Highlights:

- 31% of central banks have delayed CBDC implementation, while others proceed with plans.

- Regulatory, political, and economic challenges contribute to delays in CBDC development.

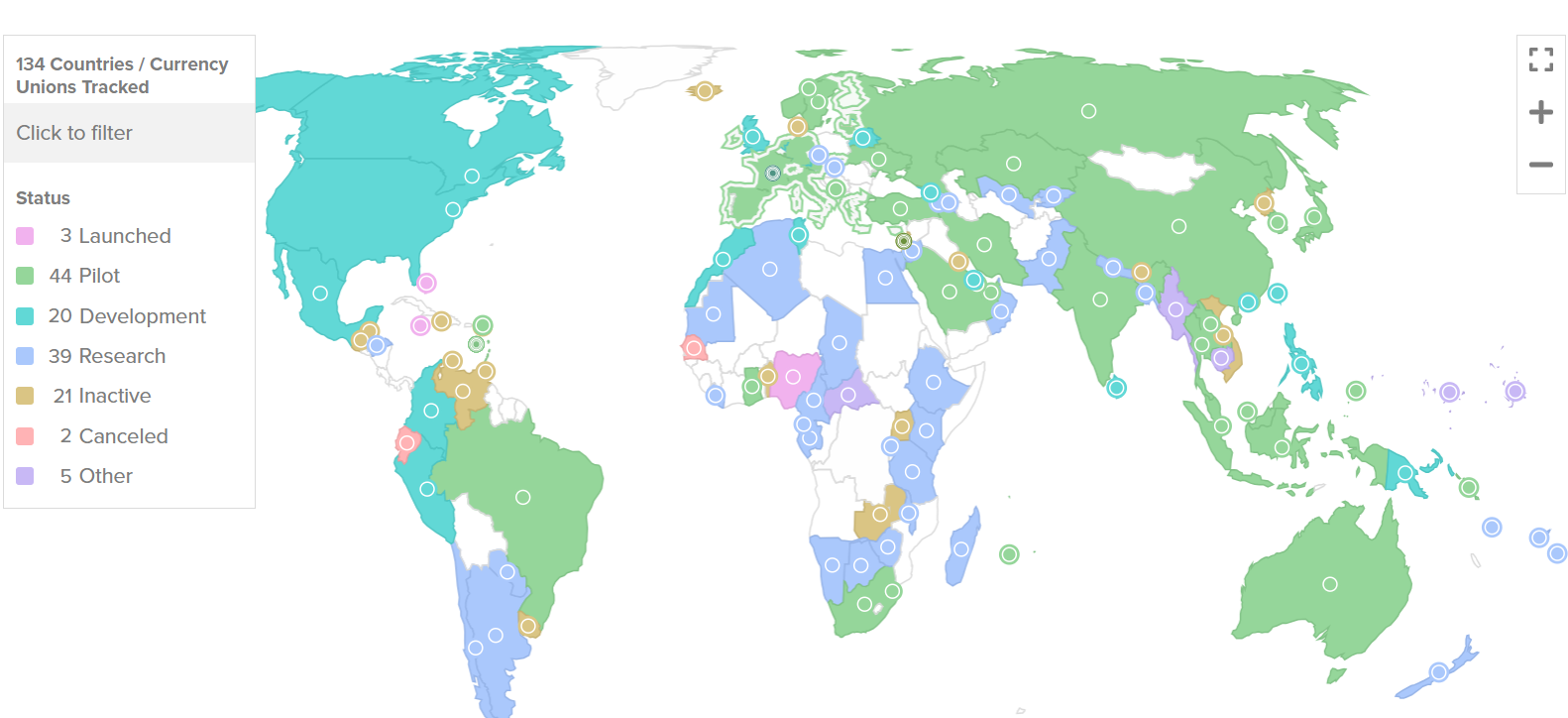

- Another report shows 134 countries are exploring digital currencies, with 66 in advanced stages of development.

A report released on February 11 by the Official Monetary and Financial Institutions Forum (OMFIF) and security company Giesecke+Devrient Currency Technology surveyed 34 central banks to assess their progress in Central Bank Digital Currency (CBDC) development. The report found that central banks intending to launch a CBDC are proceeding with their plans, while approximately 31% have delayed implementation.

Central banks have explored retail #CBDCs for years, but few have launched. Our latest report with G+D shows shifting opinions—many say they’re ready, but are they moving fast enough. Optimism grows as key challenges are overcome.

Download report for free: https://t.co/STIIYkwF4w pic.twitter.com/PUj7gvYnLI— Digital Monetary Institute (@OMFIFDMI) February 11, 2025

Regulatory, Political, and Economic Hurdles Slow CBDC Progress

The report points to regulatory and governance uncertainties and economic challenges as the main causes of delays. Moreover, the study emphasizes that the establishment of CBDCs depends not only on the technical capabilities of central banks but also on the strength of political will. For example, in the USA, political factors contribute to delays in the introduction of CBDC.

On January 23, U.S. President Donald Trump issued an executive order prohibiting the creation, issuance, and circulation of a CBDC in the United States. Moreover, on February 11, Fed Chair Jerome Powell reinforced his stance, stating that a CBDC would not be introduced under his leadership. While some in the crypto industry supported this decision, others feared it might hinder global CBDC development.

G+D Currency Technology chief executive Wolfram Seidemann stated:

“CBDCs hold significant potential for advancing the digital economy. By offering a public infrastructure, central banks can pave the way for innovative financial products and services, while reducing fragmentation in the financial system.”

Beyond political concerns, economic pressures have also significantly delayed CBDC launches. For instance, one central bank cited rising inflation and mounting debt issues as reasons for postponement. The OMFIF report states that technical challenges are no longer a major hurdle for most central banks.

User Experience and Shifting Sentiment Challenge CBDC Development

In previous surveys, OMFIF found that central banks faced offline payments, privacy concerns, and interoperability with existing payment systems. However, now, user experience is the biggest technical challenge.

Despite these challenges, most central banks still expect to issue a Central Bank Digital Currency in the future. However, the study highlighted a changing sentiment toward CBDCs. The percentage of central banks inclined to issue one has dropped to 18%, down from observed in previous years.

The Human Rights Foundation CBDC tracker highlights digital currencies’ benefits and risks. According to it, CBDCs can improve payment efficiency and boost financial inclusion, especially for underbanked communities. However, critics argue that CBDCs may threaten privacy by increasing government surveillance and posing corruption risks.

Central Bank Digital Currency Adoption Gains Momentum Worldwide

Another CBDC tracker by the Atlantic Council shows that 134 countries, covering 98% of the global economy, are exploring digital currencies. Of these, 66 have reached advanced stages, including pilot programs or full-scale implementations. China is expanding digital yuan trials, while Europe advances its digital euro project. India, Brazil, and Russia are also progressing with CBDCs.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.