- The token may continue falling and retest the 200-day moving average at $0.94.

The Apecoin price has dropped 14% today, with the APE/USD trading at $1.19. Its trading volume has notably plummeted 47% to $417.73 million, suggesting a fall in market activity. The lack of interest in the token has also seen the market cap drop 14% to $906.84 million. APE is now up 65% in a week, 50% in a month, and 8% in a year.

Apecoin’s price drop can be attributed to a pullback as some traders and investors commenced early profit bookings. Meanwhile, Coinglass data shows that the governance token of the Bored Ape Yacht Club ecosystem coin has some bearish prospects.

This is evident as the APE Long/Short Ratio has plunged below 1, currently at 0.95. In other words, a close above 1 indicates that the average open position is bullish, and vice versa. This suggests that a bearish sentiment in the Apecoin price is in the cards, if the price continues the downward trajectory.

Apecoin Statistical Data

Based on CoinmarketCap data:

- APE price now – $1.19

- Trading volume (24h) – $417.73 million

- Market cap – $906.84 million

- Total supply – 1 billion

- Circulating supply – 762.65 million

- APE ranking – #76

The Apecoin price broke out sharply on October 20, forming a steep upward curve resembling a parabolic move. This parabolic rise indicates strong buying pressure and a rapid price increase. The APE price increased steadily, hitting $1.75, a value last seen in April.

Apecoin Price May Continue the Downtrend

However, early-profit bookings commenced, leading to the APE price drop, currently trading at $1.19. Despite the plunge, the price still upholds a positive outlook as it trades above the key bullish indicators. These include the 50-day and 200-day SMAs, which act as immediate support zones at $0.80 and $0.94, respectively.

The Relative Strength Index (RSI) has dwindled from the 70-overbought zone as the bulls search for enough liquidity to resume a meaningful uptrend. Currently, the RSI sits at 62.27, upholding a bullish outlook, hence tilting the odds in favor of the bulls.

On the other hand, the Moving Average Convergence Divergence (MACD) has jumped to positive territory, upholding a buy signal. This is manifested as the MACD in blue has crossed above the orange signal line, suggesting intense buying pressure. In this case, traders and investors are inclined to buy APE unless the MACD changes.

Apecoin Price Forecast

Based on the daily chart timeframe, the APE price still upholds a bullish outlook despite the plunge. However, with the price retracing and investors booking early profits, the APE price could keep dwindling. In such a case, the $0.94(coinciding with the 200-day) will be in line to absorb the potential selling pressure.

A breach and break below the above support will see the price hit $0.80, invalidating the bullish thesis. On the other hand, if the bulls build momentum at this level, the APE price could rise, reclaiming the $1.75 mark.