Highlights:

- The price of Aave has decreased by 3% to $222 in the past 24 hours.

- AAVE technical indicators show a potential upside towards $278 if the $228 barrier gives way.

- A crypto analyst has highlighted a strong uptrend in AAVE, indicating that strong resistance rests at $400.

The Aave price has also seen a downward movement, sliding 3% to $222, in the past 24 hours. However, its daily trading volume has increased a whopping 119%, indicating heightened market activity. This shows increased investor confidence, which may soon boost the AAVE price towards higher levels.

Aave Price Outlook

Recent technical analysis of Aave (AAVE/USD) reveals it is gaining bullish momentum. Based on the AAVE daily price chart, the token remains above the 50-day MA at $170. Meanwhile, the bulls are targeting to break through the 200-day moving average at $228. The AAVE price is currently consolidating in the cup and handle pattern in preparation for a likely upward movement.

The RSI is above 60, indicating that buyers seem to have the upper hand right now. However, the AAVE token has not yet reached a point where the market is dangerously overbought. Also, the MACD is positive and has crossed above its signal line, indicating that buyers are currently on an upward trend. Based on these factors, a break above the key resistance at $228 might carry Aave’s price to targets around $278.

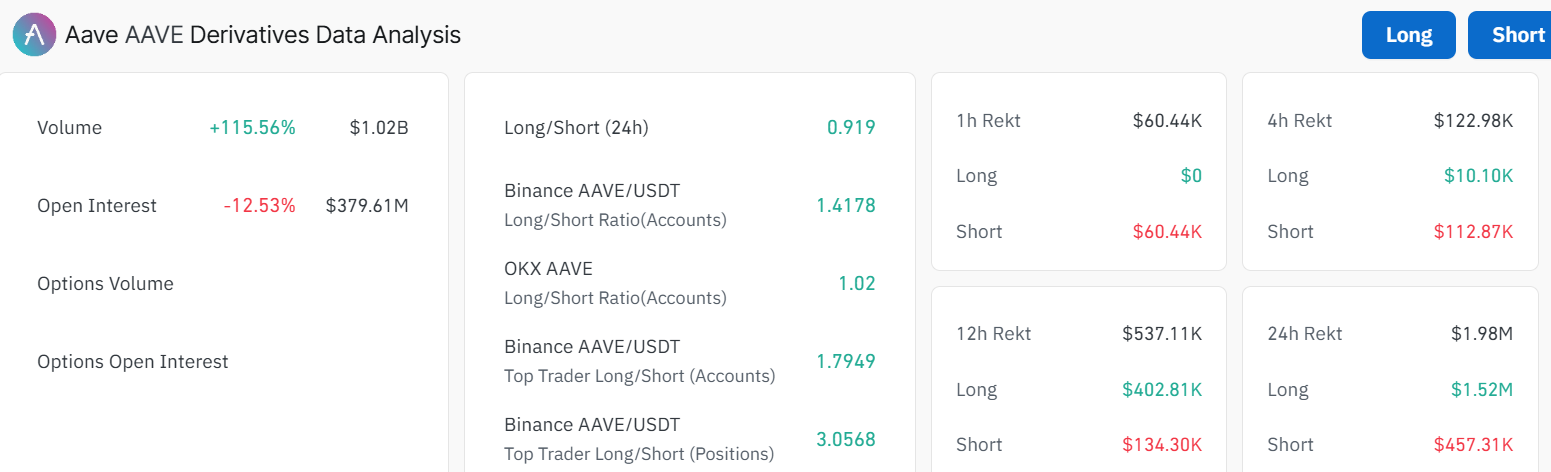

Aave Derivatives Market Activity Reflects Increased Interest

Aave’s activity in the derivatives market indicates positive expectations. In the last 24 hours, trading volume went up by 115%, bringing the total value to exceed $1 billion. However, traders seem to be closing their positions, as the open interest has decreased by 12% to $379M. The long-to-short ratio on Aave sits at 0.919, slightly below 1. Meanwhile, the highest volume on the Aave market shows that traders and investors are betting on price increases soon.

In the past 24 hours, more short positions than long positions have been liquidated in Aave. Short sale losses were worth over $450,000, which is nearly half the long liquidation amount of $1.5 million. This means that there might be a short squeeze, pushing Aave’s price up as anxious sellers leave the market.

What’s Next for Aave?

Technical analysis and movement in the derivatives market suggest that Aave is in a good phase. If buyers continue to hold the market, higher prices with a break above the 200-day average might signal a bullish breakout. In such a case, the AAVE price may continue its upward movement towards $278,334 and $400.

#AAVE It shows a strong uptrend. The strong resistance zone is at $400. Only when it breaks through will the price be able to rewrite the ATH zone! $AAVE pic.twitter.com/J37UREmFbe

— Crypto Dream (@_Crypto_Dream) May 18, 2025

On the downside, the decline in open interest tends to indicate some apprehension among traders and hints at the need to react to market volatility. If the traders keep closing their positions, a drop in Aave price could be plausible. In such a case, the $209 support zone will act as the first safety net, hindering further downside.

If the selling pressure dominates the market, the token will see a deeper correction towards the $182 and $170 support area. Only a breach below the $170 mark will trigger a panic sell-off in the Aave market, flipping the odds towards the bears. In the meantime, traders should monitor the rising trading volume and technical indicators to determine the next move in AAVE price.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.