Highlights:

- Dogecoin price falls below $0.30 as the cryptocurrency market sees a decline.

- Analyst suggests possible future price drop of DOGE as bearish signs have emerged from MVRV ratio and SMA crossover.

- Technical signals suggest that the Dogecoin price is under considerable selling pressure, and RSI has approached oversold territory.

The crypto market is experiencing another setback as most prices record significant declines. The bearish sentiment has seen the leading asset, Bitcoin, drop below the $100k physiological level while major altcoins trade in red. Furthermore, the global market cap and 24-hour trading volume have declined to $3.34 trillion and $122 billion, respectively.

Dogecoin Price Action

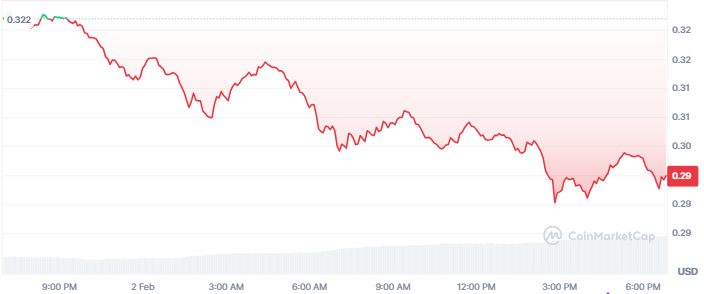

The largest memecoin, Dogecoin is down by 8% in the past 24 hours following the broad market decline. The memecoin has dropped from an intraday high of $0.3232 to a daily low of $0.2899. On the weekly and monthly charts, DOGE declined by 14% and 17%, respectively, demonstrating the recent bearish sentiment in its trading activity.

In addition, Dogecoin’s price dropped below the $0.3 support level, even dumping below the $0.29 level for the first time since December 20. As of this writing, DOGE has slightly recovered, trading at $0.2950 with a market cap of $44 billion. Despite the bearish trend, its trading volume has surged by 100% to $2.92 billion, indicating increased market activity.

Dogecoin Price Faces Potential Drop as Analyst Warns of Bearish Signal

In a recent analysis, Crypto analyst Ali Martinez noted that DOGE could be in for another significant drop. This analysis involved the use of the MVRV ratio in relation to its 30-day SMA and he pointed out that it had formed a bearish crossover. In the past, this technical pattern has triggered bearish pressure on DOGE. The price could drop significantly if history repeats itself in the coming weeks.

#Dogecoin $DOGE just experienced a bearish crossover between the MVRV Ratio and its 30-day SMA, signaling a steep price correction ahead. pic.twitter.com/PVdilYgrhg

— Ali (@ali_charts) February 2, 2025

The MVRV ratio is especially useful to make a distinction of over valued assets or under valued assets. When it goes down to a 30-day SMA, it triggers selling by the holders. This increases selling pressure thereby causing a decline in prices. Martinez’s analysis suggests that Dogecoin is currently showing signs of this bearish trend, increasing the risk of a decline.

Initially, Martinez predicted a drop to $0.20, comparing DOGE’s movement to PEPE’s recent decline. On February 1, he highlighted that Dogecoin followed a similar pattern on its four-hour chart. His analysis emphasized that breaking below the $0.31 support level could result in a deeper correction.

Is #Dogecoin following $PEPE? If so, a breakdown below $0.31 could trigger a correction toward $0.20 for $DOGE! pic.twitter.com/fuKfgUwPNI

— Ali (@ali_charts) February 1, 2025

In the event that the $0.31 support is breached, DOGE could experience increased losses. However, if high selling pressure intensfies, Dogecoin price could possibly drop further to $0.20.

DOGE Technical Analysis: Is DOGE Heading for a Deeper Correction?

Technical indicators on the daily chart show that Dogecoin’s price could continue its downward journey in the coming sessions. Indicators such as Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) are heading to negative territories.

The MACD indicator has a value of -0.1210 and continues to head further below the negative region below the signal line, suggesting a strong bearish trend. Should the current trend hold, DOGE could continue to correct further.

Furthermore, the RSI has dropped from the neutral region and currently hovers at 35 indexes toward the oversold region, indicating a lack of buying pressure in the Dogecoin market.

Moving Averages such as the Exponential Moving Average and Simple Moving Average are flashing a sell signal, solidifying the bearish trend, and Dogecoin investors should anticipate further downward momentum.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.