Highlights:

- The price of Aergo is up 33% to $0.1328 with a 1236% surge in trading volume.

- Aergo breaks out of falling wedge pattern as bulls eye bulls eye $0.40, marking 194% gains.

- Strong derivatives data and technical indicators suggest more upward momentum.

As of June 20, the Aergo price is up 33% in the past 24 hours, to $0.1328. Accompanying the positive outlook is its daily trading volume, which has increased by 1236%, indicating intense market activity. This comes as the conversion of Aergo to HPP (High Performance Platform) is going on swiftly.

The transition from Aergo to HPP is rolling out in carefully planned phases, designed to ensure clarity, continuity, and zero disruption.

📄Check out our brand transition strategy and execution plan:https://t.co/0ONKYc1j9s pic.twitter.com/0eoFvDkqGc

— Aergo (HPP) (@aergo_io) June 20, 2025

The plan is to ensure a smooth rebranding process, so that the stakeholders are in control of the change. The entire execution plan is to ensure a solid and steady experience that continues to be enhanced as the brand develops.

Aergo Price Breakout of The Falling Wedge Pattern

A daily chart outlook on Aergo implies a strong bullish grip. A slight breakout above the falling wedge is evident, tilting the odds in favor of the bulls. Moreover, the strong support at $0.1283, aligning with the 200-day MA, gives the bulls the hind wings for a potential upside. Currently, the immediate resistance lies at $0.1376, which aligns with the 50-day MA. In that, the bulls need to overcome this area to bolster the bullish thesis.

The Relative Strength Index (RSI) is already at 56.37, which means that the coin is not overbought. AERGO still has more space to have upward momentum. The positive mood is confirmed by the positive crossover of MACD. This indicates that the positive movement may continue in the near future.

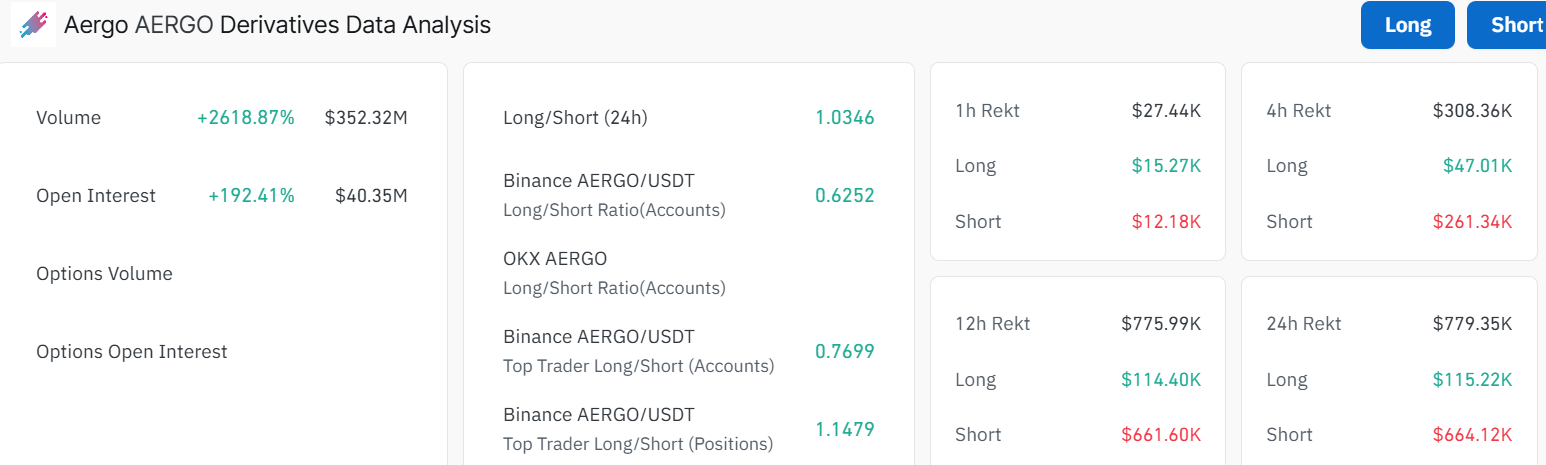

Additionally, the data analysis of the Aergos derivative indicates prominent long positioning. The Aergo volume has spiked 2618% to $352M, indicating that the trading activities in the market are on the rise. Such high demand in the AERO among traders has resulted in a 192.41% increase in open interest to reach an amount of 40.35 million.

The 24-hour long/short ratio is 1.0346, and the majority of the traders are wagering on a price increase. This positive outlook could further bolster upside in the Aergo price.

Aergo Bulls Eye $194% Gains

Zooming out on the Aergo price, the bulls seem to have put their best feet forward, with no signs of stopping anytime soon. Further, the positive derivatives analysis reinforces the bullish grip in the market. If the support at $0.12 holds, the bulls could rally towards the $0.1376 resistance. A breakout above the key resistance could open the doors towards $0.19, $0.24, and $0.3 resistance zones. However, in the medium term, Aergo price could rally towards $0.35 -$0.40, marking 194% upside from current price levels.

On the flip side, if the RSI spills into the overbought region and early profiteering kicks off, it could trigger a dip towards the $0.12 support zone. If this area gives way, further downside towards $0.10, $0.07, and $0.06 will be imminent, invalidating the bullish grip. In the meantime, the bullish grip could spark a rally in the short term towards $0.19.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.