Highlights:

- Aerodrome Finance price soars 1% to $1.35, despite the trading volume sliding 0.45%.

- AERO volume has spiked over $1 billion, surpassing the best DEX on base.

- Technical indicators signal a potential drop to $1.22-$0.88 before bouncing hard.

The Aerodrome Finance price continues its bullish momentum, rising 1.73% to $1.45, before correcting to $1.35. The daily trading volume has, however, dropped 0.45%, showing a slight drop in market activity. AERO still boasts 44% in the past week and 46% in the past month.

Meanwhile, Aerodrome is compared to the other platforms of the DeFi ecosystem. The second and third places in the list are Uniswap and PancakeSwap, containing $657 million and $517 million, respectively. This kind of contrast highlights what Aerodrome can do in terms of adopting a long dominant market share, owing to the prevailing distinctive services and practices.

Aerodrome Volume Soars Past 1 Billion ✈️

In the last 24 hours, Aerodrome volume reached $1.17B—capturing 55% more volume than the next best DEX on @base.

Accelerate. pic.twitter.com/WzUMikHES0

— Aerodrome (@AerodromeFi) August 14, 2025

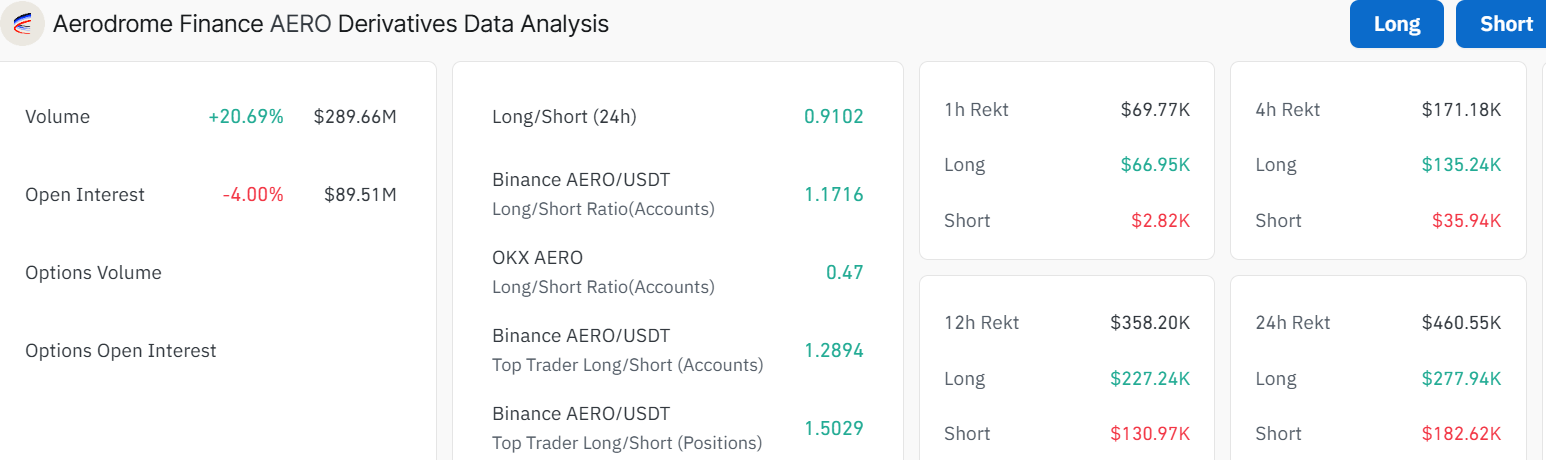

Aerodrome Finance has also recorded high activity in derivative markets in addition to its trading volume. Current data on its AERO derivatives analysis shows that there has been a 20.69% increment in volume to $289.66 million. In spite of this growth, the platform has seen the open interest decline marginally by 4% to $89.51 million. This is an indication that although there is an increased involvement in the market, there is still the feeling of caution with traders before larger positioning.

On the other hand, the ratio of the longs and the shorts, including Binance and OKX, is optimistic. Currently, the long-to-short ratio sits at 0.91, showing a slight bearish grip, as it is below 1.

Aerodrome Finance Price Signals a Bullish Continuation

A quick look at the daily chart shows that Aerodrome Finance’s price is still holding above the rising parallel channel. This shows that AERO is still on a bullish continuation, despite the slight intraday correction from the $1.43 to $1.35 zone. Further, the 50-day($0.88) and the 200-day ($0.69) Simple Moving Averages are acting as major support zones, indicating long-term upward movement.

Meanwhile, the Relative Strength Index (RSI) is sitting at 70.48, which is overbought territory. That means AERO’s been running hot and might see a quick breather or undergo a pullback to cool off. This could push the price back to support around $1.22or or even $0.88 if sellers overwhelm buyers. However, it should be no cause for panic as it would be part of a healthy correction after such a strong surge.

The Moving Average Convergence Divergence (MACD) shows a bullish crossover on Aug. 8, 2025, with the MACD line currently soaring above the signal line (orange), indicating sustained momentum.

What’s Next in AERO?

In the short term, traders can expect some volatility. With the RSI overheated, Aerodrome Finance’s price could retrace to $1.22-$0.88. Conversely, if volume builds strongly and no major dumps happen, AERO’s price might bounce hard. Mid-term, by the end of September, the asset may hit $1.90-$2 as a realistic target. In the long term, if this breakout sticks, Aerodrome Finance’s price could eye $3 or higher by Q4 2025. However, the overbought RSI level means flash crashes are possible, so traders should keep an eye on the charts.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.