Highlights:

- Aerodrome Finance price soars 3% despite the trading volume sliding 12%.

- The recent surge follows Coinbase’s visibility gains.

- Technical indicators show a potential surge to $2.36 previous ATH.

The Aerodrome Finance price is up a staggering 3% to $1.17, despite its daily trading volume slipping 12%. The recent surge comes following Coinbase’s visibility gains and technical validation through the Golden Cross. These factors have brought in new investors and whales, causing the price to rally over 63% in the past week.

Looks like @AerodromeFi and @base just put in their highest DEX volume day since February. 📈

Especially notable bc just a small % of @coinbase’s 100M+ users have received DEX access so far.

Next wave of distribution is coming shortly. 🛫 pic.twitter.com/LsKsj2Y1RX

— alexander (@wagmiAlexander) August 12, 2025

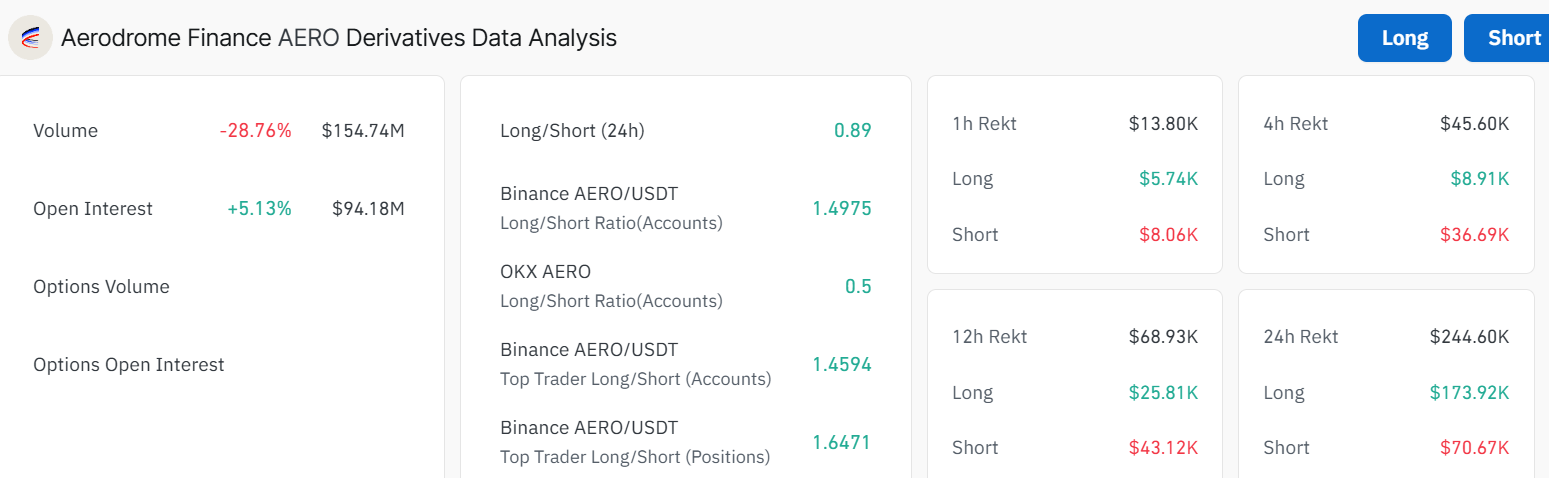

On the other hand, the derivatives price data action on Aerodrome Finance price data, we can obtain even better insight. The information shows that there is a small drop in trading volume of 28.76% to $154.74 million. But in spite of the decrease in volumes, open interest increased by 5.13% to $94.18 million. This demonstrates that, although there are fewer positions, the ones already opened are retained. This suggests prolonged optimism about the future of $AERO.

The Long/Short ratio over the past 24hours stands at 0.89, which points to short positions taking the lion’s share in the market. Additionally, the risk of liquidation shows that the positions ended with enormous losses. In the last 24 hours, there has been a liquidation of a total of 244.60K, and the lion’s share of losses is short positions. This again gives us an impression that there might still be a bearish mood amongst some traders.

Aerodrome Finance Price Breaks Above an Ascending Channel

The Aerodrom Finance price daily chart timeframe shows the 50 Simple Moving Average (SMA) hovering around $0.8499. Further, the AERO price has been trending above it lately. The price spiked to $1.28 before pulling back to $1.17 near the 50 SMA, showing some profit-taking action.

Digging into the indicators, the Relative Strength Index (RSI) at 67.81 is flirting with overbought territory, close to that 70 line where price tends to pull back. The RSI has been climbing steadily, but that recent dip hints at cooling momentum. However, the odds still lean towards the upside.

Moreover, the Moving Average Convergence Divergence (MACD) shows the MACD line (blue)(0.0791) above the signal line(orange) (0.0388). This indicates a bullish crossover, calling for traders to buy more AERO tokens.

AERO Bulls Aim for a Rally Towards $2.36

Looking ahead, the current $1.28 peak is now resistance, cushioning the bulls against further upside. If the Aerdodrom Finance price can crack it, the asset could soar to $1.64-$2.11. In a highly bullish case, the token may reclaim $2.36 previous ATH. Conversely, if it fails, the $0.98-$0.85 support zones will be in line to cushion against further downside. However, a drop below $0.68 might tank it to $0.49, invalidating the bullish grip.

The 63% pump suggests that traders and investors are optimistic about the Aerodrome Finance price. However, the slight pullback suggests a breather, likely instigated by profit takers. Over the next month, the price of AERO could hit $2.36 – $6.00, marking over a 400% increase from current price levels, if it breaks $1.28 with substantial volume.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.