Highlights:

- Martinez forecasts a potential 7.98% July rebound for Bitcoin.

- July has historically been a strong month for the coin.

- Market uncertainty persists with upcoming Mt. Gox repayments potentially impacting Bitcoin’s price.

June has been a tough month for Bitcoin (BTC), with the cryptocurrency experiencing several failed recovery attempts. Renowned crypto market analyst Ali Martinez anticipates a price rebound for BTC in July following a month of bearish momentum.

According to Martinez’s X post on June 30, the Bitcoin price has historically shown an average price rebound of 7.98% in July following a “negative June.” In seven out of the last eleven July trading periods, BTC has recorded minimum monthly gains of 8%. According to data from Coinglass, the price of Bitcoin fell by up to 6.96% last month and has historically averaged a decline of 0.35% in June.

Historically, when #Bitcoin has had a negative June, it tends to bounce back strongly in July. In fact, $BTC has shown an average return of 7.98% and a median return of 9.60% during this month. pic.twitter.com/fJaIwc7Eob

— Ali (@ali_charts) June 30, 2024

Bitcoin’s Historical July Rebound Presents a Strategic Opportunity for Investors

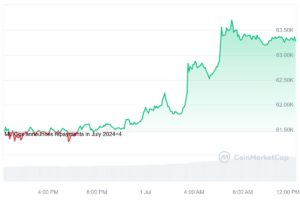

At the time of writing, Bitcoin was trading at $63,275, reflecting a 3% increase in the past 24 hours. Despite this recent uptick, the digital currency has declined about 1.5% over the past week. This decrease aligns with the overall trends observed in June, supporting Ali’s analysis of a potential recovery in the upcoming month.

Such cyclical movements are common in the crypto markets, highlighting the importance of investors remaining informed and adaptable. Historically, July has been a period of correction and recovery for Bitcoin, often following the typical June slump.

Analyst Martinez’s insights into the cryptocurrency’s past performance emphasize that Bitcoin not only tends to rebound in July but also generally achieves strong gains during this month. This pattern suggests that while short-term volatilities may influence market sentiment, July’s overall trajectory could be highly positive, presenting a strategic opportunity for investors. Furthermore, Bitcoin saw its highest average price return of 46.81% in November.

Bitcoin’s downward trend began on June 10, when the spot BTC ETFs in the US recorded their first net outflows in one month. Last week, spot BTC ETFs received $137.2 million in net inflows over their final four trading days, bringing total ETF net flows above the $14.5 billion mark.

Murad Forecasts Strong July Recovery for Bitcoin

Memecoin analyst Murad highlighted this in a post to their 103,000 followers on X, noting the quick recoveries that typically start in July. He said BTC has shown at least 28% gains in the first few weeks of every July for the past six years in a row.

Reason 1 to be bullish for July on this last day of bearish June pic.twitter.com/E5T4Qr2Rki

— Murad (@MustStopMurad) June 30, 2024

However, several analysts predict that July could be a challenging month, citing significant sales of BTC by the German government and upcoming Mt. Gox repayments that could exert pressure on Bitcoin’s price.

BTC Faces Uncertainty as Mt. Gox Repayments Loom

Mt. Gox, once the largest Bitcoin exchange, will begin repaying 140,000 BTC, valued at around $9 billion, to its creditors in early July 2024. This follows a decade-long wait since the exchange’s collapse in 2014, which resulted in the loss of over 850,000 BTC.

The upcoming distribution has raised concerns about increased selling pressure on the market. Some predict a significant drop in BTC price as creditors may sell their coins to realize profits, especially given BTC’s 16,000% price appreciation since the hack. However, some analysts believe the impact of these repayments may not be as severe as expected, with only $4 billion likely to affect the spot BTC market.