Highlights:

- Aevo Price has soared 1% today, trading at $0.36, despite the fall in daily trading volume.

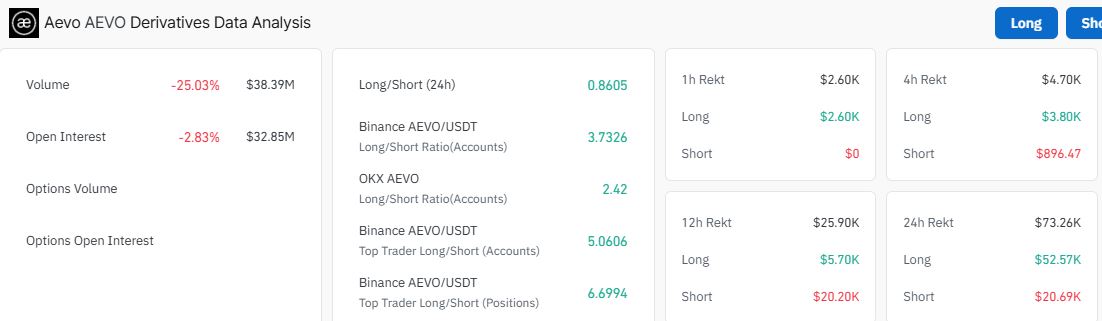

- Coinglass data shows dwindling open interest and volume in the Aevo market, suggesting that the traders may be closing their positions.

- A crypto analyst predicts a breakout to $0.76 if the Aevo price closes above $0.37.

The Aevo price is in focus today, as it surged 1% to trade at $0.36 on Nov 18 during the European trading sessions. However, its daily trading volume has dumped 13% to $78.10 million, suggesting a fall in market activity.

Meanwhile, Coinglass data shows dwindling open interest and volume in the Aevo market, suggesting that the traders may be closing their positions and the current trend may weaken. The open interest has plunged 2.83% to $32.85M, while the volume has plummeted 25% to $38.39.

However, Divergent -XBT, a crypto analyst, is optimistic that the Aevo price could get the long-awaited boost to $0.76 if the Aevo price closes above $0.37.

$AEVO held the ATR support nicely.

Reclaimed the 50MA.

If we close above $0.3770 today, there's a good chance of getting that long-awaited boost tomorrow.

Will see. https://t.co/xGnZjCufek pic.twitter.com/4Ru7v7rWq1

— Divergent 🪙🪢 (@Divergent_XBT) November 16, 2024

Aevo Statistical Data

Based on CoinmarketCap data:

- AEVO price now – $0.3682

- Trading volume (24h) – $78.10 million

- Market cap – $326.26 million

- Total supply – 1 billion

- Circulating supply – 887.76 million

- AEVO ranking – #177

Aevo Price Shows Signs of a Bullish Breakout

The Aevo price might break out very soon, as it has already flipped the key bullish indicators into support in the market. Currently, Aevo trades well above the 50-day and 200-day SMAs, at $0.34 and $0.35, respectively. If the support levels remain intact at this level, the bulls could trigger a rally, obliterating the next critical area at $0.39 to $0.50.

Meanwhile, the Relative Strength Index (RSI) sits at 51.52, indicating equilibrium prospects. This means that the bulls and the bears are at a tug-of-war, with neither giving in. However, increased momentum in either direction will cause Aevo’s price to lean towards it. Meanwhile, the odds tend to lean towards the upside.

On the other hand, the Moving Average Convergence Divergence (MACD) introduces a bullish outlook with a buy signal. This calls traders to rally behind Aevo as the MACD in blue crosses above the orange signal line. As the momentum indicator gradually ascends above the mean line (0.00) into the positive region, the path with the least resistance stays on the upside.

Aevo Price Prediction: Will Aevo Bulls Break Out?

The Aevo price shows bullish prospects in the 4-hour chart timeframe, tilting the odds towards the bulls. Meanwhile, increased buying appetite reinforced by the MACD will see the Aevo price soar. If the key support levels stay intact ($0.34 and $0.35), the bulls could initiate a strong leg up, hitting the $0.5 mark in the short term.

On the other hand, if the bears step into the market at this level, a breach and break below the $0.35 mark will cause the price to dwindle, reaching the $0.34 support area.