Highlights:

- The price of Aerodrome Finance has risen 10% to $0.92, with a 20% jump in daily trading volume.

- AERO technical indicators show strong upward momentum, but caution is due to overbought conditions.

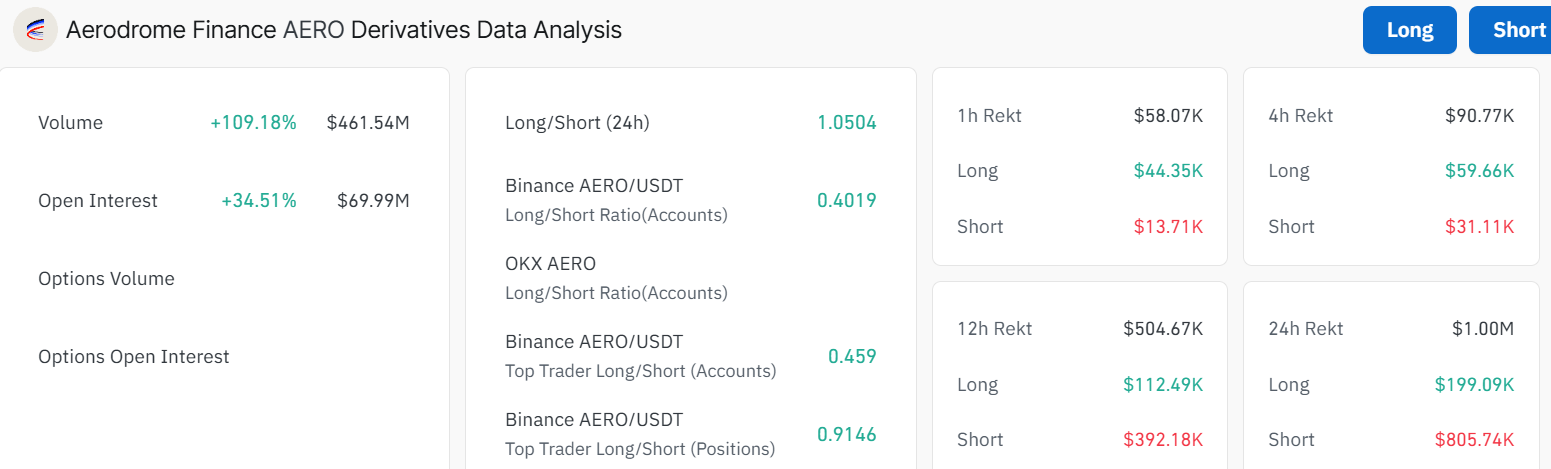

- Derivatives market grows with 109.18% increase in volume and 34.51% rise in open interest.

As of 19 June, the Aerodrome Finance price has increased 10% to $0.92, as its daily trading volume soared 20% to $149 M. This comes following Coinbase’s efforts to obtain the approval of the U.S. Securities and Exchange Commission (SEC) to launch trading in tokenized stocks.

$AERO | Aerodrome is flying again — up +22% and hitting $0.94, even in this market.

And the best part Coinbase is seeking SEC approval to offer tokenized stock trading — a move that could reshape traditional finance.

If approved, this puts Coinbase in direct competition with… pic.twitter.com/qiQPO4xFct

— CryptoED (@Crypto_ED7) June 19, 2025

When accepted, this may put Coinbase on the same level as already proven platforms such as Robinhood and Schwab. Being the major decentralized exchange (DEX) on Base blockchain, Aerodrome ($AERO) can expect to profit immensely.

AERO Technical Indicators Caution Of Overbought Conditions

Analysing the technical price movement of the $AERO, the chart appears strong in the upward direction, where the token reached 0.9261, up by 7.22%. Further, the bulls have put their best feet forward, as they have established strong support at $0.64 and $0.87. This tilts the odds towards the bulls as they could drive the price further to the upside.

The $AERO token has been experiencing continuous testing of the higher levels, and bulls could be poised for a rally to $1. Bolstered by the rising parallel channel, the token could hit $1.5 in a highly bullish case.

The Relative Strength Index (RSI) value stands at 70.38 at the time of writing, which means that the token is being overbought. At this level, traders should be cautious of a potential correction. The MACD (Moving Average Convergence Divergence) is exhibiting positive gains, which also creates a bullish sentiment about the future of the Aerodrome Finance price.

The $AERO derivatives market has been rising tremendously, with its trading volume going up by 109.18% and the open interest increasing by 34.51%. Having a trading volume of 461.54 million and an open interest of 69.99 million, it shows that both institutional and retail investors are becoming more confident about $AERO.

The rise in volume and the open interest indicate the expanding use of the market and interest in $AERO, in which both long and short positions are gaining momentum. Data analysis also shows a positive long/short ratio of 1.05, meaning that there are more traders taking long positions in the Aerodrome Finance price. This reinforces the bullish grip in the market, which could rally the token above $1.

Aerodrome Finance Poised for a Rally Above $1

Based on the outlook, the bulls are showing strength with no signs of slowing down. If the buyers capitalize on the buy signal from the MACD and the support zones hold, AERO could surge towards $1. In a highly bullish case, the bulls could target $1.13, $1.24, and $1.37. However, if the early profiteering commences and a correction emerges due to overbought conditions, AERO could drop. The $0.87 support could act as a safety net against further downside. If the selling pressure mounts, Aerodrome finance could drop towards the $0.79, $0.72, and $0.64 support areas.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.