Highlights:

- The Injective price has increased by 5% to trade at $3.23 today.

- The bullish mood is reinforced by the network’s approval of its IIP-619 proposal.

- The derivatives market shows growing investor confidence, as INJ bulls target $3.80.

The Injective (INJ) price has spiked by about 5% to $3.23 today. This rally is reinforced by the rising trading volume, which has soared by 621%, indicating intense market activity. Further, the bullish picture is backed by the recent network approval of its IIP-619 proposal.

The upgrade to the green of the mainnet has further enhanced the confidence of the traders. Additionally, this will increase Injective’s potential to process the next generation of payments. Technically, INJ has further gains ahead, as the bulls target the $3.37-$3.80 crucial resistance.

On Thursday, Injective posted an official X in which it stated that its new mainnet upgrade proposal, IIP-619, passed. According to the post, it aims to vastly scale the actual time EVM structure at Injective as well as advance its capacity to support next-gen payment.

The new Injective Mainnet Upgrade proposal (IIP-619) has officially passed!

This aims to significantly scale Injective's real-time EVM architecture while also enhancing its capabilities to support next-gen payments.

February 19 at 9 AM EST (15:00 UTC). pic.twitter.com/kaOnK6ZSWx

— Injective 🥷 (@injective) February 18, 2026

The update significantly improves the functionality of the MultiVM architecture of Injective. It is worth noting that it will maximize the integration of the Real-World Asset with Chainlink oracles to get real-time price updates and enhance the capability of a new shared liquidity layer.

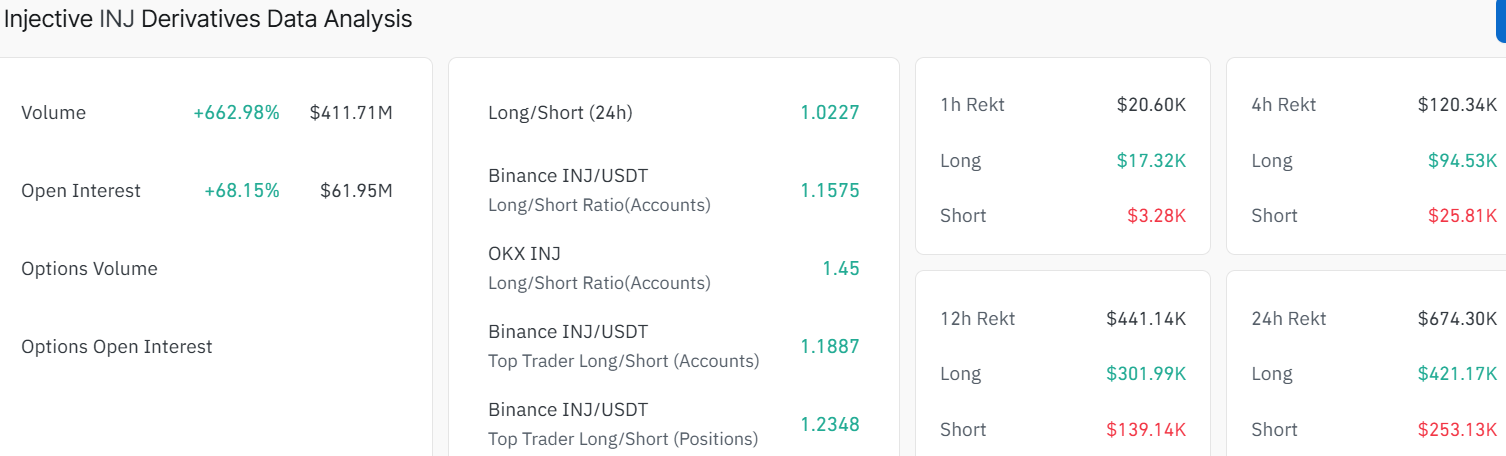

On the other hand, the derivatives market shows heightened retail demand, as the open interest and volume spike. The data shows a spike in open interest by 68% to $61.95 million. The sudden surge in OI indicates that new money is flowing into the Injective market and may cause further gains. The long-to-short ratio is also above 1 at 1.02, indicating a growing bullish picture in the INJ market.

Injective Price Targets $3.37-$3.80 Barrier

The Injective price action shows the token trading at $3.23 with a 4-hour candle hitting a high of around $3.64 before pulling back to recent levels. This recent surge suggests a serious bullish attitude in the market. The 50-day Simple Moving Average (SMA) is currently at $3.12, serving as the immediate support zone, as the price is well above it.

Digging into the indicators, the RSI at 54.89 shows that the bulls are still in control, despite the retracement from the 67.91 zone. This pullback enables the bulls to cool off before embarking on another rally. For now, the odds still favour the buyers, as the RSI sits well above the 50-level.

The 5% pump has pushed INJ above the 50-day SMA, with the immediate resistance around $3.80. If the bulls regain momentum at this level, the Injective price could rally towards the $3.37-$3.80 barrier.

However, with the dwindling RSI, if the correction continues, INJ token could slide back towards the $3.16-$3.12 support zones. A solid entry might be on a pullback to these support levels, offering a better risk-reward ratio for traders. In the long run, Injective’s recent network approval of its IIP-619 proposal might keep the token hype alive, as investor confidence in the market grows.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.