Highlights:

- AlphaTON secures $71M funding, buys first set of TON tokens for $30 million.

- The company aims to acquire $100 million worth of TON tokens by the end of 2025’s Q4.

- The fundraising benefited from a shared private placement program and a BitGo Prime loan facility.

AlphaTON Capital Corp., a digital asset firm focused on establishing and managing a strategic Telegram Open Network (TON) treasury, has completed a $71 million financing round. The company announced the successful fundraising in a press release on September 25, 2025, noting that it also made its first significant purchase of TON Tokens with part of the proceeds.

The fundraising round included a private placement of 6.32 million shares at $5.73 each, totalling $36.2 million, and another $35 million from a loan facility with BitGo Prime, a crypto lending brokerage. With the fundraising proceeds, AlphaTON secured $30 million worth of TON tokens to become one of the world’s largest TON holding firms. The company said it plans to expand its TON treasury to $100 million by the fourth quarter (Q4) of this year.

Telegram ecosystem, announced it has completed a $71 million financing round and acquired its initial $30 million tranche of TON tokens. The company plans to expand its TON treasury to $100 million by Q4 2025.https://t.co/g5hJD9pZHI

— Wu Blockchain (@WuBlockchain) September 26, 2025

AlphaTON Targets Telegram’s Unique Use Cases

The move forms part of AlphaTON’s efforts to cement its position as a key player in the rapidly growing Telegram blockchain ecosystem. AlphaTON believes TON has the potential to become a top-10 blockchain, driven by Telegram’s massive user base and unique infrastructure. The company aims to combine steady yield generation and ecosystem adoption by focusing on staking and Decentralised Finance (DeFi). Notably, the token acquisition followed AlphaTON’s rebranding announcement in early September.

On September 3, AlphaTON announced that its company stock will continue trading on Nasdaq. However, its market ticker symbol will change from PRTG to ATON. The company also disclosed plans to acquire $100 million worth of TON tokens, providing investors direct exposure to the Telegram network’s over 1 billion monthly users.

Strategic Partnerships Drive AlphaTON’s TON Treasury

Beyond BitGo, AlphaTON has also partnered with leading crypto and traditional finance companies. These include Animoca Brands, TwinsStakes, Crypto.com, Kraken, DWF Labs, DNA, SkyBridge Capital, Alpha Sigma Capital, and P2P. Meanwhile, investment bank Chardan led the $71 million financing round, with legal support from other leading firms, including Lucosky Brookman, Hogan Lovells, Forbes Hare, and Golenbock Eiseman Assor Bell & Peskoe.

Brittany Kaiser, AlphaTON’s Chief Executive Officer (CEO), described the company’s latest feat as a strong starting point, underscoring the firm’s faith in the Telegram ecosystem. She noted that AlphaTON will not only hold TON tokens, as she highlights the company’s future steps. These include launching staking and validation operations. It also involves investing in high-potential TON mini apps and DeFi protocols. AlphaTON also plans to expand developer partnerships in the Telegram ecosystem and provide regular updates to shareholders on its treasury performance and ecosystem growth.

The CEO added:

“This is the kind of transformational moment our shareholders invested in, and I’m thrilled to deliver institutional-grade exposure to one of the most exciting opportunities in digital assets today.”

Enzo Villain, AlphaTON’s Executive Chairman and Chief Investment Officer (CIO), echoed the CEO’s view, adding that shareholders will benefit from every stage of AlphaTON’s TON treasury growth.

The Executive Chairman stated:

“We’re building a platform that will enable our shareholders to benefit from every layer of growth within the TON ecosystem, from infrastructure to applications to user adoption.”

TON Remains Below $3 as AlphaTON Secures $71M Funding

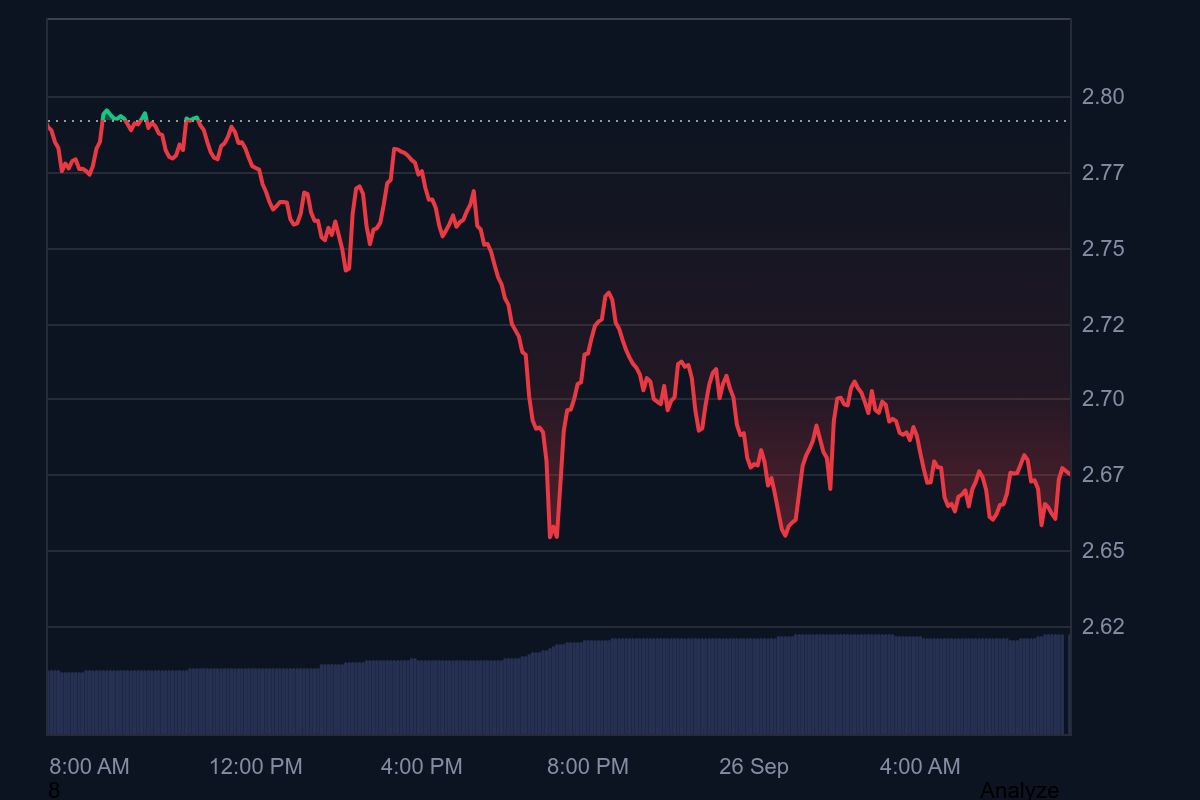

TON is changing hands at $2.67, following a 4.1% decline in the past 24 hours. Within the same timeframe, TON has fluctuated between $2.65 and $2.79. Despite the price drop, TON’s 24-hour trading volume spiked 48.73% to reach $168.37 million. Its 7-day-to-date price change variable showed a 15.9% decline, with price extremes oscillating between $2.66 and $3.17. Other extended period metrics also showed decrements. For context, TON dropped 16.2% month-to-date and 53.6% year-to-date.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.